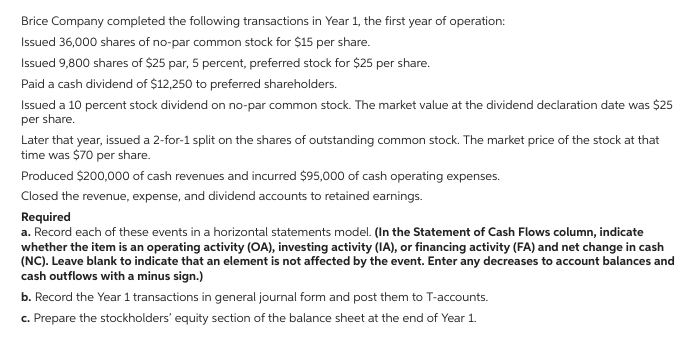

Brice Company completed the following transactions in Year 1, the first year of operation: Issued 36,000 shares of no-par common stock for $15 per share. Issued 9,800 shares of $25 par, 5 percent, preferred stock for $25 per share. Paid a cash dividend of $12,250 to preferred shareholders. Issued a 10 percent stock dividend on no-par common stock. The market value at the dividend declaration date was $25 per share. Later that year, issued a 2-for-1 split on the shares of outstanding common stock. The market price of the stock at that time was $70 per share. Produced $200,000 of cash revenues and incurred $95,000 of cash operating expenses. Closed the revenue, expense, and dividend accounts to retained earnings. Required a. Record each of these events in a horizontal statements model. (In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA) and net change in cash (NC). Leave blank to indicate that an element is not affected by the event. Enter any decreases to account balances and cash outflows with a minus sign.) b. Record the Year 1 transactions in general journal form and post them to T-accounts. c. Prepare the stockholders' equity section of the balance sheet at the end of Year 1.

Brice Company completed the following transactions in Year 1, the first year of operation: Issued 36,000 shares of no-par common stock for $15 per share. Issued 9,800 shares of $25 par, 5 percent, preferred stock for $25 per share. Paid a cash dividend of $12,250 to preferred shareholders. Issued a 10 percent stock dividend on no-par common stock. The market value at the dividend declaration date was $25 per share. Later that year, issued a 2-for-1 split on the shares of outstanding common stock. The market price of the stock at that time was $70 per share. Produced $200,000 of cash revenues and incurred $95,000 of cash operating expenses. Closed the revenue, expense, and dividend accounts to retained earnings. Required a. Record each of these events in a horizontal statements model. (In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA) and net change in cash (NC). Leave blank to indicate that an element is not affected by the event. Enter any decreases to account balances and cash outflows with a minus sign.) b. Record the Year 1 transactions in general journal form and post them to T-accounts. c. Prepare the stockholders' equity section of the balance sheet at the end of Year 1.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter12: Statement Of Stockholders’ Equity (stockeq)

Section: Chapter Questions

Problem 4R: The following selected transactions and events occurred during 2013: a. Issued 200 shares of...

Related questions

Question

Ww.229.

Transcribed Image Text:Brice Company completed the following transactions in Year 1, the first year of operation:

Issued 36,000 shares of no-par common stock for $15 per share.

Issued 9,800 shares of $25 par, 5 percent, preferred stock for $25 per share.

Paid a cash dividend of $12,250 to preferred shareholders.

Issued a 10 percent stock dividend on no-par common stock. The market value at the dividend declaration date was $25

per share.

Later that year, issued a 2-for-1 split on the shares of outstanding common stock. The market price of the stock at that

time was $70 per share.

Produced $200,000 of cash revenues and incurred $95,000 of cash operating expenses.

Closed the revenue, expense, and dividend accounts to retained earnings.

Required

a. Record each of these events in a horizontal statements model. (In the Statement of Cash Flows column, indicate

whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA) and net change in cash

(NC). Leave blank to indicate that an element is not affected by the event. Enter any decreases to account balances and

cash outflows with a minus sign.)

b. Record the Year 1 transactions in general journal form and post them to T-accounts.

c. Prepare the stockholders' equity section of the balance sheet at the end of Year 1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning