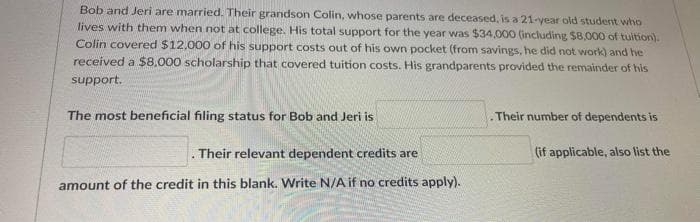

Bob and Jeri are married. Their grandson Colin, whose parents are deceased, is a 21-year old student who lives with them when not at college. His total support for the year was $34,000 (including $8.000 of tuition). Colin covered $12,000 of his support costs out of his own pocket (from savings, he did not work) and he received a $8.000 scholarship that covered tuition costs. His grandparents provided the remainder of his support. The most beneficial filing status for Bob and Jeri is Their number of dependents is Their relevant dependent credits are (if applicable, also list the amount of the credit in this blank. Write N/A if no credits apply).

Bob and Jeri are married. Their grandson Colin, whose parents are deceased, is a 21-year old student who lives with them when not at college. His total support for the year was $34,000 (including $8.000 of tuition). Colin covered $12,000 of his support costs out of his own pocket (from savings, he did not work) and he received a $8.000 scholarship that covered tuition costs. His grandparents provided the remainder of his support. The most beneficial filing status for Bob and Jeri is Their number of dependents is Their relevant dependent credits are (if applicable, also list the amount of the credit in this blank. Write N/A if no credits apply).

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter3: Preparing Your Taxes

Section: Chapter Questions

Problem 4FPE

Related questions

Question

Transcribed Image Text:Bob and Jeri are married. Their grandson Colin, whose parents are deceased, is a 21-year old student who

lives with them when not at college. His total support for the year was $34,000 (including $8,000 of tuition).

Colin covered $12,000 of his support costs out of his own pocket (from savings, he did not work) and he

received a $8.000 scholarship that covered tuition costs. His grandparents provided the remainder of his

support.

The most beneficial filing status for Bob and Jeri is

Their number of dependents is

. Their relevant dependent credits are

(if applicable, also list the

amount of the credit in this blank. Write N/A if no credits apply).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT