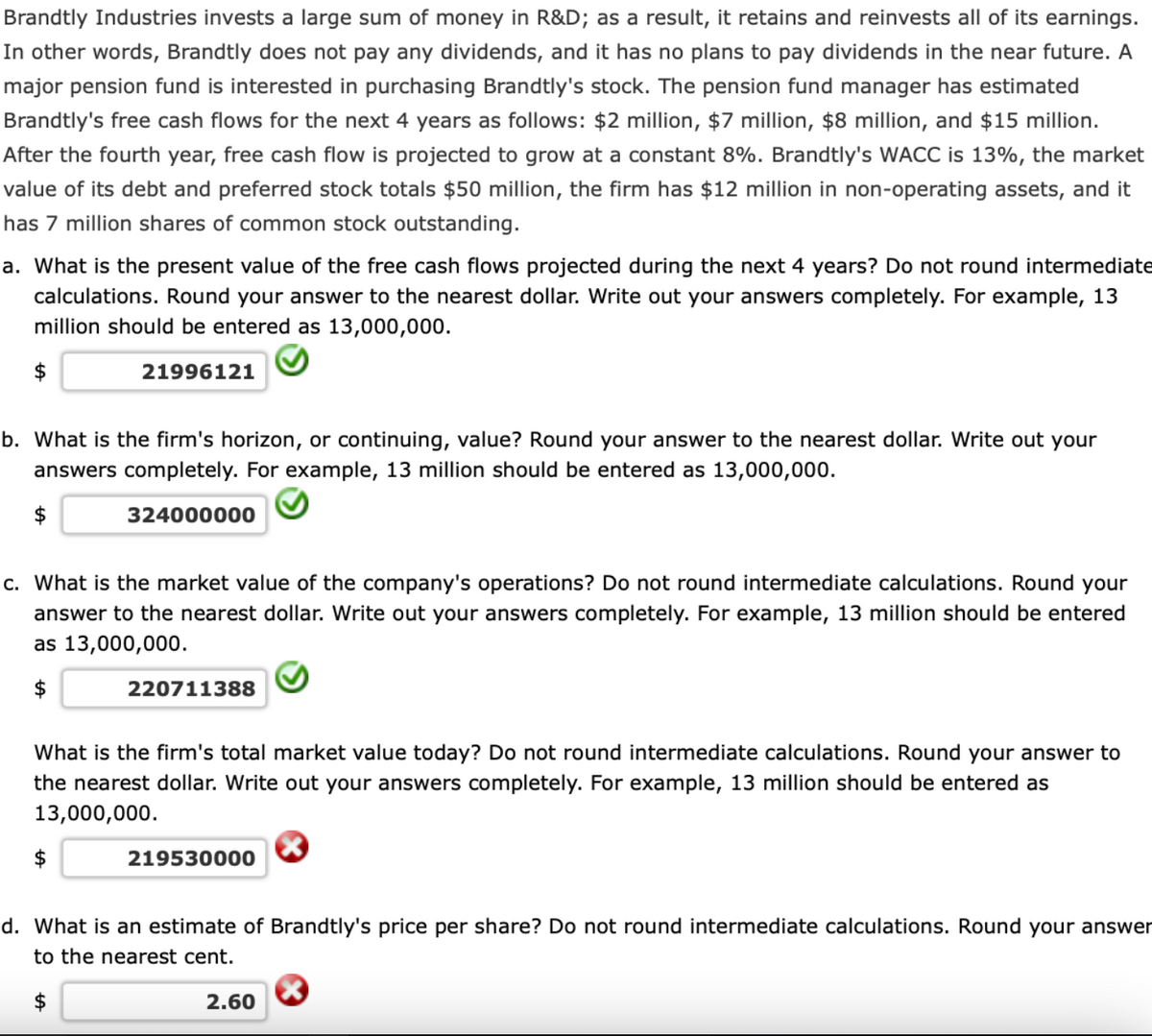

Brandtly Industries invests a large sum of money in R&D; as a result, it retains and reinvests all of its earnings. In other words, Brandtly does not pay any dividends, and it has no plans to pay dividends in the near future. A major pension fund is interested in purchasing Brandtly's stock. The pension fund manager has estimated Brandtly's free cash flows for the next 4 years as follows: $2 million, $7 million, $8 million, and $15 million. After the fourth year, free cash flow is projected to grow at a constant 8%. Brandtly's WACC is 13%, the market value of its debt and preferred stock totals $50 million, the firm has $12 million in non-operating assets, and it has 7 million shares of common stock outstanding. a. What is the present value of the free cash flows projected during the next 4 years? Do not round intermediate calculations. Round your answer to the nearest dollar. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 21996121 b. What is the firm's horizon, or continuing, value? Round your answer to the nearest dollar. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 324000000 c. What is the market value of the company's operations? Do not round intermediate calculations. Round your answer to the nearest dollar. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 220711388 What is the firm's total market value today? Do not round intermediate calculations. Round your answer to the nearest dollar. Write out your answers completely. For example, 13 million should be entered as 13,000,000. $ 219530000 d. What is an estimate of Brandtly's price per share? Do not round intermediate calculations. Round your answer to the nearest cent. $ 2.60

Brandtly Industries invests a large sum of money in R&D; as a result, it retains and reinvests all of its earnings. In other words, Brandtly does not pay any dividends, and it has no plans to pay dividends in the near future. A major pension fund is interested in purchasing Brandtly's stock. The pension fund manager has estimated Brandtly's free cash flows for the next 4 years as follows: $2 million, $7 million, $8 million, and $15 million. After the fourth year, free cash flow is projected to grow at a constant 8%. Brandtly's WACC is 13%, the market value of its debt and preferred stock totals $50 million, the firm has $12 million in non-operating assets, and it has 7 million shares of common stock outstanding. a. What is the present value of the free cash flows projected during the next 4 years? Do not round intermediate calculations. Round your answer to the nearest dollar. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 21996121 b. What is the firm's horizon, or continuing, value? Round your answer to the nearest dollar. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 324000000 c. What is the market value of the company's operations? Do not round intermediate calculations. Round your answer to the nearest dollar. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 220711388 What is the firm's total market value today? Do not round intermediate calculations. Round your answer to the nearest dollar. Write out your answers completely. For example, 13 million should be entered as 13,000,000. $ 219530000 d. What is an estimate of Brandtly's price per share? Do not round intermediate calculations. Round your answer to the nearest cent. $ 2.60

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 5MC: David Lyons, CEO of Lyons Solar Technologies, is concerned about his firms level of debt financing....

Related questions

Question

C and D is wrong. I need help please.

Transcribed Image Text:Brandtly Industries invests a large sum of money in R&D; as a result, it retains and reinvests all of its earnings.

In other words, Brandtly does not pay any dividends, and it has no plans to pay dividends in the near future. A

major pension fund is interested in purchasing Brandtly's stock. The pension fund manager has estimated

Brandtly's free cash flows for the next 4 years as follows: $2 million, $7 million, $8 million, and $15 million.

After the fourth year, free cash flow is projected to grow at a constant 8%. Brandtly's WACC is 13%, the market

value of its debt and preferred stock totals $50 million, the firm has $12 million in non-operating assets, and it

has 7 million shares of common stock outstanding.

a. What is the present value of the free cash flows projected during the next 4 years? Do not round intermediate

calculations. Round your answer to the nearest dollar. Write out your answers completely. For example, 13

million should be entered as 13,000,000.

2$

21996121

b. What is the firm's horizon, or continuing, value? Round your answer to the nearest dollar. Write out your

answers completely. For example, 13 million should be entered as 13,000,000.

324000000

c. What is the market value of the company's operations? Do not round intermediate calculations. Round your

answer to the nearest dollar. Write out your answers completely. For example, 13 million should be entered

as 13,000,000.

$

220711388

What is the firm's total market value today? Do not round intermediate calculations. Round your answer to

the nearest dollar. Write out your answers completely. For example, 13 million should be entered as

13,000,000.

$

219530000

d. What is an estimate of Brandtly's price per share? Do not round intermediate calculations. Round your answer

to the nearest cent.

2.60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning