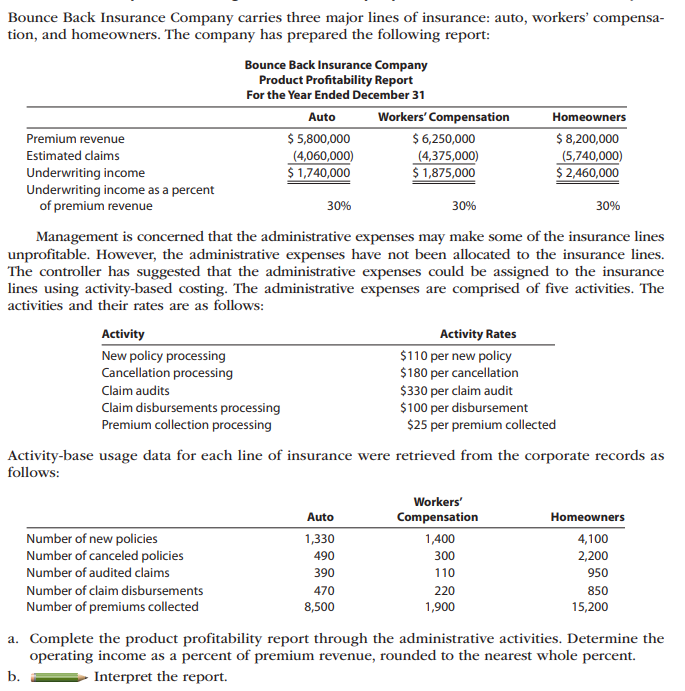

Bounce Back Insurance Company carries three major lines of insurance: auto, workers' compensa- tion, and homeowners. The company has prepared the following report: Bounce Back Insurance Company Product Profitability Report For the Year Ended December 31 Workers' Compensation $ 6,250,000 (4,375,000) $ 1,875,000 Auto Homeowners $ 5,800,000 (4,060,000) $ 1,740,000 $ 8,200,000 (5,740,000) $ 2,460,000 Premium revenue Estimated claims Underwriting income Underwriting income as a percent of premium revenue 30% 30% 30% Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows: Activity Activity Rates $110 per new policy $180 per cancellation $330 per claim audit $100 per disbursement $25 per premium collected New policy processing Cancellation processing Claim audits Claim disbursements processing Premium collection processing Activity-base usage data for each line of insurance were retrieved from the corporate records as follows: Workers' Auto Compensation Homeowners Number of new policies Number of canceled policies 1,330 1,400 4,100 490 300 2,200 Number of audited claims 390 110 950 Number of claim disbursements 470 220 850 Number of premiums collected 8,500 1,900 15,200 a. Complete the product profitability report through the administrative activities. Determine the operating income as a percent of premium revenue, rounded to the nearest whole percent. b. Interpret the report.

Bounce Back Insurance Company carries three major lines of insurance: auto, workers' compensa- tion, and homeowners. The company has prepared the following report: Bounce Back Insurance Company Product Profitability Report For the Year Ended December 31 Workers' Compensation $ 6,250,000 (4,375,000) $ 1,875,000 Auto Homeowners $ 5,800,000 (4,060,000) $ 1,740,000 $ 8,200,000 (5,740,000) $ 2,460,000 Premium revenue Estimated claims Underwriting income Underwriting income as a percent of premium revenue 30% 30% 30% Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows: Activity Activity Rates $110 per new policy $180 per cancellation $330 per claim audit $100 per disbursement $25 per premium collected New policy processing Cancellation processing Claim audits Claim disbursements processing Premium collection processing Activity-base usage data for each line of insurance were retrieved from the corporate records as follows: Workers' Auto Compensation Homeowners Number of new policies Number of canceled policies 1,330 1,400 4,100 490 300 2,200 Number of audited claims 390 110 950 Number of claim disbursements 470 220 850 Number of premiums collected 8,500 1,900 15,200 a. Complete the product profitability report through the administrative activities. Determine the operating income as a percent of premium revenue, rounded to the nearest whole percent. b. Interpret the report.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 14EA: Toren Inc. employs one person to run its solar management company. The employees gross income for...

Related questions

Question

Transcribed Image Text:Bounce Back Insurance Company carries three major lines of insurance: auto, workers' compensa-

tion, and homeowners. The company has prepared the following report:

Bounce Back Insurance Company

Product Profitability Report

For the Year Ended December 31

Workers' Compensation

$ 6,250,000

(4,375,000)

$ 1,875,000

Auto

Homeowners

$ 5,800,000

(4,060,000)

$ 1,740,000

$ 8,200,000

(5,740,000)

$ 2,460,000

Premium revenue

Estimated claims

Underwriting income

Underwriting income as a percent

of premium revenue

30%

30%

30%

Management is concerned that the administrative expenses may make some of the insurance lines

unprofitable. However, the administrative expenses have not been allocated to the insurance lines.

The controller has suggested that the administrative expenses could be assigned to the insurance

lines using activity-based costing. The administrative expenses are comprised of five activities. The

activities and their rates are as follows:

Activity

Activity Rates

$110 per new policy

$180 per cancellation

$330 per claim audit

$100 per disbursement

$25 per premium collected

New policy processing

Cancellation processing

Claim audits

Claim disbursements processing

Premium collection processing

Activity-base usage data for each line of insurance were retrieved from the corporate records as

follows:

Workers'

Auto

Compensation

Homeowners

Number of new policies

Number of canceled policies

1,330

1,400

4,100

490

300

2,200

Number of audited claims

390

110

950

Number of claim disbursements

470

220

850

Number of premiums collected

8,500

1,900

15,200

a. Complete the product profitability report through the administrative activities. Determine the

operating income as a percent of premium revenue, rounded to the nearest whole percent.

b.

Interpret the report.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning