the MACRS five-year class, and it will have a salvage value at the end of the project of $68,000. The press also requires an initial investment in spare parts inventory of $13,000, along with an additional $1,800 in inventory for each succeeding year of the project. The shop’s tax rate is 22 percent and the project's required return is 10 percent. Refer to Table 8.3. what is the NPV of this project?

the MACRS five-year class, and it will have a salvage value at the end of the project of $68,000. The press also requires an initial investment in spare parts inventory of $13,000, along with an additional $1,800 in inventory for each succeeding year of the project. The shop’s tax rate is 22 percent and the project's required return is 10 percent. Refer to Table 8.3. what is the NPV of this project?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter5A: Depreciation Methods

Section: Chapter Questions

Problem 4SEB: MODIFIED ACCELERATED COST RECOVERY SYSTEM Using the information given in Exercise 5Apx-1B and the...

Related questions

Question

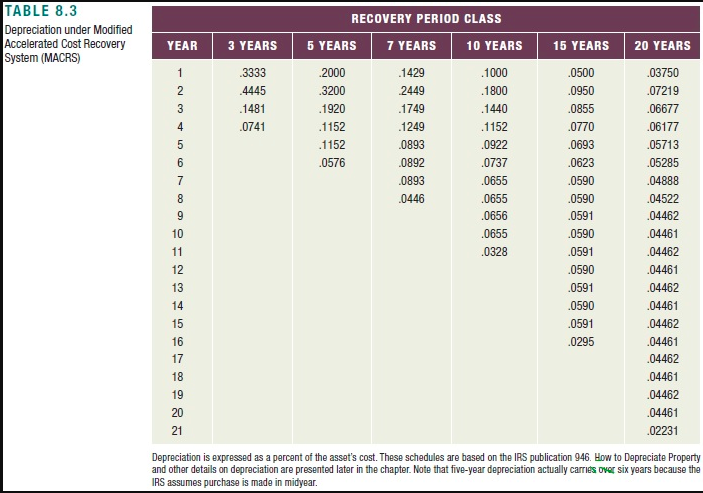

Geller Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $400,000 is estimated to result in $155,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage value at the end of the project of $68,000. The press also requires an initial investment in spare parts inventory of $13,000, along with an additional $1,800 in inventory for each succeeding year of the project. The shop’s tax rate is 22 percent and the project's required return is 10 percent. Refer to Table 8.3.

what is the NPV of this project?

Transcribed Image Text:TABLE 8.3

Depreciation under Modified

Accelerated Cost Recovery

System (MACRS)

RECOVERY PERIOD CLASS

5 YEARS

7 YEARS

YEAR

3 YEARS

10 YEARS

15 YEARS

20 YEARS

1

.3333

2000

.1429

.1000

.0500

.03750

2

.4445

3200

2449

.1800

.0950

.07219

3

.1481

.1920

.1749

.1440

.0855

.06677

4

.0741

.1152

.1249

.1152

.0770

.06177

.1152

.0893

.0922

.0693

.05713

6

.0576

.0892

.0737

.0623

.05285

7

.0893

.0655

.0590

,04888

.0446

.0655

.0590

.04522

.0656

.0591

.04462

10

.0655

.0590

.04461

11

.0328

.0591

.04462

12

0590

.04461

13

.0591

.04462

14

.0590

.04461

15

.0591

.04462

16

.0295

.04461

17

.04462

18

.04461

19

.04462

20

.04461

21

.02231

Depreciation is expressed as a percent of the asset's cost. These schedules are based on the IRS publication 946. How to Depreciate Property

and other details on depreciation are presented later in the chapter. Note that five-year depreciation actually carries over six years because the

IRS assumes purchase is made in midyear.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College