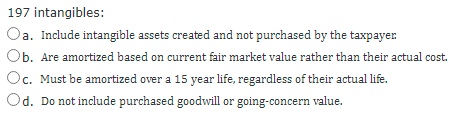

197 intangibles: Oa. Include intangible assets created and not purchased by the taxpayer Ob. Are amortized based on current fair market value rather than their actual cost Oc. Must be amortized over a 15 year life, regardless of their actual life. Od. Do not include purchased goodwill or going-concern value.

197 intangibles: Oa. Include intangible assets created and not purchased by the taxpayer Ob. Are amortized based on current fair market value rather than their actual cost Oc. Must be amortized over a 15 year life, regardless of their actual life. Od. Do not include purchased goodwill or going-concern value.

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 28CE: LO.7 On October 1, 2019, Priscilla purchased a business. Of the purchase price, 60,000 is allocated...

Related questions

Question

Transcribed Image Text:197 intangibles:

Oa. Include intangible assets created and not purchased by the taxpayer

Ob. Are amortized based on current fair market value rather than their actual cost.

Oc. Must be amortized over a 15 year life, regardless of their actual life.

а.

Od. Do not include purchased goodwill or going-concern value.

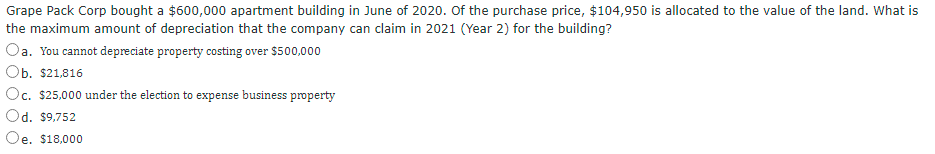

Transcribed Image Text:Grape Pack Corp bought a $600,000 apartment building in June of 2020. Of the purchase price, $104,950 is allocated to the value of the land. What is

the maximum amount of depreciation that the company can claim in 2021 (Year 2) for the building?

Oa. You cannot depreciate property costing over $500,000

Оb. $21.816

Oc. $25,000 under the election to expense business property

Od. $9,752

Oe. $18,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT