Bounce Back Insurance Company carries three major lines of insurance: auto, workers' compensation, and homeowners. The company has prepared the following report: Bounce Back Insurance Company Product Profitability Report For the Year Ended December 31 Auto Workers' Compensation Homeowners Premium revenue $5,800,000 $6,250,000 $8,200,000 Estimated claims (4,060,000) (4,375,000) (5,740,000) Underwriting income $1,740,000 $1,875,000 $2,460,000 Underwriting income as a percent of premium revenue 30% 30% 30% Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows: Activity Activity Rates New policy processing $110 per new policy Cancellation processing $180 per cancellation Claim audits $330 per claim audit Claim disbursements processing $100 per disbursement Premium collection processing $25 per premium collected Activity-base usage data for each line of insurance were retrieved from the corporate records as follows: Auto Workers' Compensation Homeowners Number of new policies 1,330 1,400 4,100 Number of canceled policies 490 300 2,200 Number of audited claims 390 110 950 Number of claim disbursements 470 220 850 Number of premiums collected 8,500 1,900 15,200 a. Complete the product profitability report through the administrative activities. Determine the operating income as a percent of premium revenue. Rounded to the nearest whole percent. Bounce Back Insurance CompanyProduct Profitability ReportFor the Year Ended December 31

Bounce Back Insurance Company carries three major lines of insurance: auto, workers' compensation, and homeowners. The company has prepared the following report:

| Bounce Back Insurance Company Product Profitability Report For the Year Ended December 31 |

|||||

| Auto | Workers' Compensation | Homeowners | |||

| Premium revenue | $5,800,000 | $6,250,000 | $8,200,000 | ||

| Estimated claims | (4,060,000) | (4,375,000) | (5,740,000) | ||

| Underwriting income | $1,740,000 | $1,875,000 | $2,460,000 | ||

| Underwriting income as a percent of premium revenue | 30% | 30% | 30% |

Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows:

| Activity | Activity Rates |

| New policy processing | $110 per new policy |

| Cancellation processing | $180 per cancellation |

| Claim audits | $330 per claim audit |

| Claim disbursements processing | $100 per disbursement |

| Premium collection processing | $25 per premium collected |

Activity-base usage data for each line of insurance were retrieved from the corporate records as follows:

| Auto | Workers' Compensation | Homeowners | ||||||

| Number of new policies | 1,330 | 1,400 | 4,100 | |||||

| Number of canceled policies | 490 | 300 | 2,200 | |||||

| Number of audited claims | 390 | 110 | 950 | |||||

| Number of claim disbursements | 470 | 220 | 850 | |||||

| Number of premiums collected | 8,500 | 1,900 | 15,200 |

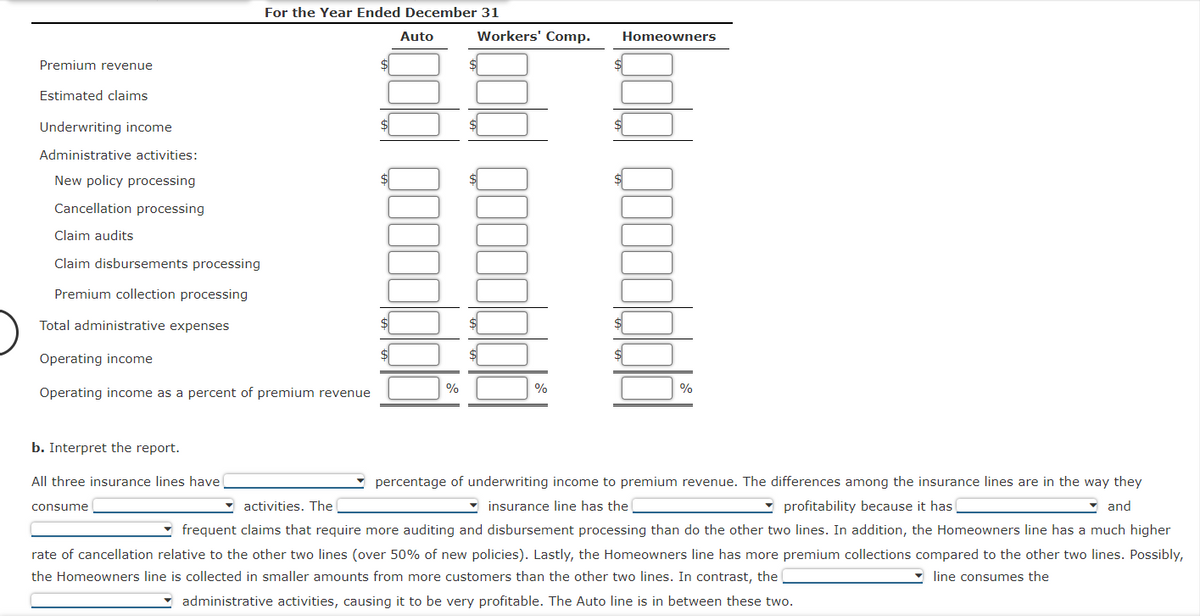

a. Complete the product profitability report through the administrative activities. Determine the operating income as a percent of premium revenue. Rounded to the nearest whole percent.

Bounce Back Insurance CompanyProduct Profitability ReportFor the Year Ended December 31

Trending now

This is a popular solution!

Step by step

Solved in 3 steps