Prepare the journal entry on Crane's books to record the restructuring of this debt. (Cr

Q: Problem 9-15 Multiple choice (IFRS) 1. Comprehensive income includes all of the following except a.…

A: Disclaimer: "Since you have asked multiple questions, we will solve the first three questions for…

Q: Pincus Associates uses the allowance method to account for bad debts. During 2021, its first year of…

A: Using allowance method, the accounts are written off as debit allowance for uncollectible accounts…

Q: d. With respect to the deferred gain on intercompany sale, what effect (i.e., amount) will it have…

A: An adjusting journal entry is made in the company's general ledger at the end of an accounting…

Q: Allocation of variable plant overhead based on labour hours worked on the building, $34,000…

A: An alternate approach to estimating asset worth is to calculate the "cost to generate," which…

Q: Madison Corporation is authorized to issue $600,000 of 7-year bonds dated June 30, 2019, with a…

A: Time value of money :— According to this concept, value of money in present day is greater than the…

Q: at the mom Discuss whether the subsidiary can be classified as held for sale.

A: Holding Company:- An Holding company is considered as the company who have a controlling interest in…

Q: 23. On January 1, 2021, Blue Company purchased 20% of the outstanding ordinary shares of Yellow…

A: Equity method is used by the investor company when it has significant influence over the company in…

Q: Vaughn, Inc. had the following equity investment portfolio at January 1, 2025. Evers Company Rogers…

A: Journal entry is a specific format for recording day-to-day business transactions. It follows a…

Q: The market value of lodging received by an employee may be excluded from income if the lodging is on…

A: Note: As per the Policy, We’ll answer the first question since the exact one wasn’t specified.…

Q: Sales Total Variable Cost Total contribution margin Total fixed cost Operating income (loss) Units…

A: Break even is the point at which the entity is in a position of no profit and no loss. It is the…

Q: The condensed statement of financial position of Ricablanca, Tac-an and Dimalanta partnership as of…

A: Note : On liquidation of partnership amount received on sale of assets after settlement of liability…

Q: The Production Department of Hruska Corporation has submitted the following forecast of units to be…

A: Manufacturing overhead : These are the indirect charges incurred in connection with production in…

Q: Crane Corp. purchased land as a factory site for $280000. They paid $12200 to tear down two…

A: Cost of land includes all the direct related cost for acquisition and preparation for the intended…

Q: Jobs, Inc. has recently started the manufacture of Tri-Robo, a three-wheeled robot that can scan a…

A: Make or buy is the decision making analysis that helps the entity to decide if it should make the…

Q: B. Manchester Company provided the following information on December 31, 2021: Employee income taxes…

A: Answer is option a) 8,100,000

Q: The first of 12 semiannual payments of $2,700 will be made 6 years from today. What is the present…

A: present value means the current value of the future sum.

Q: Dorsey Company manuf processing costs up to th company allocates these point. Unit selling prices…

A: To determine the financial advantage or disadvantage of further processing each product beyond the…

Q: Chapter 8 Applying Excel Data Budgeted Unit Sales Selling price per unit Accounts receivable,…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: Oriole Company's Work in Process-Painting account shows the following activity. 5/1 Balance 5/31…

A: Total units accounted for :— It is calculated by adding units in beginning WIP and units started and…

Q: Companies in the tire manufacturing business use a lot of property, plant, and equipment. Tyrell…

A: Depreciation is the concept of accounting which states the value of the asset is allocated or…

Q: Tracy Company, a manufacturer of air conditioners, sold 200 units to Thomas Company on November 17,…

A: Credit terms 2/10, n/30 means that if payment is being made in 10 days, then 2% discount will be…

Q: Lawn Corporation purchased 297,500 of the 1,190,000 common shares of Abacus Ltd. on October 1, 2021,…

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal Entry is the Process…

Q: Give 5 Exempt Sale of Goods or Properties.

A: Exempt sales under Indian GST law means any goods or services which attract nil rate of tax or…

Q: Arabica Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage…

A: In a job cost system, costs are tracked for each job or project and are then used to calculate the…

Q: Required Information [The following information applies to the questions displayed below.] Phoenix…

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally…

Q: Using the information below, complete (i) the operating cash flow section of the Statement of Cash…

A: Cash flow statement: The financial statement prepared to calculate the net amount of cash spent…

Q: Assume Joseph sells all of the receivables over 91 days to Ace Factoring. Approximately how much of…

A: Given in the question: The question is regarding the factoring of the accounts receivables, the…

Q: Calculate Payroll K. Mello Company has three employees-a consultant, a computer programmer, and an…

A: In Payroll we have to calculate Gross pay by multiply hourly or weekly rate with no of hours or…

Q: Assume that the current minimum wage is $7.25 per hour and the proposed increase would be $15.00 per…

A: The proposed increase in minimum wage from $7.25 to $15.00 per hour will have a significant impact…

Q: Determine the amount of the child tax credit in each of the following cases: a. A single parent with…

A: Child Tax Credit For each dependent kid under the age of 17 , the child tax credit is worth $2,000…

Q: On June 10, Marigold Company purchased $8,150 of merchandise on account from Grouper Company, FOB…

A: Debit the receiver and credit the giver. Debit what comes in and credit what goes out. Debit…

Q: Ay 4. Mosbius Design Company purchased a computers for $75,000 in 2013. It is estimated those…

A: Depreciation rate as per straight line 20% Depreciation rate as per double decline…

Q: NAME Calculate Each of the following Answer Points current ratio quick ratio…

A: ratio analysis is used to calculate the profitability or financial position of the firm over a…

Q: During the first week of January, an employee works 50 hours. For this company, workers earn 150% of…

A: Lets understand the basics. Employee gets paid normal wages for working and also a overitme wages…

Q: Concord, Inc. had net sales in 2025 of $1,428,800. At December 31, 2025, before adjusting entries,…

A: The allowance for doubtful accounts has the normal credit balance. The allowance for doubtful…

Q: Gig Harbor Boating is the wholesale distributor of a small recreational catamaran sailboat.…

A: Income statement: Income statement is the financial statement that shows the financial performance…

Q: CWB Inc. produces stuffed bunnies. The company normally produces and sells 78,000 stuffed bunnies…

A: A unit cost is a total expenditure incurred by a company to produce, store, and sell one unit of a…

Q: SP 8 Santana Rey receives the March bank statement for Business Solutions on April 11, 2022. The…

A: In order to make sure that both sets of data are correct and consistent, a corporation must compare…

Q: 6. Caper Manufacturers show the following information for the month of February 2023. Raw materials…

A: FACTORY OVERHEAD COST Factory OH Cost are those Cost which is Directly Associated with Manufacturing…

Q: SCOPE OF AUDIT IN A CIS ENVIRONMENT High Speed low clerical error Concentration of duties shifting…

A: An audit is an independent examination and evaluation of financial statements, records, and other…

Q: As of December 31, 2020, Gill Co. reported accounts receivable of $218,000 and an allowance for…

A: Bad debt expense means the amount of receivables that become bad that is irrecoverable from the…

Q: Assuming they all me 2021? a. A single taxpayer w b. A married taxpayer c. A single taxpayer w d. A…

A: If a person is self employed, qualifying specified income limit criteria and having dependent child…

Q: Direct materials Direct labor I Variable manufacturing overhead Fixed manufacturing overhead…

A: calculation of net operating income under variable costing system and reconciliation between…

Q: Lampierre makes brass and gold frames. The company computed this information to decide whether to…

A: The overhead is applied to the production on the basis of pre-determined overhead rate. The activity…

Q: a. Use the appropriate formula to determine the periodic deposit. b. How much of the financial goal…

A: Periodic deposit required must depends on the time and interest rate of the cash flow and cash flow…

Q: 21. A non-VAT business reported the following: Sales Cost of Sales Purchases, inclusive of VAT…

A: Tax payable refers to the amount of tax that an individual or business owes to the government for a…

Q: E. An entity sells washing machines that carry a three-year warranty against manufacturer's defects.…

A: Introduction:- The following basic information as follows under:- An entity sells washing machines…

Q: The ledger of Ivanhoe Company has the following work in process inventory account. Work in…

A: WEIGHTED AVERAGE METHOD :— Under this method, equivalent units is calculated by adding equivalent…

Q: Unadjusted Balance Adjusted Balance Unadjusted Balance Adjusted Balance Unadjusted Balance Adiusted…

A: Ledger is a book used to summarize the journal transactions. Closing balances are ascertained from…

Q: Frank Weston, supervisor of the Freemont Corporation's Machining Department, was visibly upset after…

A: The flexible budget enables the managers to isolate the various causes of the differences between…

Step by step

Solved in 2 steps

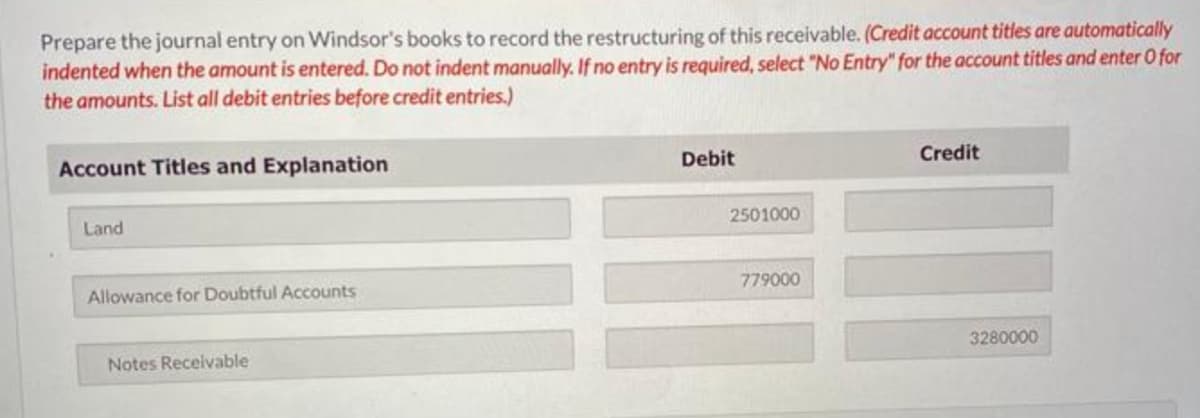

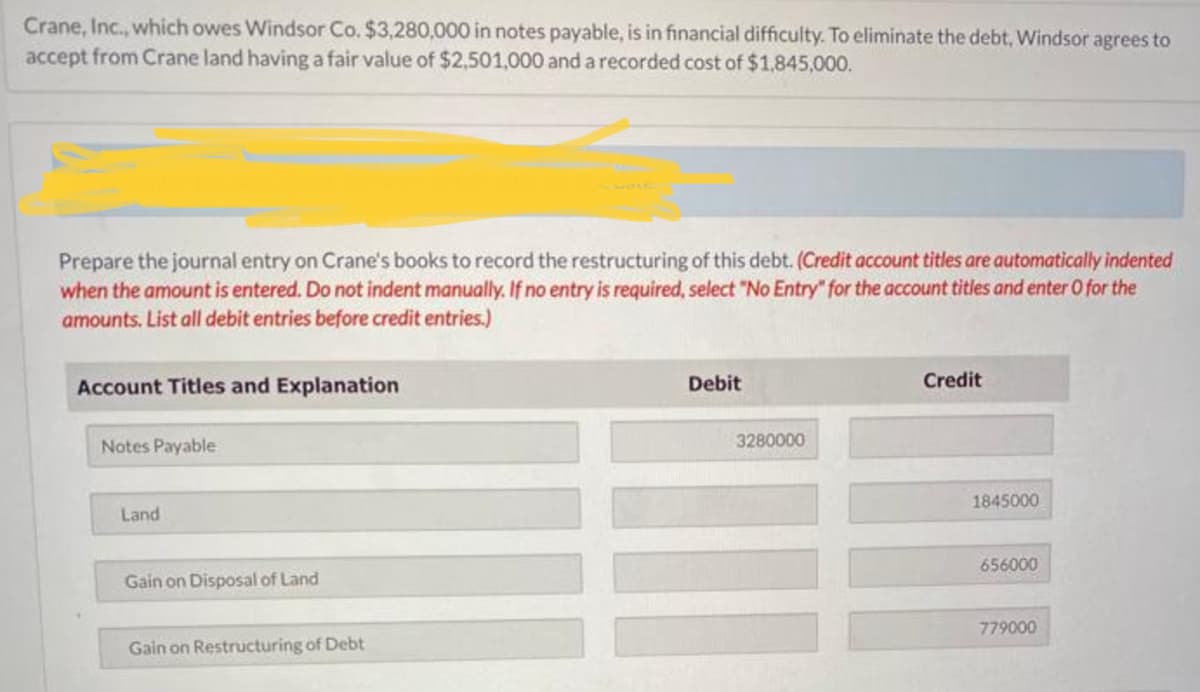

- Southwestern Wear Inc. has the following balance sheet: The trustees costs total 281,250, and the firm has no accrued taxes or wages. The debentures are subordinated only to the notes payable. If the firm goes bankrupt and liquidates, how much will each class of investors receive if a total of 2.5 million is received from sale of the assets?Pratt Industries owes First National Bank $5 million but, due to financial difficulties, is unable to comply with the original terms of the loan. The bank agrees to settle the debt in exchange for land having a fair value of $3 million. The book value of the property on Pratt’s books is $2 million. For the reporting period in which the debt is settled, what amount(s) will Pratt report on its income statement in connection with the troubled debt restructuring?Karim Inc., which owes Habib Co. SAR 900,000 in notes payable, is in financial difficulty. To eliminate the debt, Habib agrees to accept from Karim land having a fair value of SAR 610,000 and a recorded cost of SAR 450,000. a) Compute the amount of gain or loss to Karim, Inc. on the transfer (disposition) of the land. b) Compute the amount of gain or loss to Karim, Inc. on the settlement of the debt. c) Prepare the journal entry on Karim's books to record the settlement of this debt

- Before any debt cancellation, the insolvent KuhnCo holds business equipment, its only asset, with a fair market value of $1 million and related liabilities of $1.25 million. The lender agrees to cancel $400,000 of the liabilities. KuhnCo has no other liabilities. a. How much gross income does KuhnCo report as a result of the debt cancellation? b. How would your answer change, if at all, had the lender cancelled $200,000 of the debt?On December 31, 2012, Columbia Company shows the data presented in the image with respect to its matured obligation. The company is threatened with a court suit if it could not pay its maturing debt. Accordingly, the company enters into an agreement with the creditor for the transfer of a non-cash asset in full settlement of the mortgage. The agreement provides for the transfer of real estate carried in the books of Columbia at P3,000,000. The real estate has a current fair market value of P4,500,000. What amount should Columbia recognize in profit or loss for the year 2012 as a result of this transaction? Notes Payable 5,000,000 Accrued Interest Payable 500,000 a. P500,000 b. P1,000,000 c. P1,500,000 d. P2,500,000At the time it defaulted on its interest payments and filed for bankruptcy, the McDaniel Mining Company had the balance sheet shown here (in thousands of dollars). The court, after trying unsuccessfully to reorganize the firm, decided that the only recourse was liquidation under Chapter 7. Sale of the fixed assets, which were pledged as collateral to the mortgage bondholders, brought in $400,000, while the current assets were sold for another $200,000. Thus, the total proceeds from the liquidation sale were $600,000. The trustee’s costs amounted to $50,000; no single worker was due more than the maximum allowable wages per worker; and there were no unfunded pension plan liabilities. a. How much will McDaniel’s shareholders receive from the liquidation? (SHOW ALL WORK). b. How much will the mortgage bondholders receive? (SHOW ALL WORK). c. Who are the other priority claimants (in addition to the mortgage bondholders)? How much will they receive from the liquidation? (SHOW ALL…

- At the time it defaulted on its interest payments and filed for bankruptcy, the McDaniel Mining Company had the balance sheet shown here (in thousands of dollars). The court, after trying unsuccessfully to reorganize the firm, decided that the only recourse was liquidation under Chapter 7. Sale of the fixed assets, which were pledged as collateral to the mortgage bondholders, brought in $400,000, while the current assets were sold for another $200,000. Thus, the total proceeds from the liquidation sale were $600,000. The trustee’s costs amounted to $50,000; no single worker was due more than the maximum allowable wages per worker; and there were no unfunded pension plan liabilities. Balance Sheet (Thousands of Dollars) Current assets $ 400 Accounts payable $50 Net fixed assets 600 Accrued taxes 40 Accrued wages 30 Notes Payable 180 Total current liabilities 300 First-mortgage bonds $300 Second-mortgage bonds 200 Debentures 200…At the time it defaulted on its interest payments and filed for bankruptcy, the McDaniel Mining Company had the balance sheet shown here (in thousands of dollars). The court, after trying unsuccessfully to reorganize the firm, decided that the only recourse was liquidation under Chapter 7. Sale of the fixed assets, which were pledged as collateral to the mortgage bondholders, brought in $400,000, while the current assets were sold for another $200,000. Thus, the total proceeds from the liquidation sale were $600,000. The trustee’s costs amounted to $50,000; no single worker was due more than the maximum allowable wages per worker; and there were no unfunded pension plan liabilities. How much will each general creditor receive from the distribution before subordination adjustment and what is the effect of adjusting for subordination? (SHOW ALL WORK).At the time it defaulted on its interest payments and filed for bankruptcy, the McDaniel Mining Company had the balance sheet shown here (in thousands of dollars). The court, after trying unsuccessfully to reorganize the firm, decided that the only recourse was liquidation under Chapter 7. Sale of the fixed assets, which were pledged as collateral to the mortgage bondholders, brought in $400,000, while the current assets were sold for another $200,000. Thus, the total proceeds from the liquidation sale were $600,000. The trustee’s costs amounted to $50,000; no single worker was due more than the maximum allowable wages per worker; and there were no unfunded pension plan liabilities. Balance Sheet (Thousands of Dollars) Current assets $ 400 Accounts payable $50 Net fixed assets 600 Accrued taxes 40 Accrued wages 30 Notes Payable 180 Total current liabilities 300 First-mortgage bonds $300 Second-mortgage bonds 200 Debentures 200…

- Lugi Company was forced into bankruptcy and is in the process of liquidating assets and paying claims. Unsecured claims will be paid at the rate of forty cents on the peso. ABC holds a P30,000 non-interest bearing note receivable from Lugi collateralized by an asset with a book value of P35,000 and a liquidation value of P5,000. What amount will be realizable by ABC on this note?APA Corp. was forced into bankruptcy and is in the process of liquidating assets and paying claims. Unsecured claims will be paid at the rate of forty cents on the peso. ABC holds a P30,000 noninterest-bearing note receivable from APA collateralized by an asset with a book value of P35,000 and a liquidation value of P5,000. The amount to be realized by ABC on this note isAPA Company Owes the ABC Corporation P60,000 on account, which is secured by accounts receivable with a book value of P50,000. The unsecured portion is considered a claim under the bankruptcy law, the company has filed for bankruptcy. Its statement of affairs lists the accounts receivable securing the ABC account with an estimated realizable value of P45,000. If the dividend to general unsecured creditors is 80%, how much can ABC expect to receive?