1. Determine the share of Evie & Leo in the net income.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 12MC: Thandie and Marco are partners with capital balances of $60,000. They share profits and losses at...

Related questions

Question

Problem 3

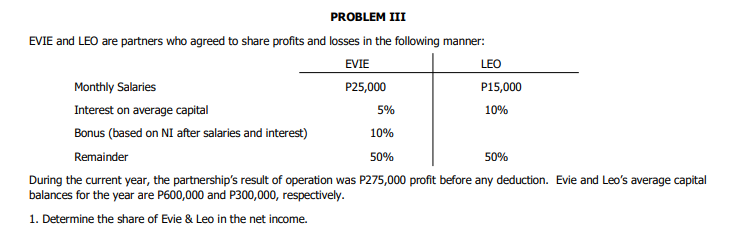

Transcribed Image Text:PROBLEM III

EVIE and LEO are partners who agreed to share profits and losses in the following manner:

EVIE

LEO

Monthly Salaries

P25,000

P15,000

Interest on average capital

5%

10%

Bonus (based on NI after salaries and interest)

10%

Remainder

50%

50%

During the current year, the partnership's result of operation was P275,000 profit before any deduction. Evie and Leo's average capital

balances for the year are P600,000 and P300,000, respectively.

1. Determine the share of Evie & Leo in the net income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning