Concept explainers

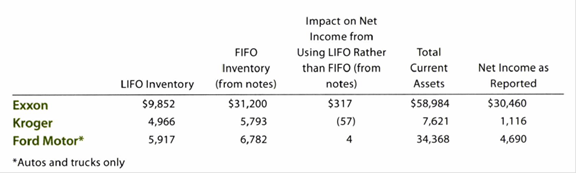

Under U.S. GAAP, LIFO is an acceptable inventory method. Financial statement information for three companies that use LIFO follows. All table numbers are in millions of dollars.

Assume these companies adopted IFRS, and thus were required to use FIFO, rather than LIFO.

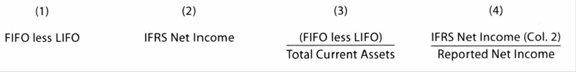

a. Prepare a table with the following columns:

(1) Difference between FIFO and LIFO

(2) Revised IFRS net income using FIFO.

(3) Difference between FIFO and LIFO inventory valuation as a percent of total current assets.

(4) Revised IFRS net income as a percent of the reported net income.

b. Complete the table for the three companies.

c. For which company would a change to IFRS for inventory valuation have the largest percentage impact on total current assets (Col. 3)?

d. For which company would a change to IFRS for inventory valuation have the largest percentage impact on net income (Col. 4)?

e. Why might Kroger have a negative impact on net income from using LIFO, while the other two companies have a positive impact on net income from using LIFO?

(a)

International Financial Reporting Standards (IFRS): IFRS are a set of international accounting standards which are framed, approved, and published by International Accounting Standards Board (IASB) for the preparation and disclosure of international financial reports.

Generally Accepted Accounting Principles (GAAP): These are the guidelines necessary to create accounting principles for the implementation of financial information reporting in the Country U.

First-in-First-Out(FIFO): In this method, items purchased initially are sold first. So, the value of the ending inventory consists the recent cost for the remaining unsold items.

Last-in-First-Out(LIFO): In this method, items purchased recently are sold first. So, the value of the ending inventory consists the initial cost for the remaining unsold items.

To draft: A table with the columns given in the problem

Explanation of Solution

Table is prepared as follows (amounts in millions of dollars):

| FIFO less LIFO | IFRS Net Income | |||

| Company E | ||||

| Company K | ||||

| Company F |

Table (1)

(b)

To complete: The table prepared in Part (a)

Explanation of Solution

Complete the table as follows (amounts in millions of dollars):

| FIFO less LIFO | IFRS Net Income | |||

| Company E | $21,348 | $30,143 | ||

| Company K | 827 | 1,173 | ||

| Company F | 865 | 4,686 |

Table (2)

Working Notes:

Compute FIFO less LIFO (amounts in millions of dollars).

| FIFO | LIFO | FIFO less LIFO | |

| Company E | $31,200 | $9,852 | $21,348 |

| Company K | 5,793 | 4,966 | 827 |

| Company F | 6,782 | 5,917 | 865 |

Table (3)

Deduct the LIFO value from FIFO value to get FIFO less LIFO.

Compute IFRS net income (amounts in millions of dollars).

| Net Income as Reported | Impact on Net Income From Using LIFO Rather Than FIFO | IFRS Net Income | |

| Company E | $30,460 | $317 | $30,143 |

| Company K | 1,116 | (57) | 1,173 |

| Company F | 4,690 | 4 | 4,686 |

Table (4)

Deduct the impact on net income value from net income reported value to get IFRS net income.

Compute FIFO less LIFO divided by total current assets (amounts in millions of dollars).

| FIFO less LIFO | Total Current Assets | ||

| Company E | $21,348 | $58,984 | 36% |

| Company K | 827 | 7,621 | 11% |

| Company F | 865 | 34,368 | 3% |

Table (5)

Divide FIFO less LIFO value by total current assets value to get the value in last column. Refer to Table (3) for value and computation of FIFO less LIFO value.

Compute IFRS net come divided by reported net income(amounts in millions of dollars).

| IFRS Net Income | Net Income as Reported | ||

| Company E | $30,143 | $30,460 | 99% |

| Company K | 1,173 | 1,116 | 105% |

| Company F | 4,686 | 4,690 | 100% |

Table (6)

Divide IFRS net income value by reported net income value to get the value in last column. Refer to Table (4) for value and computation of IFRS net income value.

(c)

To indicate: The company which would have the highest impact on total current assets due to change in inventory valuation method, if the company uses IFRS instead of GAAP

Answer to Problem 3IFRS

If the inventory valuation method is changed to reflect the use of IFRS, Company E would have greatest impact on total current assets.

Explanation of Solution

Refer to Table (5) for value and computation of impact of change in inventory valuation method on total current assets.

(d)

To indicate: The company which would have the highest impact on net income due to change in inventory valuation method, if the company uses IFRS instead of GAAP

Answer to Problem 3IFRS

If the inventory valuation method is changed to reflect the use of IFRS, Company K would have greatest impact on net income.

Explanation of Solution

Refer to Table (6) for value and computation of impact of change in inventory valuation method on net income.

(e)

To discuss: The reasons for negative impact on net income if LIFO is used rather than FIFO

Explanation of Solution

During inflation, the inventory purchased last will have higher price than the inventory purchased first. Thus, under LIFO method, the inventory purchased last with higher price will be sold first, thereby increasing the cost of goods sold. Increase in cost of goods sold decreases the net income.

Want to see more full solutions like this?

- Bhushan Company has been using LIFO for inventory purposes because it would prefer to keep gross profits low for tax purposes. In its second year of operation (20-2), the controller pointed out that this strategy did not appear to work and suggested that FIFO cost of goods sold would have been higher than LIFO cost of goods sold for 20-2. Is this possible? REQUIRED Using the information provided, compute the cost of goods sold for 20-1 and 20-2 comparing the LIFO and FIFO methods.arrow_forwardIf Barcelona Companys ending inventory was actually $122,000, but the cost of consigned goods, with a cost value of $20,000 were accidentally included with the company assets, when making the year-end inventory adjustment, what would be the impact on the presentation of the balance sheet and income statement for the year that the error occurred, if any?arrow_forwardWhen the double-extension approach to the dollar-value LIFO inventory cost flow method is used, the inventory layer added in the current year is multiplied by an index number. How would the following be used in the calculation of this index number?arrow_forward

- LIFO and Inventory Pools On January 1, 2016, Grover Company changed its inventory cost flow method to the LIFO cost method from the FIFO cost method for its raw materials inventory. It made the change for both financial statement and income tax reporting purposes. Grover uses the multiple-pools approach under which it groups substantially identical raw materials into LIFO inventory pools. It uses weighted average costs in valuing annual incremental layers. The composition of the December 31, 2018, inventory for the Class F inventory pool is as follows: Inventory transactions for the Class F inventory pool during 2019 were as follows: On March 2, 2019, 4,800 units were purchased at a unit cost of 13.50 for 64,800. On September 1, 2019, 7,200 units were purchased at a unit cost of 14.00 for 100,800. A total of 15,000 units were used for production during 2019. The following transactions for the Class F inventory pool took place during 2020: On January 11, 2020, 7,500 units were purchased at a unit cost of 14.50 for 108,750. On May 14, 2020, 5,500 units were purchased at a unit cost of 15.50 for 85,250. On December 29, 2020, 7,000 units were purchased at a unit cost of 16.00 for 112,000. A total of 16,000 units were used for production during 2020. Required: 1. Prepare a schedule to compute the inventory (units and dollar amounts) of the Class F inventory pool at December 31, 2019. Show supporting computations in good form. 2. Prepare a schedule to compute the cost of Class F raw materials used in production for the year ended December 31, 2019. 3. Prepare a schedule to compute the inventory (units and dollar amounts) of the Class F inventory pool at December 31, 2020. Show supporting computations in good form.arrow_forwardSchmidt Company began operations on January 1, 2018, and used the LIFO inventory method for both financial reporting and income taxes. However, at the beginning of 2020, Schmidt decided to switch to the average cost inventory method for financial and income tax reporting. It had previously reported the following financial statement information for 2019: An analysis of the accounting records discloses the following cost of goods sold under the LIFO and average cost inventory methods: There are no indirect effects of the change in inventory method. Revenues for 2020 total 130,000; operating expenses for 2020 total 30,000. Schmidt is subject to a 21% income tax rate in all years; it pays all income taxes payable in the next quarter. Assume that any deferred tax liability was paid in the subsequent year. Schmidt had 10,000 shares of common stock outstanding during all years; it paid dividends of 1 per share in 2020. At the end of 2020, Schmidt had cash of 15,600, inventory of 34,000, other assets of 76,000, income taxes payable of 4,200, and accounts payable of 3,000. It desires to show financial statements for the current year and previous year in its 2020 annual report. Required: 1. Prepare the journal entry to reflect the change in method at the beginning of 2020. Show supporting calculations. 2. Prepare the 2020 financial statements. Notes to the financial statements are not necessary. Show supporting calculations.arrow_forwardCompany Elmira reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 32,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?arrow_forward

- Refer to the information provided in RE8-4. If Paul Corporations inventory at January 1, 2019, had a cost and net realizable value of 300,000, prepare the journal entry to record the reductions to NRV for Paul Corporation assuming that Paul uses a periodic inventory system and the direct method. Paul Corporation uses FIFO and reports the following inventory information: Assuming Paul uses a perpetual inventory system and the direct method, prepare the journal entry to record the write-down of inventory.arrow_forwardKoopman Company began operations on January 1, 2018, and uses they FIFO inventory method for financial reporting and the average cost inventory method for income taxes. At the beginning of 2020, Koopman decided to switch to the average cost inventory method for financial reporting. It had previously reported the following financial statement information for 2019: An analysis of the accounting records discloses the following cost of goods sold under the FIFO and average cost inventory methods: There are no indirect effects of the change in inventory method. Revenues for 2020 total 130,000; operating expenses for 2020 total 30,000. Koopman is subject to a 21% income tax rate in all years; it pays the income taxes payable of a current year in the first quarter of the next year. Koopman had 10,000 shares of common stock outstanding during all years; it paid dividends of 1 per share in 2020. At the end of 2020, Koopman had cash of 10,000, inventory of 24,000, other assets of 70,800, accounts payable of 4,500, and income taxes payable of 6,000. It desires to show financial statements for the current year and previous year in its 2020 annual report. Required: 1. Prepare the journal entry to reflect the change in methods at the beginning of 2020. Show supporting calculations. 2. Prepare the 2020 financial statements. Notes to the financial statements are not necessary. Show supporting calculations.arrow_forwardIn 2022, Kimberly Corporation changed its method of inventory pricing from LIFO to FIFO. Net income computed on a LIFO as compared to a FIFO basis for the four years involved is: (Ignore income taxes.) LIFO FIFO 2019 $78,600 $87,400 2020 84,000 88,900 2021 86,800 90,600 2022 92,800 92,200 Assume that the company had switched from the average cost method to the FIFO method with net income on an average cost basis for the four years as follows: 2019, $80,400; 2020, $86,120; 2021, $90,300; and 2018, $93,600. Indicate the net income that would be shown on comparative financial statements issued at 12/31/22 for each of the four years under these conditions. Net Income 2019 $ 2020 $ 2021 $ 2022 $arrow_forward

- Below is the net income of New Girl Instrument AG, a private company, computed under the two inventory methods using a periodic system. FIFO Average-Cost 2017 $26,000 $23,000 2018 30,000 25,000 2019 29,000 27,000 2020 34,000 30,000 (ignore tax considerations) Required: a. Assume that in 2020 New Girl decided to change from the FIFO method to the average-cost method of pricing inventories. Prepare the journal entry necessary for the change that took place during 2020, and show net income reported for 2017, 2018, 2019, and 2020. b. Assume that in 2020 New Girl, which had been using the average-cost method since beginning operations in 2017, changed to the FIFO method of pricing inventories. Prepare the journal entry necessary to record the change in 2020, and show net income reported for 2017, 2018, 2019, and 2020.arrow_forward1. U.S. public companies using LIFO also report the amount that inventory wouldincrease (oroccasionally decrease) if the company had instead used FIFO. See file please.arrow_forwardThe following example was provided to encourage the use of the LIFO method. In a nutshell, LIFO subtracts inflation from inventory costs, deducts it from taxable income, and records it in a LIFO reserve account on the books. The LIFO benefit grows as inflation widens the gap between current-year and past-year (minus inflation) inventory costs. This gap is: With LIFO Without LIFO Revenues $3,200,000 $3,200,000 Cost of goods sold 2,800,000 2,800,000 Operating expenses 150,000 150,000 Operating income 250,000 250,000 LIFO adjustment 40,000 0 Taxable income $ 210,000 $ 250,000 Income taxes (36%) $ 75,600 $ 90,000 Cash flow $ 174,400 $ 160,000 Extra cash $ 14,400 0 Increased cash flow 9% 0% Instructions a. Explain what is meant by the LIFO reserve account. b. How does LIFO subtract inflation from inventory costs? c. Explain how the cash flow of $174,400 in this example was computed. Explain why this…arrow_forward

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning