Brin Company issues bonds with a par value of $700,000. The bonds mature in 6 years and pay 6% annual interest in semiannual payments. The annual market rate for the bonds is 8%. (Table B.1, Table B.2, Table B.3, and Table B.4) (Use appropriate factor(s) from the tables provided.) 1. Compute the price of the bonds as of their issue date. 2. Prepare the journal entry to record the bonds' issuance. Complete this question by entering your answers in the tabs below. Required 1 Required 2

Brin Company issues bonds with a par value of $700,000. The bonds mature in 6 years and pay 6% annual interest in semiannual payments. The annual market rate for the bonds is 8%. (Table B.1, Table B.2, Table B.3, and Table B.4) (Use appropriate factor(s) from the tables provided.) 1. Compute the price of the bonds as of their issue date. 2. Prepare the journal entry to record the bonds' issuance. Complete this question by entering your answers in the tabs below. Required 1 Required 2

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.3E: Issue Price The following terms relate to independent bond issues: 500 bonds; $1,000 face value; 8%...

Related questions

Question

Transcribed Image Text:Brin Company issues bonds with a par value of $700,000. The bonds mature in 6 years and pay 6% annual interest in semiannual

payments. The annual market rate for the bonds is 8%. (Table B.1, Table B.2, Table B.3, and Table B.4) (Use appropriate factor(s) from

the tables provided.)

1. Compute the price of the bonds as of their issue date.

2. Prepare the journal entry to record the bonds' issuance.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

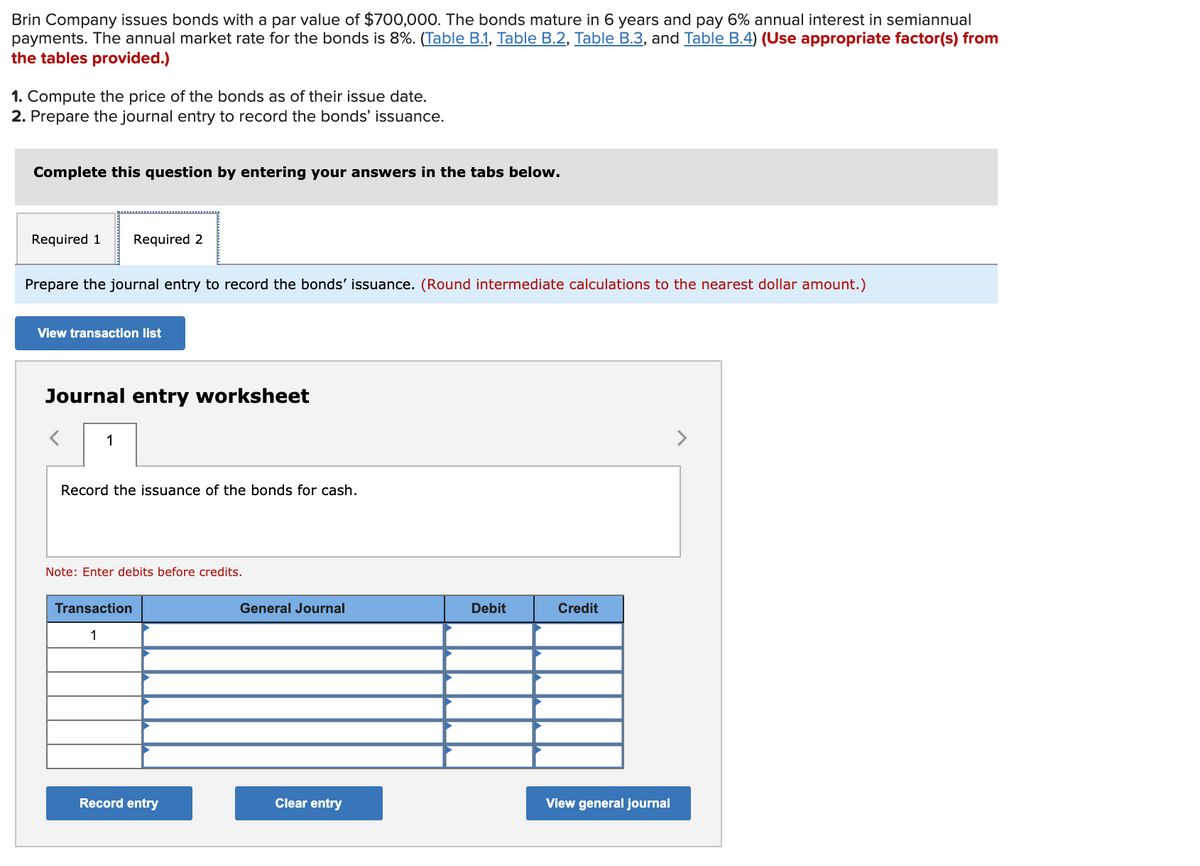

Prepare the journal entry to record the bonds' issuance. (Round intermediate calculations to the nearest dollar amount.)

View transaction list

Journal entry worksheet

1

>

Record the issuance of the bonds for cash.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Record entry

Clear entry

View general journal

Transcribed Image Text:Brin Company issues bonds with a par value of $700,000. The bonds mature in 6 years and pay 6% annual interest in semiannual

payments. The annual market rate for the bonds is 8%. (Table B.1, Table B.2, Table B.3, and Table B.4) (Use appropriate factor(s) from

the tables provided.)

1. Compute the price of the bonds as of their issue date.

2. Prepare the journal entry to record the bonds' issuance.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

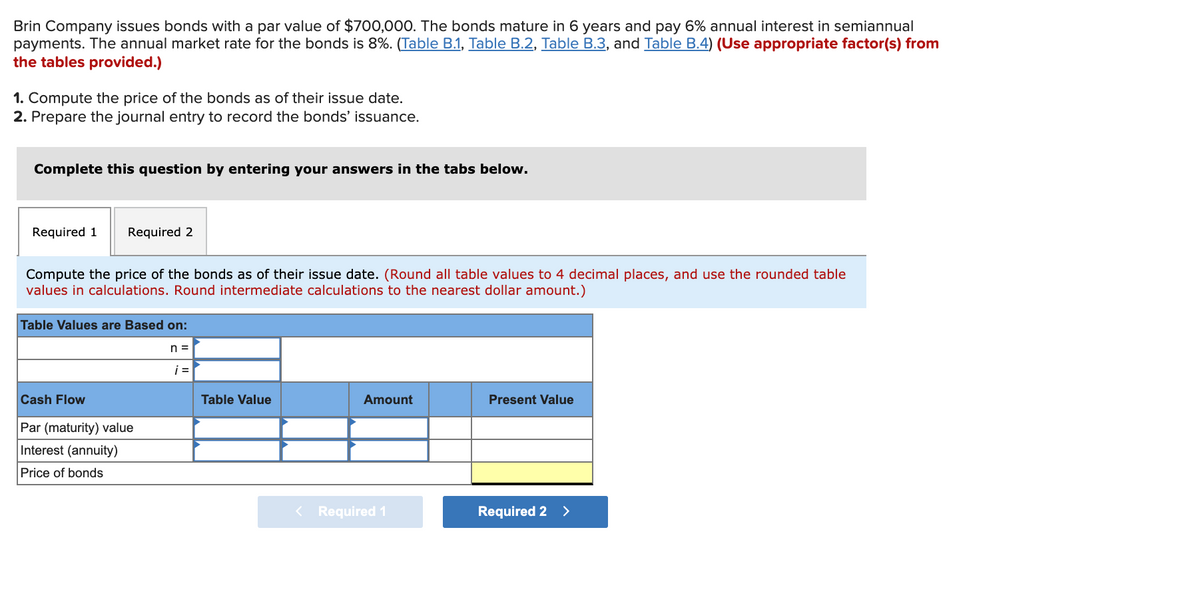

Compute the price of the bonds as of their issue date. (Round all table values to 4 decimal places, and use the rounded table

values in calculations. Round intermediate calculations to the nearest dollar amount.)

Table Values are Based on:

n =

i =

Cash Flow

Table Value

Amount

Present Value

Par (maturity) value

Interest (annuity)

Price of bonds

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning