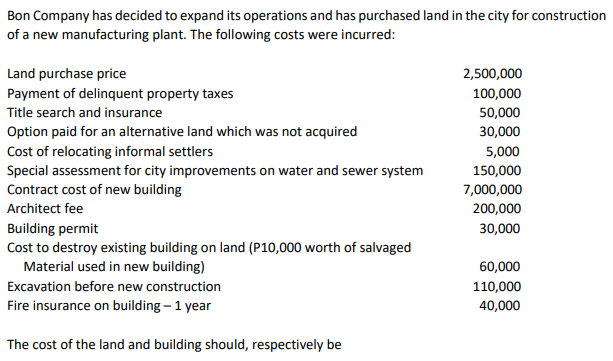

Bon Company has decided to expand its operations and has purchased land in the city for construction of a new manufacturing plant. The following costs were incurred: Land purchase price 2,500,000 Payment of delinquent property taxes 100,000 Title search and insurance 50,000 Option paid for an alternative land which was not acquired Cost of relocating informal settlers Special assessment for city improvements on water and sewer system Contract cost of new building 30,000 5,000 150,000 7,000,000 200,000 Architect fee Building permit Cost to destroy existing building on land (P10,000 worth of salvaged Material used in new building) 30,000 60,000 Excavation before new construction 110,000 Fire insurance on building – 1 year 40,000 The cost of the land and building should, respectively be

Bon Company has decided to expand its operations and has purchased land in the city for construction of a new manufacturing plant. The following costs were incurred: Land purchase price 2,500,000 Payment of delinquent property taxes 100,000 Title search and insurance 50,000 Option paid for an alternative land which was not acquired Cost of relocating informal settlers Special assessment for city improvements on water and sewer system Contract cost of new building 30,000 5,000 150,000 7,000,000 200,000 Architect fee Building permit Cost to destroy existing building on land (P10,000 worth of salvaged Material used in new building) 30,000 60,000 Excavation before new construction 110,000 Fire insurance on building – 1 year 40,000 The cost of the land and building should, respectively be

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 1SEB

Related questions

Question

Transcribed Image Text:Bon Company has decided to expand its operations and has purchased land in the city for construction

of a new manufacturing plant. The following costs were incurred:

Land purchase price

2,500,000

Payment of delinquent property taxes

100,000

Title search and insurance

50,000

Option paid for an alternative land which was not acquired

30,000

Cost of relocating informal settlers

Special assessment for city improvements on water and sewer system

Contract cost of new building

5,000

150,000

7,000,000

Architect fee

200,000

Building permit

Cost to destroy existing building on land (P10,000 worth of salvaged

Material used in new building)

30,000

60,000

Excavation before new construction

110,000

Fire insurance on building – 1 year

40,000

The cost of the land and building should, respectively be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning