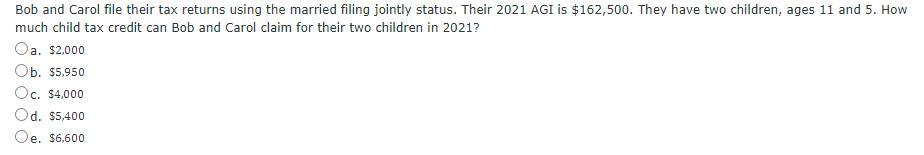

Bob and Carol file their tax returns using the married filing jointly status. Their 2021 AGI is $162,500. They have two children, ages 11 and 5. How much child tax credit can Bob and Carol claim for their two children in 2021? Oa. $2,000 Оb. 55.950 Oc. $4,000 Od. $5,400 'e. $6,600

Bob and Carol file their tax returns using the married filing jointly status. Their 2021 AGI is $162,500. They have two children, ages 11 and 5. How much child tax credit can Bob and Carol claim for their two children in 2021? Oa. $2,000 Оb. 55.950 Oc. $4,000 Od. $5,400 'e. $6,600

Chapter6: Accounting Periods And Other Taxes

Section: Chapter Questions

Problem 17MCQ

Related questions

Question

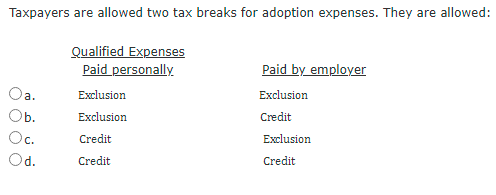

Transcribed Image Text:Taxpayers are allowed two tax breaks for adoption expenses. They are allowed:

Qualified Expenses

Paid personally

Paid by employer

a.

Exclusion

Exclusion

Exclusion

Credit

Oc.

Credit

Exclusion

Od.

Credit

Credit

Transcribed Image Text:Bob and Carol file their tax returns using the married filing jointly status. Their 2021 AGI is $162,500. They have two children, ages 11 and 5. How

much child tax credit can Bob and Carol claim for their two children in 2021?

Oa. $2.000

Ob. $5,950

Oc. $4,000

Od. $5,400

Oe. $6,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage