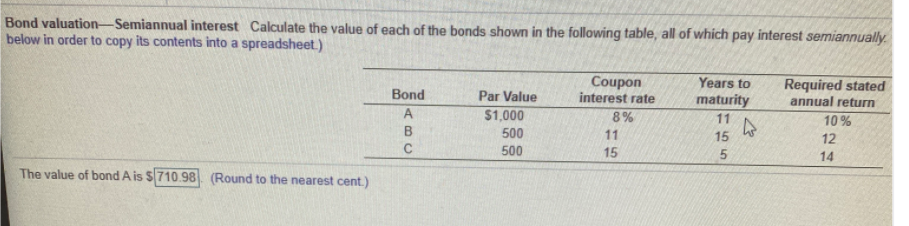

Bond valuation-Semiannual interest Calculate the value of each of the bonds shown in the following table, all of which pay interest semiannually. below in order to copy its contents into a spreadsheet.) Coupon interest rate Years to Required stated annual return Bond Par Value maturity 11 A $1,000 8% 10 % 500 11 15 12 C 500 15 14 The value of bond A is $710.98 (Round to the nearest cent.)

Bond valuation-Semiannual interest Calculate the value of each of the bonds shown in the following table, all of which pay interest semiannually. below in order to copy its contents into a spreadsheet.) Coupon interest rate Years to Required stated annual return Bond Par Value maturity 11 A $1,000 8% 10 % 500 11 15 12 C 500 15 14 The value of bond A is $710.98 (Round to the nearest cent.)

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter4: Bond Valuation

Section: Chapter Questions

Problem 7P: Bond Valuation with Semiannual Payments

Renfro Rentals has issued bonds that have a 10% coupon rate,...

Related questions

Question

Transcribed Image Text:Bond valuation-Semiannual interest Calculate the value of each of the bonds shown in the following table, all of which pay interest semiannually.

below in order to copy its contents into a spreadsheet.)

Coupon

interest rate

Years to

Required stated

annual return

Bond

Par Value

maturity

11

A

$1,000

8%

10 %

500

11

15

12

C

500

15

14

The value of bond A is $710.98 (Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning