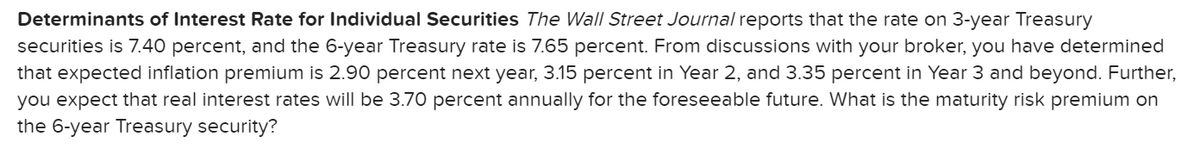

Determinants of Interest Rate for Individual Securities The Wall Street Journal reports that the rate on 3-year Treasury securities is 7.40 percent, and the 6-year Treasury rate is 7.65 percent. From discussions with your broker, you have determined that expected inflation premium is 2.90 percent next year, 3.15 percent in Year 2, and 3.35 percent in Year 3 and beyond. Further, you expect that real interest rates will be 3.70 percent annually for the foreseeable future. What the 6-year Treasury security? the maturity risk premium on

Determinants of Interest Rate for Individual Securities The Wall Street Journal reports that the rate on 3-year Treasury securities is 7.40 percent, and the 6-year Treasury rate is 7.65 percent. From discussions with your broker, you have determined that expected inflation premium is 2.90 percent next year, 3.15 percent in Year 2, and 3.35 percent in Year 3 and beyond. Further, you expect that real interest rates will be 3.70 percent annually for the foreseeable future. What the 6-year Treasury security? the maturity risk premium on

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter4: Bond Valuation

Section: Chapter Questions

Problem 4P: Determinant of Interest Rates

The real risk-free rate of interest is 4%. Inflation is expected to be...

Related questions

Question

Transcribed Image Text:Determinants of Interest Rate for Individual Securities The Wall Street Journal reports that the rate on 3-year Treasury

securities is 7.40 percent, and the 6-year Treasury rate is 7.65 percent. From discussions with your broker, you have determined

that expected inflation premium is 2.90 percent next year, 3.15 percent in Year 2, and 3.35 percent in Year 3 and beyond. Further,

you expect that real interest rates will be 3.70 percent annually for the foreseeable future. What is the maturity risk premium on

the 6-year Treasury security?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning