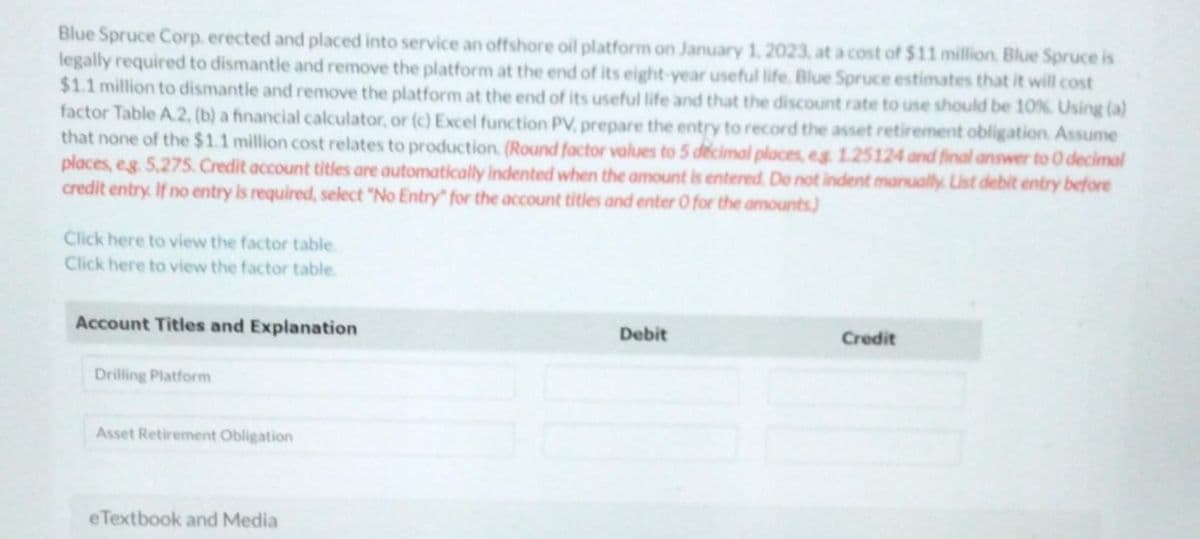

Blue Spruce Corp. erected and placed into service an offshore oil platform on January 1, 2023, at a cost of $11 million Blue Spruce is legally required to dismantle and remove the platform at the end of its eight-year useful life. Blue Spruce estimates that it will cost $1.1 million to dismantle and remove the platform at the end of its useful life and that the discount rate to use should be 10%. Using (a) factor Table A.2, (b) a financial calculator, or (c) Excel function PV, prepare the entry to record the asset retirement obligation. Assume that none of the $1.1 million cost relates to production. (Round factor values to 5 decimal places, eg 1.25124 and final answer to 0 decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts)

Blue Spruce Corp. erected and placed into service an offshore oil platform on January 1, 2023, at a cost of $11 million Blue Spruce is legally required to dismantle and remove the platform at the end of its eight-year useful life. Blue Spruce estimates that it will cost $1.1 million to dismantle and remove the platform at the end of its useful life and that the discount rate to use should be 10%. Using (a) factor Table A.2, (b) a financial calculator, or (c) Excel function PV, prepare the entry to record the asset retirement obligation. Assume that none of the $1.1 million cost relates to production. (Round factor values to 5 decimal places, eg 1.25124 and final answer to 0 decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts)

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6...

Related questions

Question

Vaibhav

Transcribed Image Text:Blue Spruce Corp. erected and placed into service an offshore oil platform on January 1, 2023, at a cost of $11 million Blue Spruce is

legally required to dismantle and remove the platform at the end of its eight-year useful life. Blue Spruce estimates that it will cost

$1.1 million to dismantle and remove the platform at the end of its useful life and that the discount rate to use should be 10%. Using (a)

factor Table A.2, (b) a financial calculator, or (c) Excel function PV, prepare the entry to record the asset retirement obligation. Assume

that none of the $1.1 million cost relates to production (Round factor values to 5 decimal places, eg 1.25124 and final answer to 0 decimal

places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before

credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts)

Click here to view the factor table.

Click here to view the factor table.

Account Titles and Explanation

Drilling Platform

Asset Retirement Obligation

eTextbook and Media

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning