Boston files his lawsuit against Mallory in a South Dakota state court, the state where he resides. Mallory is a resident of North Dakota. The case has a claim at stake worth $100,000. What right, if any, does Mallory have in this case, jurisdictionally? Multiple Choice Mallory can have the case moved to federal court only if the state trial court judge grants permission at his or her discretion. Mallory can have the case moved to federal court only if federal jurisdiction question is involved. Mallory has no choice, and the case will stay in state court. Mallory as the defendant has a right to move the case to federal court under the process of removal jurisdiction Mallory can ask the federal court to hear the case. However, it does not have to hear the case since the amount in controversy is over $75,000.

Boston files his lawsuit against Mallory in a South Dakota state court, the state where he resides. Mallory is a resident of North Dakota. The case has a claim at stake worth $100,000. What right, if any, does Mallory have in this case, jurisdictionally? Multiple Choice Mallory can have the case moved to federal court only if the state trial court judge grants permission at his or her discretion. Mallory can have the case moved to federal court only if federal jurisdiction question is involved. Mallory has no choice, and the case will stay in state court. Mallory as the defendant has a right to move the case to federal court under the process of removal jurisdiction Mallory can ask the federal court to hear the case. However, it does not have to hear the case since the amount in controversy is over $75,000.

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 37P

Related questions

Question

Transcribed Image Text:Please answer ASAP. Thank you

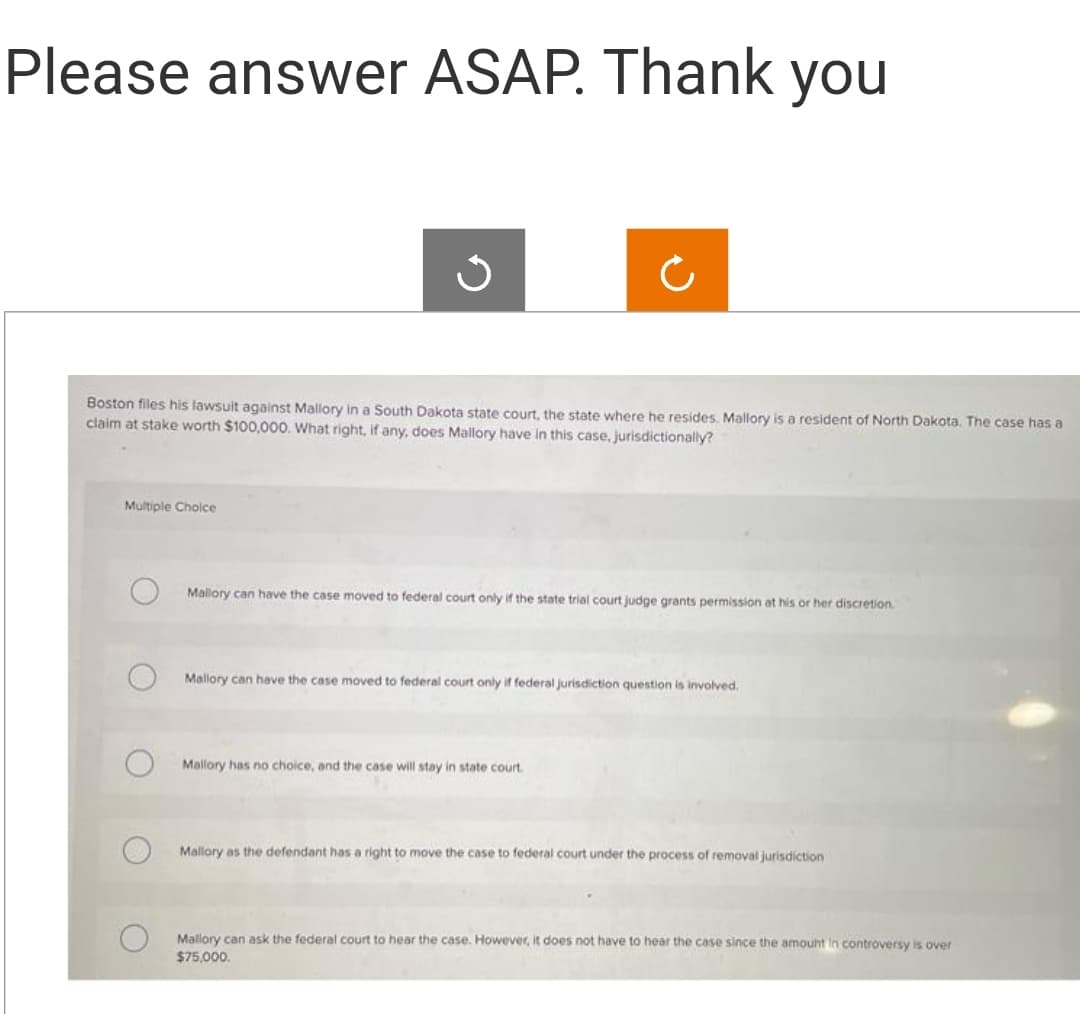

Boston files his lawsuit against Mallory in a South Dakota state court, the state where he resides. Mallory is a resident of North Dakota. The case has a

claim at stake worth $100,000. What right, if any, does Mallory have in this case, jurisdictionally?

Multiple Choice

Mallory can have the case moved to federal court only if the state trial court judge grants permission at his or her discretion.

Mallory can have the case moved to federal court only if federal jurisdiction question is involved.

Mallory has no choice, and the case will stay in state court.

Mallory as the defendant has a right to move the case to federal court under the process of removal jurisdiction

Mallory can ask the federal court to hear the case. However, it does not have to hear the case since the amount in controversy is over

$75,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT