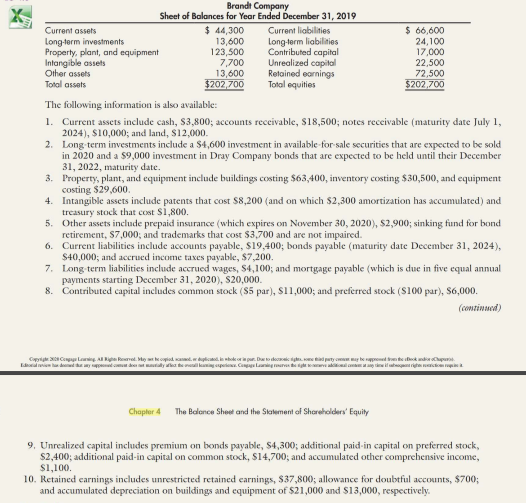

Brandt Company Current assets Long-term investments Property, plant, and equipment Intangible assets Other assets Total assets Sheet of Balances for Year Ended December 31, 2019 Current liabilities Long-term liabilities Contributed capital Unrealized capital Retained earnings Total equities $ 44,300 13,600 123,500 7,700 13,600 $202,700 $ 66,600 24,100 17,000 22,500 72,500 $202,700 The following information is also available: 1. Current assets include cash, $3,800; accounts rececivable, $18,500; notes rececivable (maturity date July 1, 2024), S10,000; and land, S12,000. 2. Long term investments include a $4,600 investment in available-for-sale securities that are expected to be sold in 2020 and a $9,000 investment in Dray Company bonds that are expected to be held until their December 31, 2022, maturity date. 3. Property, plant, and equipment include buildings costing $63,400, inventory costing $30,500, and equipment costing $29,600. 4. Intangible assets include patents that cost $8,200 (and on which $2,300 amortization has accumulated) and treasury stock that cost S1,800. 5. Other assets include prepaid insurance (which expires on November 30, 2020), S2,900; sinking fund for bond retirement, S7,000; and trademarks that cost $3,700 and are not impaired. 6. Current liabilities include accounts payable, $19,400; bonds payable (maturity date December 31, 2024), $40,000; and accrued income taxes payable, $7,200. 7. Long term liabilities include accrued wages, S4,100; and mortgage payable (which is due in five equal annual payments starting December 31, 2020), S20,000. 8. Contributed capital includes common stock (S5 par), s11,000; and preferred stock (S100 par), S6,000. (continued) Cpyie Conpaga Lag R Reet. Me e opiad t.ic hok or pur. Dao decelc ig tad paty om may be rponed te kndi oapur. Ele de ypd m d y a te lkgpee. Cnpa Laning rran ge i abgrighe i Chapter 4 The Balance Sheet and the Stotement of Shoreholders' Equity 9. Unrealized capital includes premium on bonds payable, S4,300; additional paid-in capital on preferred stock, S2,400; additional paid-in capital on common stock, S14,700; and accumulated other comprehensive income, S1,100. 10. Retained carnings includes unrestricted retained carnings, $37,800; allowance for doubtful accounts, $700; and accumulated depreciation on buildings and equipment of $21,000 and S13,000, respectively.

Brandt Company Current assets Long-term investments Property, plant, and equipment Intangible assets Other assets Total assets Sheet of Balances for Year Ended December 31, 2019 Current liabilities Long-term liabilities Contributed capital Unrealized capital Retained earnings Total equities $ 44,300 13,600 123,500 7,700 13,600 $202,700 $ 66,600 24,100 17,000 22,500 72,500 $202,700 The following information is also available: 1. Current assets include cash, $3,800; accounts rececivable, $18,500; notes rececivable (maturity date July 1, 2024), S10,000; and land, S12,000. 2. Long term investments include a $4,600 investment in available-for-sale securities that are expected to be sold in 2020 and a $9,000 investment in Dray Company bonds that are expected to be held until their December 31, 2022, maturity date. 3. Property, plant, and equipment include buildings costing $63,400, inventory costing $30,500, and equipment costing $29,600. 4. Intangible assets include patents that cost $8,200 (and on which $2,300 amortization has accumulated) and treasury stock that cost S1,800. 5. Other assets include prepaid insurance (which expires on November 30, 2020), S2,900; sinking fund for bond retirement, S7,000; and trademarks that cost $3,700 and are not impaired. 6. Current liabilities include accounts payable, $19,400; bonds payable (maturity date December 31, 2024), $40,000; and accrued income taxes payable, $7,200. 7. Long term liabilities include accrued wages, S4,100; and mortgage payable (which is due in five equal annual payments starting December 31, 2020), S20,000. 8. Contributed capital includes common stock (S5 par), s11,000; and preferred stock (S100 par), S6,000. (continued) Cpyie Conpaga Lag R Reet. Me e opiad t.ic hok or pur. Dao decelc ig tad paty om may be rponed te kndi oapur. Ele de ypd m d y a te lkgpee. Cnpa Laning rran ge i abgrighe i Chapter 4 The Balance Sheet and the Stotement of Shoreholders' Equity 9. Unrealized capital includes premium on bonds payable, S4,300; additional paid-in capital on preferred stock, S2,400; additional paid-in capital on common stock, S14,700; and accumulated other comprehensive income, S1,100. 10. Retained carnings includes unrestricted retained carnings, $37,800; allowance for doubtful accounts, $700; and accumulated depreciation on buildings and equipment of $21,000 and S13,000, respectively.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 15P: Investments in Equity Securities Manson Incorporated reported investments in equity securities of...

Related questions

Question

Brandt Company presents the following December 31, 2019,

Transcribed Image Text:Brandt Company

Current assets

Long-term investments

Property, plant, and equipment

Intangible assets

Other assets

Total assets

Sheet of Balances for Year Ended December 31, 2019

Current liabilities

Long-term liabilities

Contributed capital

Unrealized capital

Retained earnings

Total equities

$ 44,300

13,600

123,500

7,700

13,600

$202,700

$ 66,600

24,100

17,000

22,500

72,500

$202,700

The following information is also available:

1. Current assets include cash, $3,800; accounts rececivable, $18,500; notes rececivable (maturity date July 1,

2024), S10,000; and land, S12,000.

2. Long term investments include a $4,600 investment in available-for-sale securities that are expected to be sold

in 2020 and a $9,000 investment in Dray Company bonds that are expected to be held until their December

31, 2022, maturity date.

3. Property, plant, and equipment include buildings costing $63,400, inventory costing $30,500, and equipment

costing $29,600.

4. Intangible assets include patents that cost $8,200 (and on which $2,300 amortization has accumulated) and

treasury stock that cost S1,800.

5. Other assets include prepaid insurance (which expires on November 30, 2020), S2,900; sinking fund for bond

retirement, S7,000; and trademarks that cost $3,700 and are not impaired.

6. Current liabilities include accounts payable, $19,400; bonds payable (maturity date December 31, 2024),

$40,000; and accrued income taxes payable, $7,200.

7. Long term liabilities include accrued wages, S4,100; and mortgage payable (which is due in five equal annual

payments starting December 31, 2020), S20,000.

8. Contributed capital includes common stock (S5 par), s11,000; and preferred stock (S100 par), S6,000.

(continued)

Cpyie Conpaga Lag R Reet. Me e opiad t.ic hok or pur. Dao decelc ig tad paty om may be rponed te kndi oapur.

Ele de ypd m d y a te lkgpee. Cnpa Laning rran ge

i abgrighe i

Chapter 4

The Balance Sheet and the Stotement of Shoreholders' Equity

9. Unrealized capital includes premium on bonds payable, S4,300; additional paid-in capital on preferred stock,

S2,400; additional paid-in capital on common stock, S14,700; and accumulated other comprehensive income,

S1,100.

10. Retained carnings includes unrestricted retained carnings, $37,800; allowance for doubtful accounts, $700;

and accumulated depreciation on buildings and equipment of $21,000 and S13,000, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning