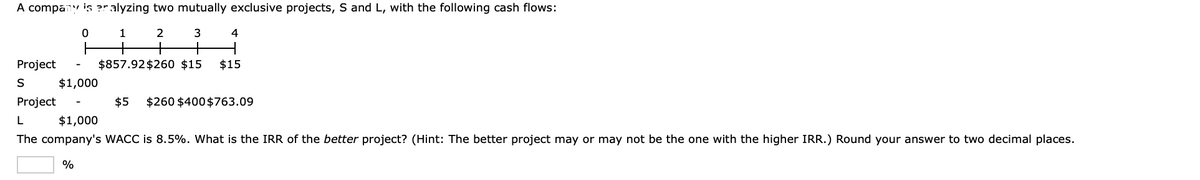

A company is er alyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 4 Project $857.92 $260 $15 $15 S $1,000 Project $5 $260 $400 $763.09 L $1,000 The company's WACC is 8.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.

Q: effective interest rate

A: The effective rate of interest refers to the interest rate which is charged on the amount of the…

Q: Fancy Furry Felines Pty Ltd (FFF) is a company that retails products for cats both through physical…

A: An organization is a lawful substance framed by a gathering of people to take part in and work a…

Q: A motor truck has an original value of $2500, a probable life of 6 years, and a final salvage value…

A: We have; Original Value of machine is $2500 Probable life is 6 years Salvage Value is $200 Interest…

Q: Would the tax treatment of dividend income versus capital gains income affect the managers’…

A: Dividends and stock repurchases: Dividends are cash disbursements to a company's common…

Q: 35. What is the amount of the annuity at the end of 10 years?

A: Future value of the Annuity: It is estimated by the product of the present stream of cash flows and…

Q: Understand why financial management is important in today’s competitive economy.

A: Financial management is basically the strategic planning, organizing, directing, and administration…

Q: Perez Company is considering an investment of $21,555 that provides net cash flows of $6,800…

A: First we need to calculate present value factor by using this formula Present value factor =Initial…

Q: DIS How much did the preferred shareholders receive in 20112

A: Preferred Stock Holders: The holders of the preferred stock have part ownership in a business and…

Q: Answer question 34

A: Intermediate Bonds also known as medium term funds are a type of debt funds that invest in debt…

Q: Warren bought a bicycle for $2500, plus 13% HST. He arranged to make a payment to the store at the…

A: Loans are paid by monthly payment that carry the payment of interest and also payment for the…

Q: ZippleCrunch Corp. will pay a dividend of $2.34 per share at the end of next year (end of year 1)…

A: We will first calculate the dividend rate thereafter we will use that dividend to calculate the…

Q: Hook Industries's capital structure consists solely of debt and common equity. It can issue debt at…

A: The capital structure of a company consists of equity and debt. The costs of raising funds from both…

Q: Warren bought a bicycle for $2500, plus 13% HST. He arranged to make a payment to the store at the…

A: Here, Purchase price = $2,500 HST = 13% Time = 2 years Interest rate = 6% compounded monthly To…

Q: a series of 12 annual payments of $2400 is equivalent to three equal payments, one each at the end…

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at…

Q: 1. Plans qualifying for preferential tax treatment must meet minimum participation and vesting…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: What happens to the price of a three-year annual coupon paying bond with an 8% coupon when interest…

A: When the interest rate is equal to the coupon offered by the bond then the price of the bond is…

Q: Show the complete solution by showing your answer in terms of : • Cash flow diagram General Formula…

A: Here, Annual Payment is $70,000 Time Period is 12 years Interest Rate is 7% General Formula with…

Q: $5476.6 monthly If you can afford to pay the monthly payment from the above calculation, how much…

A: Here, Monthly Payment is $5476.6 Time Period (n) is 20 years Interest Rate (Rate) is 6.25%…

Q: 10. Warren bought a bicycle for $2500, plus 13% HST. He arranged to make a payment to the store at…

A: Equated Monthly Instalment: It is a fixed portion total made by a borrower to a lender at a…

Q: Consider the following information: State of Economy Probability of State of Economy Rate of…

A: In the case of probabilistic data, return is calculated by multiplying each return by its respective…

Q: You deposit $100 each month into an account earning 4% interest compounded monthly. a) How much…

A: Amount Deposited Each month is $100 Interest rate is 4% Compounded monthly Time period is 15 years…

Q: ORDINARY if the proble

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: I will give an upvote if you follow my instructions. thank you. please skip if you have already done…

A: The question is related Classification of Cost. It means the grouping of costs according to their…

Q: State the advantages of long-term debt financing.

A: Long term debt financing is also referred to as long term liabilities. They have a maturity period…

Q: Amalgamated Industries has Sales of 3,500, COGS of 1,500, and EBIT of 600. If Depreciation is 400,…

A: Here, Sales is 3,500 COGS is 1,500 EBIT is 600 Depreciation is 400 Interest Expense is 200 Taxes is…

Q: 8. a. What is the annual interest amount for a $2,000 bond that pays 7.5 percent interests? b.…

A: The Annual Interest is calculated with the help of following formula Annual Interest = Face Value…

Q: Your firm would like to evaluate a proposed new operating division. You have forecasted cash flows…

A: Continuation value/ terminal value : The terminal value of a corporation is calculated by…

Q: 44) Which is the definition of a protective covenant? a) Bonds are repaid at maturity, where…

A: Protective covenants are certain clauses in bond indenture which will be limiting the actions of…

Q: A college scholarship fund received a gift of $ 156,469.08. The money is invested in CDs, bonds, and…

A: Gift received from scholarship is $156,469.08 Simple Interest rate in CDs is 4.25% Simple Interest…

Q: QUESTION 16 Bahrain Specialist Hospital has recently hired you to improve their inventory management…

A: Its basic role is to help an organization in keeping a reliable stock level while on the other hand…

Q: (Calculating rates of return) The S&P stock index represents a portfolio comprised of 500 large…

A: As per Bartleby honor code, the expert is required only to solve those parts of questions which are…

Q: If you invest $2,000 today, withdraw $1,000 in 3 years, deposit $3,000 in 5 years, deposit $1,500 in…

A: Given, The amount invested today is $2000 The rate of interest is 7%

Q: Lashonda is taking out an amortized loan for $29,000 to buy a new car and is deciding between the…

A: Here, Loan Amount is $29,000 Time Period of Credit Union is 7 years Time Period (n) of Bank is 5…

Q: an Asset's Value You purchased an asset that is expected to provide $5,000 cash flow per year for 4…

A: Here, Cash Flow is $5,000 Time Period is 4 years Required Rate of Return is 6%

Q: 9. Read the following sentences and answer the questions. Company A plans to carry out $1 million in…

A: Value at Risk is a financial metric that measures the risk of an investment. It is a statistical…

Q: Why has Macro-prudential policy increased in use following the GFC? Provide explanations in detail…

A: The GFC refers to the Global Financial Crisis. It occurred in the year 2008 when the subprime…

Q: You are purchasing a new car for $27,600. The dealership offers you three options: • 0% financing: 0…

A: Car Price = $27,600 Time Period(Months) = 48 Interest Rate = 0% Down Payment = $0

Q: Find the final amount of money in an account if $3,900$3,900 is deposited at 7.5%7.5% interest…

A: Calculations are done in excel, so there is no intermediate rounding. (1+i) = (1+i(2)2))^2(1+i) =…

Q: uclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a very…

A: Applying capital budgeting concepts will help you decide whether leasing an item is a better choice…

Q: 9.7. You are to calculate rates effective for the year beginning Jan. 1, 2020 for one-year policies…

A: The amount of money an insurer is obligated to pay to cover claims, including the costs of…

Q: Wouldn't this be a multi-growth Dividend approach? Why was the dividend for Year 2, and 3 calculated…

A: We will use the dividend discount model here. As per the dividend discount model the value of a…

Q: Suppose that LilyMac Photography expects EBIT to be approximately $46,000 per year for the…

A: The taxable income is calculated with the help of following formula Taxable Income = EBIT -…

Q: If you'd like to have $5,000,000 at retirement in 45 years and you expect to earn 10% annually,…

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at…

Q: Red Fire has a Debt/Equity Ratio of .15, and Equity Multiplier of 1.15, a return on sales of 6.4,…

A: Here, Debt Equity Ratio is 0.15 Equity Multiplier is 1.15 Return on Sales is 6.4 Asset Turnover is…

Q: A firm whose cost of capital is 10% is considering two mutually exclusive projects X and Y, the…

A: NPV refers to Net Present Value.It is calculated by subtracting the present value of cash inflows…

Q: Describe monetary policy and its function to the financial system

A: Monetary policy is reflective of policy of Central bank in order to control the level of money flow…

Q: Use the Buying a Car information above to answer this question. The rebate offer is $3500, and you…

A: Calculation of the monthly payment if the rebate is chosen and secure a loan for the balance at the…

Q: If the current USDJPY exchange rate is 135.00 Japanese yen per U.S. dollar, the price of a Big Mac…

A: The law of one price is a concept which will advocate for uniform price across different nation for…

Q: ppose the spot rate is A$1.77/GBP. An Audi can be purchased in Sydney, Australia, for A$30,00 in…

A: According to purchase power parity the price of goods in two countries must be in equilibrium with…

Q: You would like to have $550,000 when you retire in 40 years. How much should you invest each quarter…

A: Required Amount at retirement is $550,000 Time period is 40 years Interest rate is 6.4% Compounded…

Please note that 1000 is -1000 for both.

Step by step

Solved in 3 steps with 2 images

- Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 01234 Project S-$1,000$869.10$260$5$10Project L-$1,000$0$250$420$831.87 The company's WACC is 8.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.

- A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 2 3 4 Project S -$1,000 $895.52 $240 $10 $10 Project L -$1,000 $5 $260 $400 $807.20 The company's WACC is 8.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.Bates & Reid, LLC, has identified two mutually exclusive projects, A and B. Project A has a NPV of $14,050.47. Project B has cash flows as described below. Year Cash Flow B 0 -$77,000 1 35,000 2 25,000 3 25,000 4 25,000 If the WACC is 8%, then B’s NPV is _______ and therefore the firm should accept _________ $11,337.55; project B because NPVA > NPVB. $15,062.43; project B because NPVA < NPVB. $15,062.43; project A because NPVA < NPVB. The projects are equally profitable. $11,337.55; project A because NPVA > NPVB.A company is analyzing two mutually exclusive projects, with the cash flows below. If their WACC is 8.5%, what is the IRR of each? Strictly based on IRR, which project should the company go with? Time Project A Project B 0 -$1,000 -$1,000 1 $870 $0 2 $250 $250 3 $25 $400 4 $25 $845

- a company is deciding between two mutually exclusive projects. the cash flows are shown below. year 0 project a -$1,000 project b -$1,000 ywar 1 project a 550 project b 400 year 2 project a 550 projecy b 600 year 3 project a 550 project b 900 if the cosy of capital is 10% which project should the compsny selectCRAYON corporation has identified the following two mutually exclusive projects: YEAR Cash flow ( A) Cash flow ( B) 0 -$300,000 -$300,000 1 68,950 135,000 2 83,900 105,500 3 93,200 75,000 4 105,600 55,600 5 115,600 45,600 What is the IRR for each of this project (range: 10-16%)? Using the IRR decision rule, which project should the company accept? How do you interpret IRR of a project? If the required return is 15%, what is the NPV of these projects? Which project will the company choose if it applies the NPV decision rule? How do you interpret NPV of a project? Calculate the Payback period and discounted pay back period of these projects! Which project should the company accept? What are the differences of payback period and discounted payback…Thomas Company is considering two mutually exclusive projects. The firm, which has a cost of capital of 14%, has estimated its cash flows as shown in the following table: Project A Project B Initial investment (CF0) $150,000 $83,000 Year (t) Cash inflows (CFt) 1 $20,000 $45,000 2 $35,000 $25,000 3 $40,000 $35,000 4 $50,000 $10,000 5 $70,000 $15,000 a. Calculate the NPV of each project, and assess its acceptability. b. Calculate the IRR for each project, and assess its acceptability.

- Bruin, Incorporated, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$ 66,000 −$ 66,000 1 42,000 28,400 2 36,000 32,400 3 24,000 38,000 4 15,200 24,400 a-1. What is the IRR for each of these projects? a-2. If you apply the IRR decision rule, which project should the company accept? b-1. Assume the required return is 12 percent. What is the NPV for each of these projects? b-2. Which project will you choose of you apply the NPV decision rule? c-1. Over what range of discount rates would you choose Project A? c-2. Over what range of discount rates would you choose Project B? d. At what discount rate would you be indifferent between these two projects?Garage, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$43,500 -$43,500 1 21,400 6,400 2 18,500 14,700 3 13,800 22,800 4 7,600 25,200 What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct? If the required return is 11 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule? Over what range of discount rates would the company choose project? A? Project B? At what discount rate would the company be indifferent between these two projects? Explain.Green Grocers is deciding among two mutually exclusive projects. The two projects have the following cash flows: Year Project A CF Project B CF 0 -$34,139 -$36,502 1 $10,614 $6,107 2 $12,162 $8,946 3 $21,200 $42,600 4 $17,189 $18,174 The company’s weighted average cost of capital is 5.7 percent (WACC = 5.7). What is the What is the net present value (NPV) of the project with the highest internal rate of return (IRR)? Should that project be accepted? Group of answer choices $29,915.68; Yes $27,915.68; No $25,915.68; Yes $25,915.68; No $27,915.68; Yes