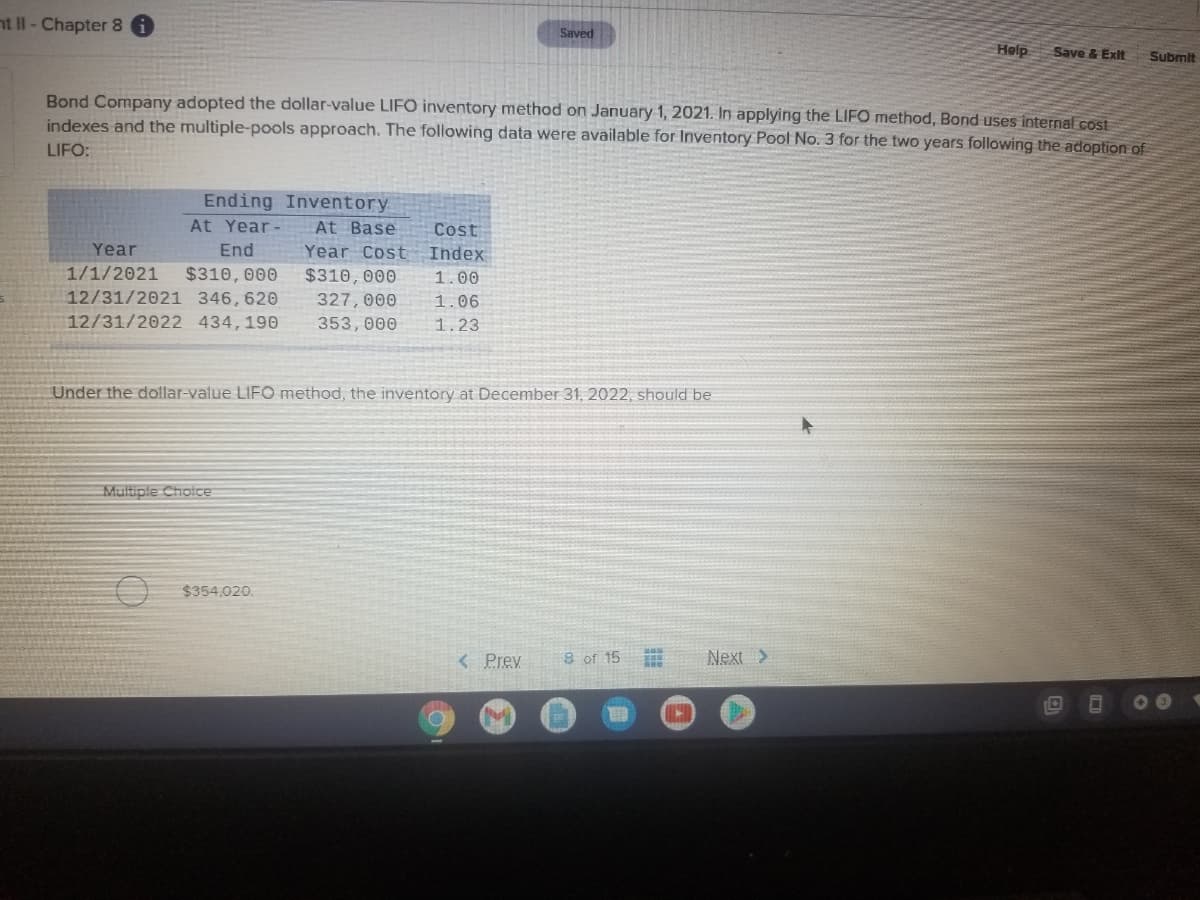

Bond Company adopted the dollar-value LIFO inventory method on January 1, 2021. In applying the LIFO method, Bond uses internal cost indexes and the multiple-pools approach. The following data were available for Inventory Pool No. 3 for the two years following the adoption of LIFO: Ending Inventory At Year- At Base Cost Year End Year Cost Index 1/1/2021 $310, 000 12/31/2021 346,620 $310,000 1.00 327, 000 1.06 12/31/2022 434,190 353,000 1.23 Under the dollar-value LIFO method, the inventory at December 31, 2022, should be

Bond Company adopted the dollar-value LIFO inventory method on January 1, 2021. In applying the LIFO method, Bond uses internal cost indexes and the multiple-pools approach. The following data were available for Inventory Pool No. 3 for the two years following the adoption of LIFO: Ending Inventory At Year- At Base Cost Year End Year Cost Index 1/1/2021 $310, 000 12/31/2021 346,620 $310,000 1.00 327, 000 1.06 12/31/2022 434,190 353,000 1.23 Under the dollar-value LIFO method, the inventory at December 31, 2022, should be

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 12P: Dollar-Value LIFO Kwestel Company adopted the dollar-value LIFO method for inventory valuation at...

Related questions

Topic Video

Question

Transcribed Image Text:nt II - Chapter 8

Saved

Hølp

Save & Exit

Submit

Bond Company adopted the dollar-value LIFO inventory method on January 1, 2021. In applying the LIFO method, Bond uses internal cost

indexes and the multiple-pools approach. The following data were available for Inventory Pool No. 3 for the two years following the adoption of

LIFO:

Ending Inventory

At Year-

Cost

Index

At Base

Year

End

Year Cost

$310, 000

12/31/2021 346,620

12/31/2022 434,190

1/1/2021

$310,000

1.00

327, 000

1.06

353,000

1.23

Under the dollar-value LIF0 method, the inventory at December 31, 2022, should be

Multiple Choice

O $354,020.

< Prev

8 of 15

Next >

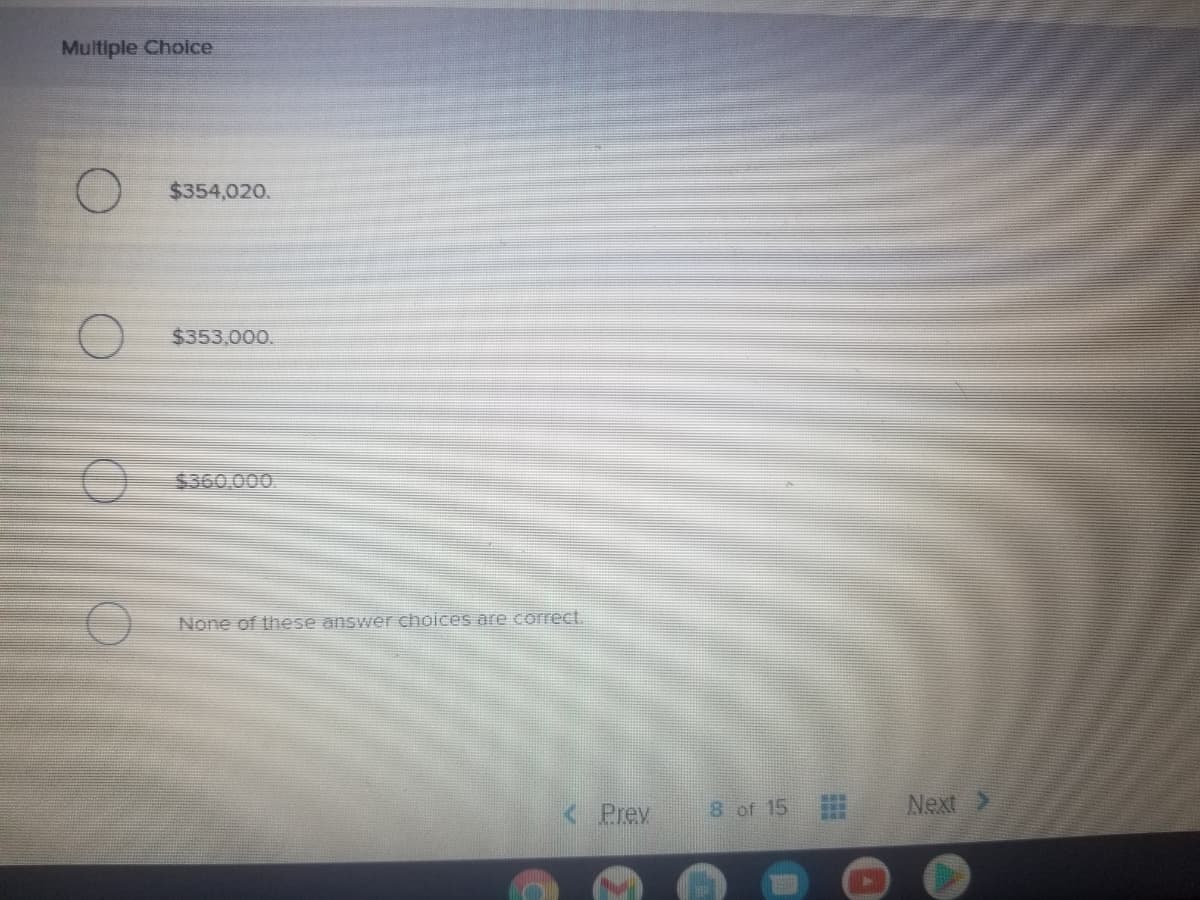

Transcribed Image Text:Multiple Choice

$354,020.

$353,000.

5360000.

None of these answer choices are correct.

< Prev

8 of 15

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning