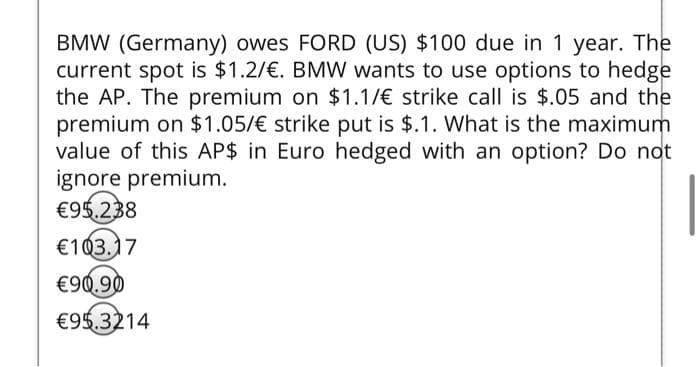

BMW (Germany) owes FORD (US) $100 due in 1 year. The current spot is $1.2/€. BMW wants to use options to hedge the AP. The premium on $1.1/€ strike call is $.05 and the premium on $1.05/€ strike put is $.1. What is the maximum value of this AP$ in Euro hedged with an option? Do not ignore premium. €95.238 €103.17 €90.90 €95.3214

Q: Bulldogs Inc. expects to use 48,000 boxes of chocolate per year costing P12 per box. Inventory carry...

A: Solution:- Carrying cost of inventory means the cost incurred in order to store the inventory.

Q: You want to start saving for your first car which costs R300 000. You decide to save by investing in...

A: Cost of car = R300,000 Per month investment = R2500 Beta = 0.9 Treasury bill rate = 4.15% JSE market...

Q: Which of the following is not a way in which banks lend short-term unsecured loans? Through cred...

A: Banks offer and provide short term loans which are unsecured to borrowers. It has been explained in ...

Q: /C ratio (modified) of a building that houses students during their classroom discussion. The accomm...

A: B/C is the ratio of present value of annual benefits to present value of all cost. If it is more th...

Q: Calculate the annual effective interest rate using ERR method i

A: ERR stands for economic rate of return means it compares the benefits from the project with its co...

Q: You want to be able to withdraw $35,000 from your account each year for 20 years after you retire. Y...

A: Solution:- When an equal amount is withdrawn or deposited for a number of periods, it is called annu...

Q: A machine costs $400,000 with salvage value of 20,000. Life of it is six years. In the first year, 4...

A: Solution:- The fall in value of asset due to its wear and tear cost is called depreciation. Deprecia...

Q: If the market value of your home is $250000, but the replacement cost of the structure is $190000, h...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: Compute the principal (in $) for the loan. Use ordinary interest when time is stated in days. Princi...

A: Data given: Rate = 7% Time= 112 years = 32years Interest = $ 735 Required:: Principal (in $) For...

Q: You have just sold your house for $900,000 in cash. Your mortgage was originally a 30-year mortgage ...

A: Amortized Loan: Amortized loan is a type of loan in which the borrower would pay periodic payments ...

Q: When the default risk is high, ___. the debtor charges high interest the debtor earns more the cred...

A: Default risk is the risk faced by an investor or lender that the borrower becomes unable to pay the ...

Q: You want to buy a $258,000 home. You plan to pay 20% as a down payment, and take out a 4% APR loan f...

A: Amortized Loan: Amortized loan is a type of loan in which the borrower would pay periodic payments ...

Q: Find the Present Value of the Cash Flow 1 and, using this and the previous information, calculate th...

A: The value of money changes over time. For example, the value of $1000 today will not be the same as ...

Q: True or false: the investor will be eligible to receive the dividends when he/she buy the company st...

A: Meaning of Dividend It is a distribution of stock or cash to the shareholders of a company. Basical...

Q: Bulldogs Inc. loaned a certain amount from a reputable bank for a term of one year at 8% quoted rate...

A: Compensating loan is a provision that the bank asks the loan taker to maintain as a security when th...

Q: On April 1, S10,000.00 364-day treasury bills were auctioned off to yield 2.31%. (a) What is the pri...

A: Hi, since you have posted a question with multiple sub-parts, we will answer the first three as per ...

Q: Inc., a corporation that issues ordinary shares with par value, completed a 2-for-1 stock split on a...

A: New Par Value = Existing Par Value * (1/stock split ratio) = 175 * (1/2) = 87.5 New par value is 87....

Q: 7. Options A. How does the price of a call option respond to the following changes, other things equ...

A: As per our guidelines we are supposed to answer only one question (if there are multiple questions a...

Q: Compare the entrepreneurs in the past and today. How are they different each other based on the entr...

A: Entrepreneurship is defined as the capacity and willingness to create, organize, and run a firm, inc...

Q: What single payment 6 months from now would be economically equivalent to payments of $1500 due (but...

A: The time value of money concept states that if the same amount of money is compared, the amount we h...

Q: a The value of an investment account has a doubling time of 13 years and $35,000 was originally depo...

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one...

Q: The M.I.R.R. is based on a Cash flows being reinvested at a rate always different from WACC b ...

A: Modified internal rate of return is an improvement on the internal rate of return method.

Q: tains a cash buffer for unexpected cash outlays for the year amounting to 3,000. Bank of WildPUS cha...

A: Company needs to maintain the cash amount so that company do not have any problem in smooth flow ope...

Q: (Related to Checkpoint 5.5) (Solving for n) Jack asked Jill to marry him, and she has accepted under...

A: We will have to use the concept of time value of money. As per the concept of time value of money th...

Q: You decide to make monthly payments into a retirement fund earning 4.75% compounded monthly. Note: ...

A: We need to use excel formulas to calculate above requirements.

Q: 0.mm MADE IN PR You are given the future value of an annuity, A, the monthly payment, R, and the ann...

A: Since the question above the line is incomplete, so the following solution is for the question below...

Q: capitalized cost of the commodity and the equivalent uniform annual cost.

A: Capitalized cost can be defined as the present value of cashflows which continue for an infinite per...

Q: A credit is paid as follows: a down payment corresponding to 30% of the value of the credit, 16 equa...

A: Fist we need to calculate present value of all payments starting at 3 months after by using annuity ...

Q: what is the estimated cost of ordinary equity?

A: Cost of ordinary equity refers to the cost incurred by the company for issuing new ordinary equity. ...

Q: Preferred stocks are characterized by all the following, except voting rights are generally not ...

A: As per Bartleby honor code, when multiple questions are asked, the expert is required only to answer...

Q: A proposed relaxation of credit standards of Mama Inc. will increase the balance of accounts receiva...

A: Solution:- Average collection period means the days it takes for a firm to recover amount from its r...

Q: Use MV = P(1 + RT) to find the maturity value (in $) of the loan. Principal Rate (%) Time Maturity V...

A: Given Principal $15,660. Rate is 11 1/2% number of months is 42.

Q: Co.? ABC Co. has the following projected results for next year's operation depending on the chosen c...

A: The optimal capital structure is which have maximum value of shares. That is going to be the value m...

Q: WHAT DOES EXIM BANK JAMAICA DO?

A: Banks are very important for growth and development of any country.

Q: Ron Enterprises forecasts the free cash flows (in millions) shown below. The weighted average cost o...

A: The value of firm is calculated as discounted value of cash flows.

Q: calculate the price of a $1,000, 5% bond with 4 years to maturity with 6.5 % market interest rates. ...

A: Par Value of Bond is 5% Coupon rate is 5% Time to maturity is 4 years Market interest rate is 6.5% T...

Q: plz solve it within 30-40 mins I'll give you multiple upvote

A: When two or more people combine their resources to invest in a business, it is called partnership. P...

Q: How many more $1000 investments than $1100 investments will it take to accumulate $100.000? calculat...

A: Annuity Due: It represents the annuity payment made immediately at the beginning of each period. It...

Q: When a note is non-interest-bearing, the maturity value equals the _____. a.principal b.bank discou...

A: Non interest bearing note- It is type of note with no stated interest rate. But it does not mean th...

Q: You are asked to evaluate the following project for a corporation with profitable ongoing operations...

A: Net present value is a capital budgeting techniques which makes the decision making process easier f...

Q: haac has analyzed two mutualy exclusive projects of simlar sire and has compled the following inform...

A: Solution:- While analyzing two mutually exclusive projects, the decision regarding which project to ...

Q: Discuss the importance of the role of a wealth manager professional in the context of protecting the...

A: Financial planning, investment portfolio management, and a number of aggregated financial services a...

Q: Convert the following cash flows to a uniform payment series, where n=3 starting at year 3 and i=3%....

A: The value of same amount of money will be different at various point of time. This is because, the v...

Q: You are pleased to see that you have been given a 6.28% raise this year. However, you read on the Wa...

A: Solution:- We know, real purchasing power means the increment percentage after taking effect of infl...

Q: McCabe Corporation is expected to pay the following dividends over the next four years: $15, $11, $9...

A: Answer - Formula for Share Price P0 = D0 (1+g) / [R-g]= D1 / [R-g]Price at P4 -= D5 / [R-g]= (2.95x1...

Q: The shares of AMC plc are currently quoted at 200p per share and the company has been paying a divid...

A: Note: All the Above Mentioned Given Options are incorrect, so we are solving for the correct solutio...

Q: J&J Inc. has decided to issue new stock to raise $9,000,000 to expand its operations. J&J currently ...

A: Data given: Net income = $4.1 million No. of common shares outstanding = 2.6 million Fund to be rais...

Q: Bulldogs Inc. is given terms of 2/10, net 45 by its suppliers. If Bulldogs Inc. forgoes the cash dis...

A: Answer- Calculation of annual interest rate cost- Cost of not taking discount- = [2% / (100% - 2%...

Q: 1. On average it needs Php 250,000 per year and an additional Php 600,000 every year for major repai...

A: Total annual cost (AC) = 250,000+600,000 = Php. 850,000 Interest rate (r) = 8% Period (n) = 3 Years

Q: nery worth $80 million and a net working capital of $20 million. The entire outlay will be incurred...

A: Capital budgeting is the procedure through which a corporation examines potential large projects or ...

Step by step

Solved in 2 steps

- American Express sells a call option on euros (contract size is €500,000) at a premium of $0.04 per euro. If the exercise price is $0.91 and the spot price of the euro at date of expiration is $0.93, what is American express’s profit or loss on this call option?Sysco corporation has purchased currency call options to hedge a 4,320,000 Swedish krona payable. The premium is $0.015 (per unit of Swedish krona) and the exercise price of the option is $0.097 per Swedish krona. If the spot rate at the time of maturity is S0.105 per Swedish krona, what is the total amount paid by the corporation if it acts rationally (after accounting for the premium paid)? Question 27 options: S 419,040. $354,240. $518,400. S453,600. $483,840.Suppose a German importer owes an Australian exporting company 150,000 AUD, due in three months. S_0 (EUR/AUD) 0.60 Se (EUR/AUD) 0.50 (0.3) and 0.65 (0.7) Premium on AUD call option R = EUR0.02 Exercise exchange rate E = 0.62 Time to expiry 3 months What is the expected value of payables in AUD under hedge Will the option to hedge be undertaken on the basis of expected spot rate? Explain.

- Mender Co. will be receiving 700,000 Australian dollars in 180 days. Currently, a 180-day call option with an exercise price of $.74and a premium of $.02 is available. Also, a 180-day put option with an exercise price of $.72 and a premium of $.02 is available. Mender plans to purchase options to hedge its receivables position. Assume that the spot rate in 180 days is $.73. (1) Should the company use call options or put options? Why? (2) Calculate the amount received from the currency option hedge (after considering the premium paid). (3) Would the company have received more without hedging?Malibu, Inc., is a U.S. company that imports British goods. It plans to use call options to hedge payables of 100,000 pounds in 90 days. Three call options are available that have an expiration date 90 days from now. Fill in the number of dollars needed to pay for the payables (including the option premium paid) for each option available under each possible scenario. Spot Rate of Pound Exercise Price Exercise Price Exercise Price 90 Days = $1.71; = $1.76; = $1.80; Scenario from Now Premium = $.04 Premium = $.06 Premium = $.03 1 $1.65 2 1.74 3…You trade in two types of options. First, you purchase 7 call option contracts on the Euro with an exercise price of 1.25. Second, you sell 8 put option contracts on the Euro with an exercise price of 1.22. The fees/prices on the contracts are $.04 (calls) and $.03 (puts). Forward Rates for the Euro are 1.210-11 $/E. If contract sizes for Euros are 125,000 options per contract and the final price of Euros is 1.40. $/E, how much profit/loss have you made from participation in options?

- Melbourne Capital Ltd considers selling European call options on ANZ Bank Ltd for $1.50 per option. The current market price is $17.70 on 28th September 2020, the exercise price is $20, and the maturity of each call option is 6 months. Under what circumstances does the investor make a profit? Under what circumstances will the option be exercised? How many call options should the investor sell to raise a total capital of $1,260,000? Company A agrees to enter into an FRA agreement with Company B in which Company A borrows $ 40,000,000 in 6-month time for a period of 9 months, and Company B invests $ 40,000,000 in 6-month time for a period of 9 months. The 6-month interest rate is 0.77% per annum and the 9-month interest rate is 0.89% per annum. What is the interest rate that both companies agreed upon? Suppose that at the expiry date of the FRA, the 6-month interest rate is 0.81% per annum and the 9-month interest rate is 0.96% per annum, calculate the…Yoyo, a german company expects to pay US$10 million to a supplier in US. It is now December and the payment is due in March. The current spot rate is 1.2100. The company wants to use currency options to hedge the exposure. March currency put options are available and are for 125,000 euros, have a strike price of $1.2200 and the tick size is $0.0001. The cost of the option contract is 2.75 US cents per euro.Assuming that there is no basis,(i) Devise a hedging strategy for Yoyo using currency options.(ii) Advise on the action to be taken by Yoyo and the outcome in case the spot rate in March when the dollars must be paid is:(a) $1.2500 = €1 (b) $1.1800 = €1i sold a call option with an exercise price of $1.20/euro. the premium was $0.02/euro. what is my profit or loss if the exchange rate is $1.205/euro?

- A Japanese exporter has a €1,000,000 receivable due in one year. To hedge the position, you will buy put options on euro True or False?As a US exporter selling to Europe. You wish to hedge a 1,040,000 Euro to be received in 3 months with futures or forwards. Futures contract sizes for the Euro are 125,000E each. How many dollars will you receive/pay for the goods if you hedge with futures, forwards, and not hedging? Also, rank them? Now End Spot 1.100-01 $/E 1.300-01 $/E Futures 1.120 $/E 1.315 $/E Forwards 1.130-31 $/ETyson Inc. has an account payable in Swedish krona due in 60 days. Which would be an appropriate hedge? Question 9 options: Enter into a forward contract to sell Swedish krona in two months Borrow Swedish krona for 60 days for the purpose of a money market hedge Buy a put option on the Swedish krona, expiring in 60 days Buy a call option on the Swedish krona, expiring in 60 days