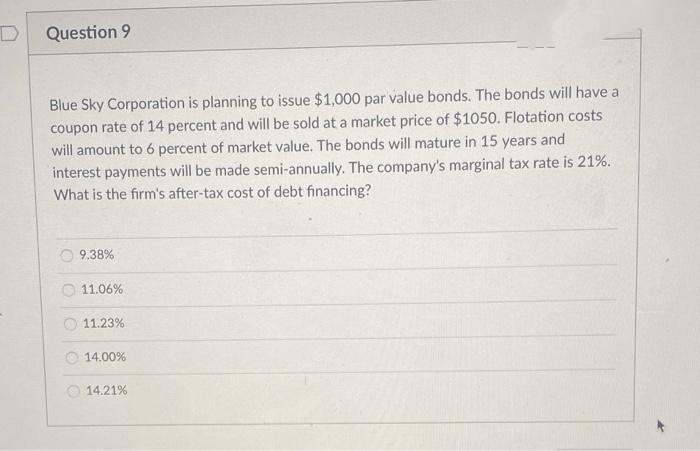

Blue Sky Corporation is planning to issue $1,000 par value bonds. The bonds will have a coupon rate of 14 percent and will be sold at a market price of $1050. Flotation costs will amount to 6 percent of market value. The bonds will mature in 15 years and interest payments will be made semi-annually. The company's marginal tax rate is 21%. What is the firm's after-tax cost of debt financing? 9.38% 11.06% 11.23% O 14.00% 14.21%

Blue Sky Corporation is planning to issue $1,000 par value bonds. The bonds will have a coupon rate of 14 percent and will be sold at a market price of $1050. Flotation costs will amount to 6 percent of market value. The bonds will mature in 15 years and interest payments will be made semi-annually. The company's marginal tax rate is 21%. What is the firm's after-tax cost of debt financing? 9.38% 11.06% 11.23% O 14.00% 14.21%

Chapter11: The Cost Of Capital

Section: Chapter Questions

Problem 1PROB

Related questions

Question

Transcribed Image Text:Question 9

Blue Sky Corporation is planning to issue $1,000O par value bonds. The bonds will have a

coupon rate of 14 percent and will be sold at a market price of $1050. Flotation costs

will amount to 6 percent of market value. The bonds will mature in 15 years and

interest payments will be made semi-annually. The company's marginal tax rate is 21%.

What is the firm's after-tax cost of debt financing?

9.38%

11.06%

O 11.23%

14.00%

14.21%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning