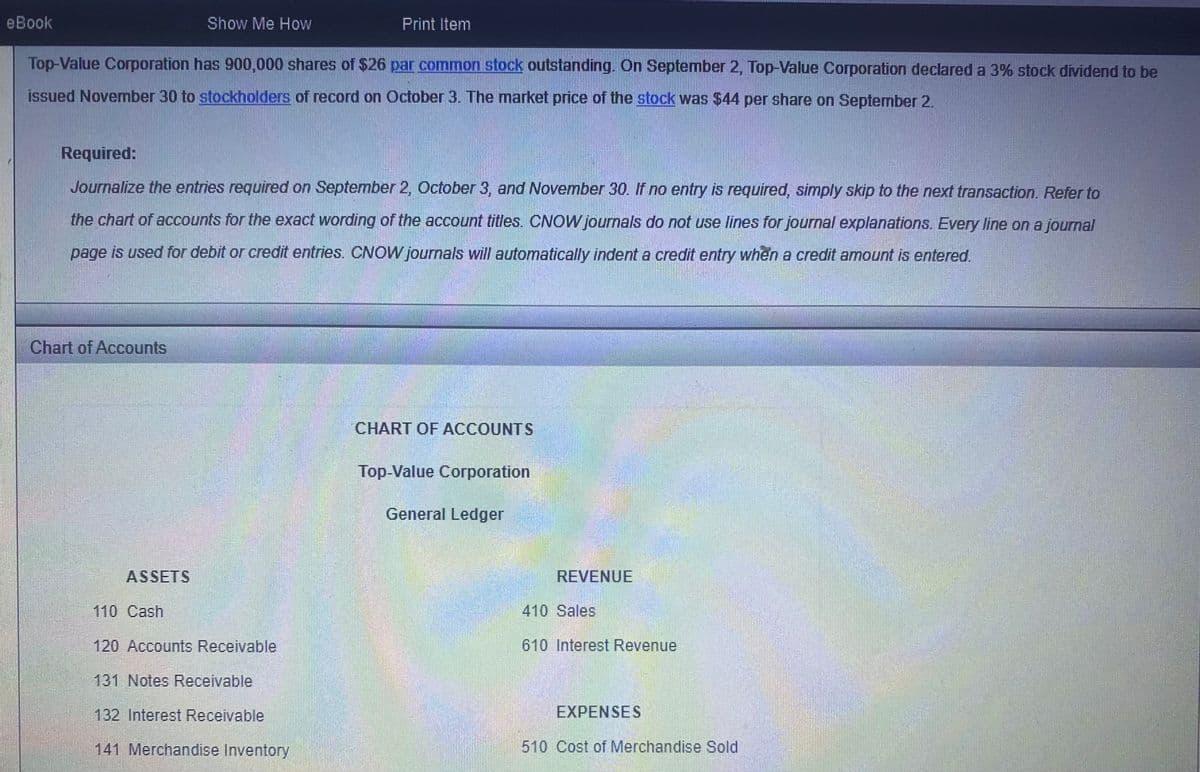

Book Show Me How Print Item Top-Value Corporation has 900,000 shares of $26 par common stock outstanding. On September 2, Top-Value Corporation declared a 3% stock dividend to be issued November 30 to stockholders of record on October 3. The market price of the stock was $44 per share on September 2. Required: Journalize the entries required on September 2, October 3, and November 30. If no entry is required, simply skip to the next transaction. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts

Book Show Me How Print Item Top-Value Corporation has 900,000 shares of $26 par common stock outstanding. On September 2, Top-Value Corporation declared a 3% stock dividend to be issued November 30 to stockholders of record on October 3. The market price of the stock was $44 per share on September 2. Required: Journalize the entries required on September 2, October 3, and November 30. If no entry is required, simply skip to the next transaction. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Chart of Accounts

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 4SEA: STOCK DIVIDENDS Kaufman Company currently has 200,000 shares of 1 par common stock outstanding. On...

Related questions

Question

Transcribed Image Text:eBook

Show Me How

Print Item

Top-Value Corporation has 900,000 shares of $26 par common stock outstanding. On September 2, Top-Value Corporation declared a 3% stock dividend to be

issued November 30 to stockholders of record on October 3. The market price of the stock was $44 per share on September 2.

Required:

Journalize the entries required on September 2, October 3, and November 30. If no entry is required, simply skip to the next transaction. Refer to

the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal

page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.

Chart of Accounts

CHART OF ACCOUNTS

Top-Value Corporation

General Ledger

ASSETS

REVENUE

110 Cash

410 Sales

120 Accounts Receivable

610 Interest Revenue

131 Notes Receivable

132 Interest Receivable

EXPENSES

141 Merchandise Inventory

510 Cost of Merchandise Sold

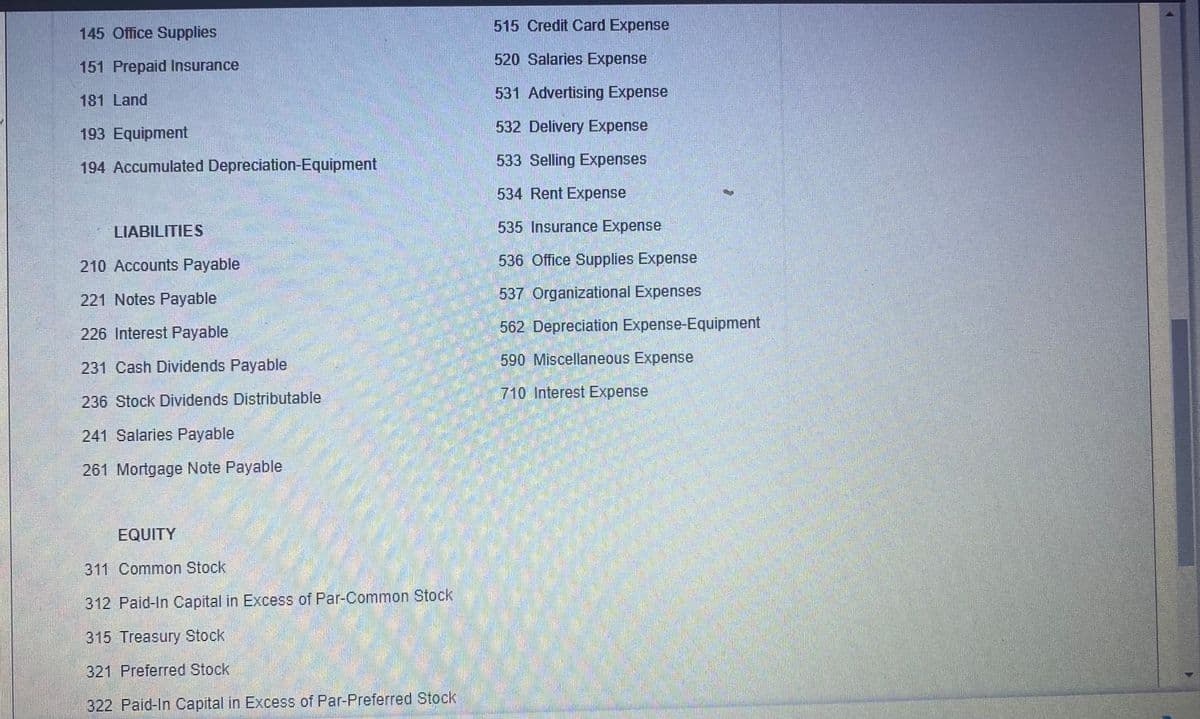

Transcribed Image Text:145 Office Supplies

515 Credit Card Expense

520 Salaries Expense

151 Prepaid Insurance

531 Advertising Expense

181 Land

532 Delivery Expense

193 Equipment

194 Accumulated Depreciation-Equipment

533 Selling Expenses

534 Rent Expense

LIABILITIES

535 Insurance Expense

210 Accounts Payable

536 Office Supplies Expense

221 Notes Payable

537 Organizational Expenses

226 Interest Payable

562 Depreciation Expense-Equipment

590 Miscellaneous Expense

231 Cash Dividends Payable

710 Interest Expense

236 Stock Dividends Distributable

241 Salaries Payable

261 Mortgage Note Payable

EQUITY

311 Common Stock

312 Paid-In Capital in Excess of Par-Common Stock

315 Treasury Stock

321 Preferred Stock

322 Paid-In Capital in Excess of Par-Preferred Stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage