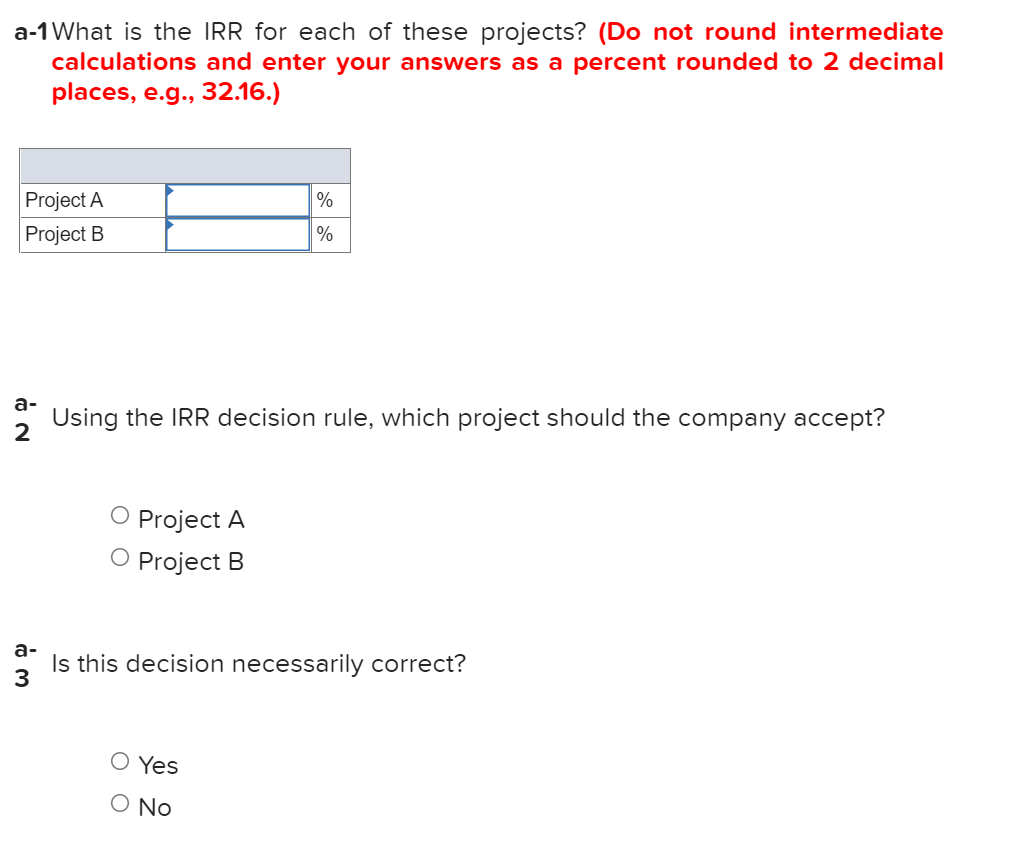

Bruin, Inc., has identified the following two mutually exclusive projects: Cash Flow Cash Flow Year (A) -$28,100 13,500 11,400 8,750 4,650 (B) -$28,100 3,850 9,350 14,300 15,900 O1234

Q: For the cash flows shown, the correct equation for FW2 using the ROIC method at the reinvestment…

A: The reinvestment rate is the rate at which the cash flows arising in a project are reinvested into…

Q: ate of to be obtalned for the investment to be made in the Is cording to the cash flow diagram…

A: Rate of return is a method which helps in knowing the net gain or loss of an asset or an equipment…

Q: Consider the following projects cash flows: End of Year (n) Project A Project B Project C Project D…

A: given, year A B C D 0 -1000 -3000 2000 -4000 1 200 2000 -600 -1000 2 500 2000 -600 6000…

Q: Given the following data for Year-1: (EBIT-taxes)=$5 million; Depreciation=$2 million; Capital…

A: (EBIT - Taxes) = $5 million Depreciation = $2 million Capital expenditure = $4 million Working…

Q: What is the IRR of the following set of cash flows? Year Cash Flow -$9,625 4,000 4,100 3. 6,200…

A: The question is related to Capital Budgeting and is of Internal Rate of Return. The IRR is the rate…

Q: Cash flows related to three mutually exclusive capital equipment projects are given in table below.…

A: The correct answer for the above question is given in the following steps for your reference

Q: Bruin, Inc., has identified the following two mutually exclusive projects: Year Cash Flow…

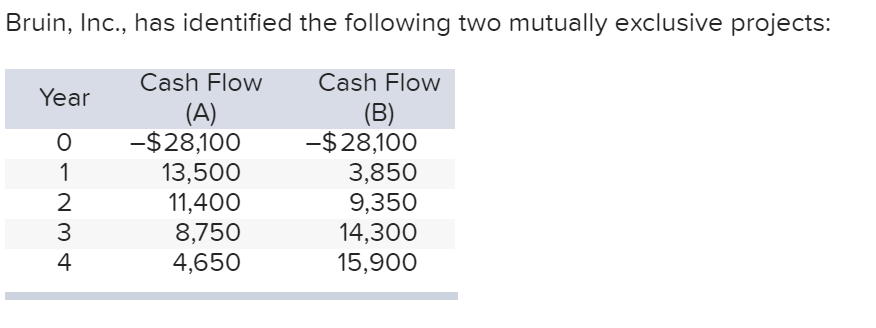

A: Therefore, the internal rate of return of Cash flow A is 17.85% and B is 17.01%.

Q: A company is er alyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1…

A: IRR is the rate of discount at which NPV of investment is zero. IRR can be calculated by using IRR…

Q: A company is analyzing two mutually exclusive projects, with the cash flows below. If their WACC is…

A: IRR is the rate at which NPV of the project is zero. given, time A B 0 -1000 -1000 1 870 0…

Q: Calculating IRR Compute the internal rate of return for the cash flows of the following two projects…

A: Internal Rate of Return is the discounting rate where the net present value of the project is zero.

Q: company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1…

A: Internal Rate of Return(IRR) comes under one of the modern capital budgeting techniques. It is the…

Q: The following cash flows have been identified by Company A for a potential capital investment…

A: Present value of cash inflows = [Year 1 cash flow/(1 + r)1] + [Year 2 cash flow/(1 + r)2]…

Q: a-1 What is the IRR for each of these projects? (Do not round intermediate calculations and enter…

A: Formulas:

Q: The following are the cash flows of two independent projects: Year Project A Project B 0…

A: NPV NPV is the best alternative method used as an indicator of the dynamic calculations of an…

Q: The following are the cash flows of two projects: Year Project A -$340 170 Project B -$340 240 170…

A: Net present value is the difference between the present value of cash in flows and present value of…

Q: Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash…

A: Calculation of IRR of both the projects and IRR of A-B: Excel workings:

Q: The capital investment committee of Overnight Express Inc. is considering two investment projects.…

A: Average income from operations = Total income from operations/Total no. of years Distribution Center…

Q: Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash…

A: "Since you have posted a question with multiple sub-parts, we have solved the first three for you.…

Q: Bruin, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A)…

A: FORMULA:

Q: Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Garage, Inc., has identified the following two mutually exclusive projects: Cash Flow (A) Cash Flow…

A: When there is a conflict between the NPV and IRR. NPV rule will prevail.

Q: Fox Co. has identified an investment project with the following cash flows. Year Cash Flow $1,290…

A: Present value is the current value of future payment at a given rate of return. Given: Year 1 cash…

Q: Thorley Inc. is considering a project that has the following cash flow data. The project's IRR is…

A: IRR is the rate of return which makes project NPV equal to zero. formula: NPV=∑NCFN1+RN0=∑NCFN1+IRRN

Q: Compute the annual-equivalence amount for the following cash flow series at i = 12% $1.600 S1.600…

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one…

Q: The project's IRR? Year 0 1 2 3 4 5 Cash flows -$8,750 $2,000…

A: Internal Rate of Return (IRR) of the project is the rate which the the Net Present Value (NPV) of…

Q: Determine the payback period for the following set of cash flows and interpret your answer. Year…

A: Payback Period The payback period is the method that helps in calculating the time in which the…

Q: A company is considering a project that has the attached cash flows: what is its IRR? Year 0=…

A: Internal rate of return (IRR) is the discount rate of cash flows at which the net present value of…

Q: A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 1 2…

A: IRR is discount rate that discounts NPV(Net Present Value) of any proposal to zero. At IRR,…

Q: Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$10,110…

A: Crossover rate is the rate at which both projects give same net present value. It means, when the…

Q: Consider the following cash flow of a company: Year Cash flow -600 10 -5000 11-40 1000 a) Compute…

A: Cash flows show the value of cash which a company can either receive or pay to other company. When…

Q: Filter Corp. has a project avallable with the following cash flows: Year Cash Flow -$13,800 6,700…

A: Information Year Cash flow 0 -13800 1 6700 2 8000 3 3900 4 3500

Q: A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0…

A: Net present value (NPV) is a measure of capital budgeting project. It is the difference between…

Q: Compute the annual-equivalence amount for the following cash flow series ati = 10%:

A: The annual worth of an asset is teh annual equivalent cash flows an investment will generate…

Q: - Suppose that the cash flows of two investments are as follows: Unit: S CASH FLOW AT YEAR YEAR: 2…

A: Solution : Computation of NPV Investment A Investment B Particulars Period PV Factor…

Q: Calculating IRR Compute the internal rate of return for the cash flows of the following two…

A: IRR is the rate at which NPV becomes Zero Using excel IRR function

Q: Sketch the NPV profile for projects A & B. Determine the crossover point for these projects’ NPV…

A: NPV refers to the net present value. It is the sum of present values of all cash flows occuring in…

Q: A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 1 2…

A: You should always pick the project with the highest NPV, not necessarily the highest IRR, because…

Q: Calculate the internal rate of return (IRR) of the following cash flows: Year 0 1 2 3 4 5…

A: Solution: Computation of IRR Year Cash Flows IRR 0 -$1,650,000.00 12.38% 1 $330,000.00 2…

Q: Find the NPV for the following cash flows assuming a WACC of 10%. YR CF 0 -15,000 1 6,000 2…

A: NPV is the difference between present value of all cash inflows and initial investment NPV =PV of…

Q: The Sloan Corporation is trying to choose between the following two mutually exclusive design…

A: The capital budgeting techniques include net present value where the company is selecting projects…

Q: 2. Compute the IRR for the investment represented by the following cash flow table: Year 0. 1 3 4 6.…

A: A discount rate at which the net present worth of an investment is equal to zero is term as an…

Q: Garage, Inc., has identified the following two mutually exclusive projects: Year Cash Flow…

A: Note:We shall answer the first question since the exact one wasn’t specified. Please submit a new…

Q: Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash…

A: NPV or Net present value is determined by adding the discounted value of all inflows and outflows to…

Q: The following table summarizes cash flows for a project: Year Cash Flow at End of Year $-5,100 1…

A: The student has particularly asked for part'c' of the question. Internal rate of return refers to…

Q: Bruin, Ic., has identified the following two mutually exclusive projects: Cash Flow Cash Flow Year…

A: Cash flows: The discount rate is 12%.

Q: Under the indirect method, how much should be reported as cash flows from operating activities? a.…

A: Introduction: Statement of cash flows: All cash in and out flows are shown in statement of cash…

Q: The following project has cash flows as follows: Year Project A 0 -$705,000 1 $225,000…

A: IRR is the rate at which NPV is zero

10

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

- Compute the PI statistic for Project Q if the appropriate cost of capital is 12 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project Q Time: 0 1 2 3 4 Cash flow: –$12,200 $3,950 $4,780 $2,120 $2,750 Should the project be accepted or rejected? multiple choice accepted rejectedWhich one of the following indicates a project should be accepted? 1. NPV = -$2,281 2. IRR = 13.8 percent; Required return = 14.5 percent 3. Discounted payback = 3.41 years; Required discounted payback = 3 years 4. None of the aboveCompute the NPV statistic for Project Y if the appropriate cost of capital is 13 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Project Y Time: 0 1 2 3 4 Cash flow: −$9,100 $3,570 $4,400 $1,740 $520 Should the project be accepted or rejected?multiple choice accepted rejected

- Compute the NPV for Project M if the appropriate cost of capital is 7 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Project M Time: 0 1 2 3 4 5 Cash flow: −$1,400 $430 $560 $600 $680 $180 Should the project be accepted or rejected?multiple choice accepted rejectedCompute the NPV statistic for Project Y if the appropriate cost of capital is 13 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Project Y Time: 0 1 2 3 4 Cash flow: –$8,200 $3,390 $4,220 $1,560 $340 Should the project be accepted or rejected? multiple choice accepted rejectedd. What is the profitability index for each project? (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) Using excel how to I find the PI for this question?

- Compute the PI statistic for Project Z if the appropriate cost of capital is 6 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project Z Time: 0 1 2 3 4 5 Cash flow: −$1,200 $390 $520 $690 $340 $140 Should the project be accepted or rejected?multiple choice rejected acceptedCompute the net present value for each project. (Round answers to 0 decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Project Bono Project Edge Project Clayton Net present value $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places Save for LaterCompute the IRR statistic for Project E. The appropriate cost of capital is 7 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project E Time: 0 1 2 3 4 5 Cash flow −$3,600 $1,110 $1,050 $900 $680 $480 Should the project be accepted or rejected?multiple choice rejected accepted

- Consider the following two mutually exclusive projects. Time Project A Project B 0 -$300 -$405 1 -$387 $134 2 -$193 $134 3 $100 $134 4 $600 $134 5 $600 $134 6 $850 $150 7 $180 $284 What is each project’s payback, discounted payback, IRR, and NPV with a cost of capital of 12%? Which project should be selected?Compute the NPV for Project M if the appropriate cost of capital is 7 percent. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Project M Time: Cash flow: NPV 0 1 -$1,700 $490 + O accepted O rejected 2 $620 3 $660 Should the project be accepted or rejected? 4 $740 Check my w 5 $240Compute the IRR statistic for Project E. The appropriate cost of capital is 8 percent. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Project E Time: Cash flow IRR 0 -$1,300 O accepted O rejected % 1 $470 2 $570 Should the project be accepted or rejected? 3 $580 4 $360 5 $160