Ekiya, who is single, has been offered a position as a city landscape consultant, the position pays $127,400 in wages. Assume Ekiya has no dependents. Ekiya deducts the standard deduction instead of itemized deductions, she is not eligible for the quailed business income deduction, and she did not make any charitable donations.

Ekiya, who is single, has been offered a position as a city landscape consultant, the position pays $127,400 in wages. Assume Ekiya has no dependents. Ekiya deducts the standard deduction instead of itemized deductions, she is not eligible for the quailed business income deduction, and she did not make any charitable donations.

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter3: Preparing Your Taxes

Section: Chapter Questions

Problem 2FPE: ESTIMATING TAXABLE INCOME, TAX LIABILITY, AND POTENTIAL REFUND. Hannah Owens is 24 years old and...

Related questions

Question

Ekiya, who is single, has been offered a position as a city landscape consultant, the position pays $127,400 in wages. Assume Ekiya has no dependents. Ekiya deducts the standard deduction instead of itemized deductions, she is not eligible for the quailed business income deduction, and she did not make any charitable donations.

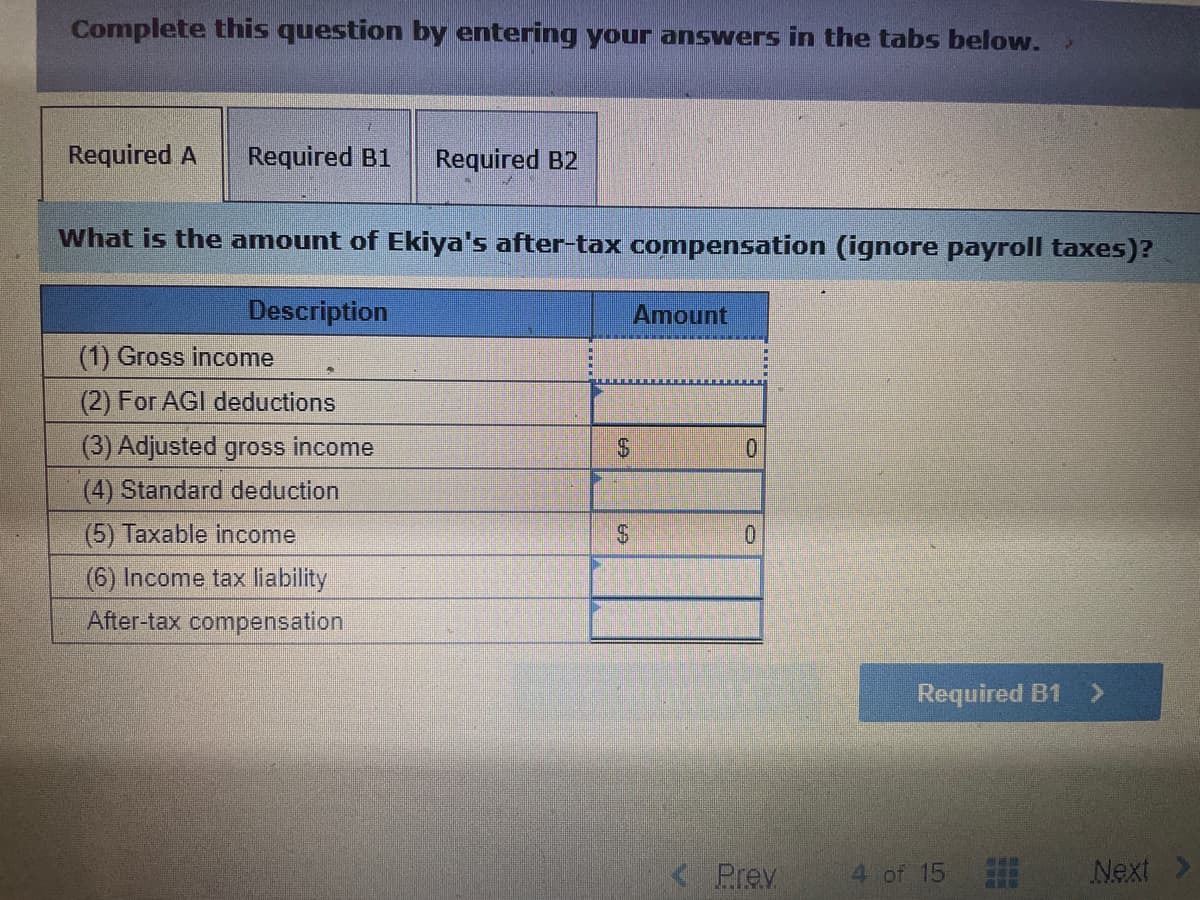

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A Required B1 Required B2

What is the amount of Ekiya's after-tax compensation (ignore payroll taxes)?

Description

(1) Gross income

(2) For AGI deductions

(3) Adjusted gross income

(4) Standard deduction

(5) Taxable income

(6) Income tax liability

After-tax compensation

$

$

Amount

0

0

Prev

Required B1 >

4 of 15

WAT

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning