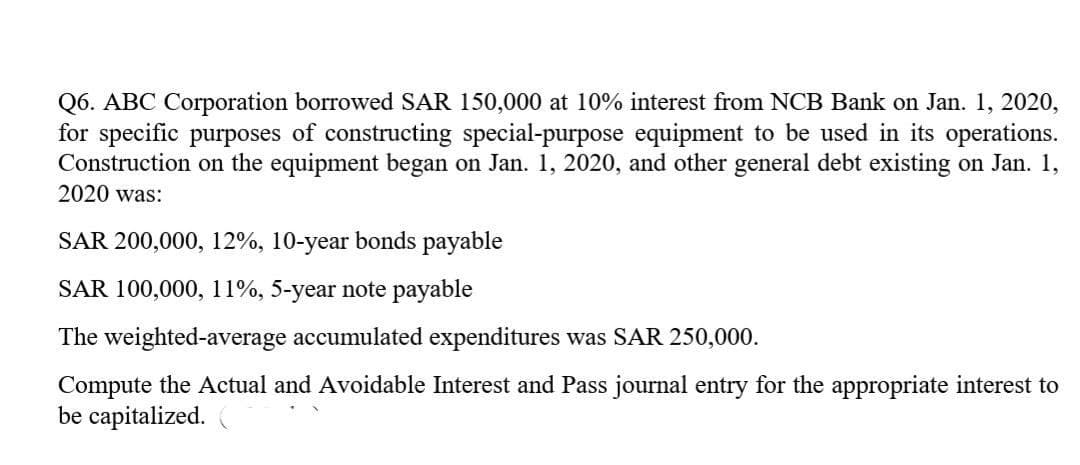

Q6. ABC Corporation borrowed SAR 150,000 at 10% interest from NCB Bank on Jan. 1, 2020, for specific purposes of constructing special-purpose equipment to be used in its operations. Construction on the equipment began on Jan. 1, 2020, and other general debt existing on Jan. 1, 2020 was: SAR 200,000, 12%, 10-year bonds payable SAR 100,000, 11%, 5-year note payable The weighted-average accumulated expenditures was SAR 250,000. Compute the Actual and Avoidable Interest and Pass journal entry for the appropriate interest to be capitalized.

Q6. ABC Corporation borrowed SAR 150,000 at 10% interest from NCB Bank on Jan. 1, 2020, for specific purposes of constructing special-purpose equipment to be used in its operations. Construction on the equipment began on Jan. 1, 2020, and other general debt existing on Jan. 1, 2020 was: SAR 200,000, 12%, 10-year bonds payable SAR 100,000, 11%, 5-year note payable The weighted-average accumulated expenditures was SAR 250,000. Compute the Actual and Avoidable Interest and Pass journal entry for the appropriate interest to be capitalized.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 1RE

Related questions

Question

Transcribed Image Text:Q6. ABC Corporation borrowed SAR 150,000 at 10% interest from NCB Bank on Jan. 1, 2020,

for specific purposes of constructing special-purpose equipment to be used in its operations.

Construction on the equipment began on Jan. 1, 2020, and other general debt existing on Jan. 1,

2020 was:

SAR 200,000, 12%, 10-year bonds payable

SAR 100,000, 11%, 5-year note payable

The weighted-average accumulated expenditures was SAR 250,000.

Compute the Actual and Avoidable Interest and Pass journal entry for the appropriate interest to

be capitalized.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning