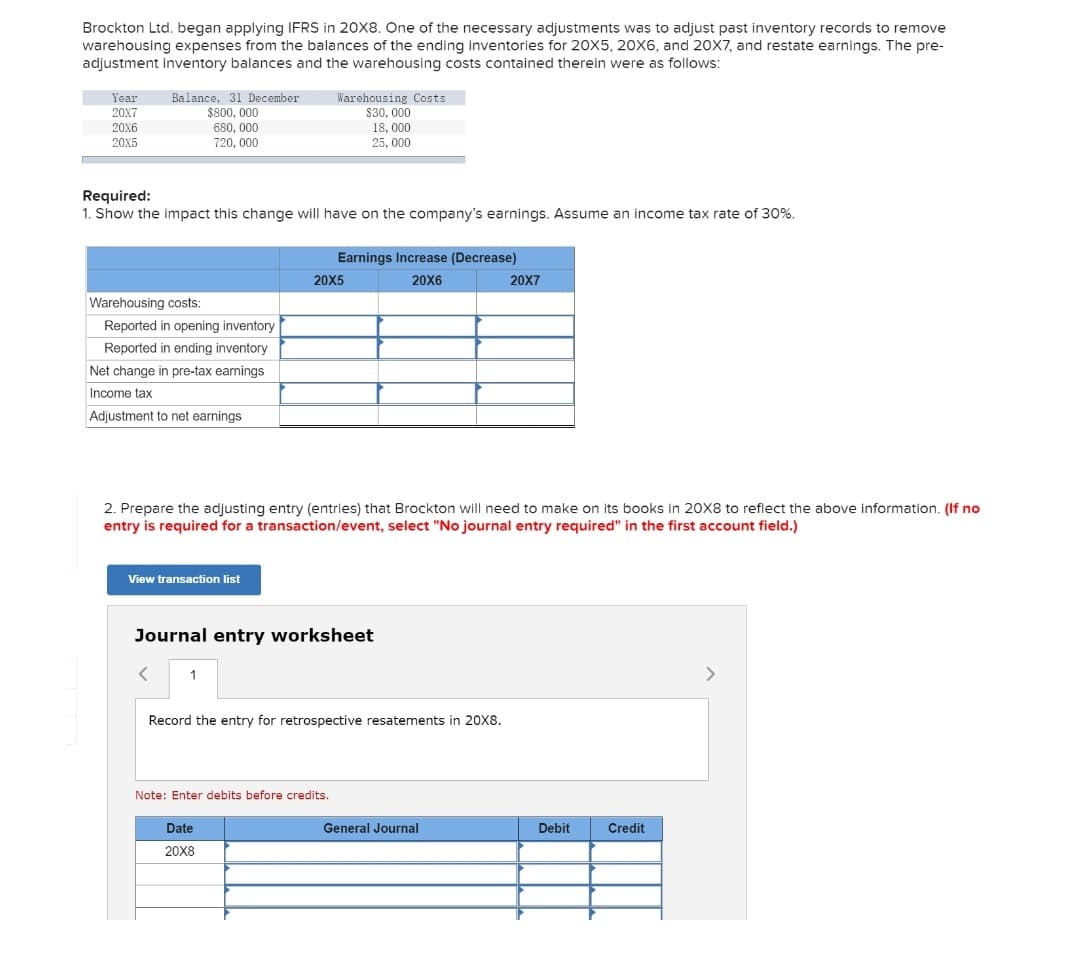

Brockton Ltd. began applying IFRS in 20X8. One of the necessary adjustments was to adjust past inventory records to remove warehousing expenses from the balances of the ending inventories for 20X5, 20X6, and 20X7, and restate earnings. The pre- adjustment inventory balances and the warehousing costs contained therein were as follows: Balance, 31 December $800, 000 Warehousing Costs $30, 000 18, 000 25, 000 Year 20X7 20X6 20X5 680, 000 720, 000 Required: 1. Show the impact this change will have on the company's earnings. Assume an income tax rate of 30%. Earnings Increase (Decrease) 20X5 20X6 20X7 Warehousing costs: Reported in opening inventory Reported in ending inventory Net change in pre-tax eanings Income tax Adjustment to net earnings

Brockton Ltd. began applying IFRS in 20X8. One of the necessary adjustments was to adjust past inventory records to remove warehousing expenses from the balances of the ending inventories for 20X5, 20X6, and 20X7, and restate earnings. The pre- adjustment inventory balances and the warehousing costs contained therein were as follows: Balance, 31 December $800, 000 Warehousing Costs $30, 000 18, 000 25, 000 Year 20X7 20X6 20X5 680, 000 720, 000 Required: 1. Show the impact this change will have on the company's earnings. Assume an income tax rate of 30%. Earnings Increase (Decrease) 20X5 20X6 20X7 Warehousing costs: Reported in opening inventory Reported in ending inventory Net change in pre-tax eanings Income tax Adjustment to net earnings

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter9: Working Capital

Section: Chapter Questions

Problem 24E

Related questions

Question

Transcribed Image Text:Brockton Ltd. began applying IFRS in 20X8. One of the necessary adjustments was to adjust past inventory records to remove

warehousing expenses from the balances of the ending inventories for 20X5, 20X6, and 2OX7, and restate earnings. The pre-

adjustment inventory balances and the warehousing costs contained therein were as follows:

Balance, 31 December

$800, 000

Year

Warehousing Costs

$30, 000

18, 000

25, 000

20X7

20X6

680, 000

720, 000

20X5

Required:

1. Show the impact this change will have on the company's earnings. Assume an income tax rate of 30%.

Earnings Increase (Decrease)

20X5

20X6

20X7

Warehousing costs:

Reported in opening inventory

Reported in ending inventory

Net change in pre-tax earnings

Income tax

Adjustment to net earnings

2. Prepare the adjusting entry (entries) that Brockton will need to make on its books in 20X8 to reflect the above information. (If no

entry is required for a transaction/event, select "No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

1

>

Record the entry for retrospective resatements in 20X8.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

20X8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning