building. Compute the exclusions from gross income of Arturo:

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

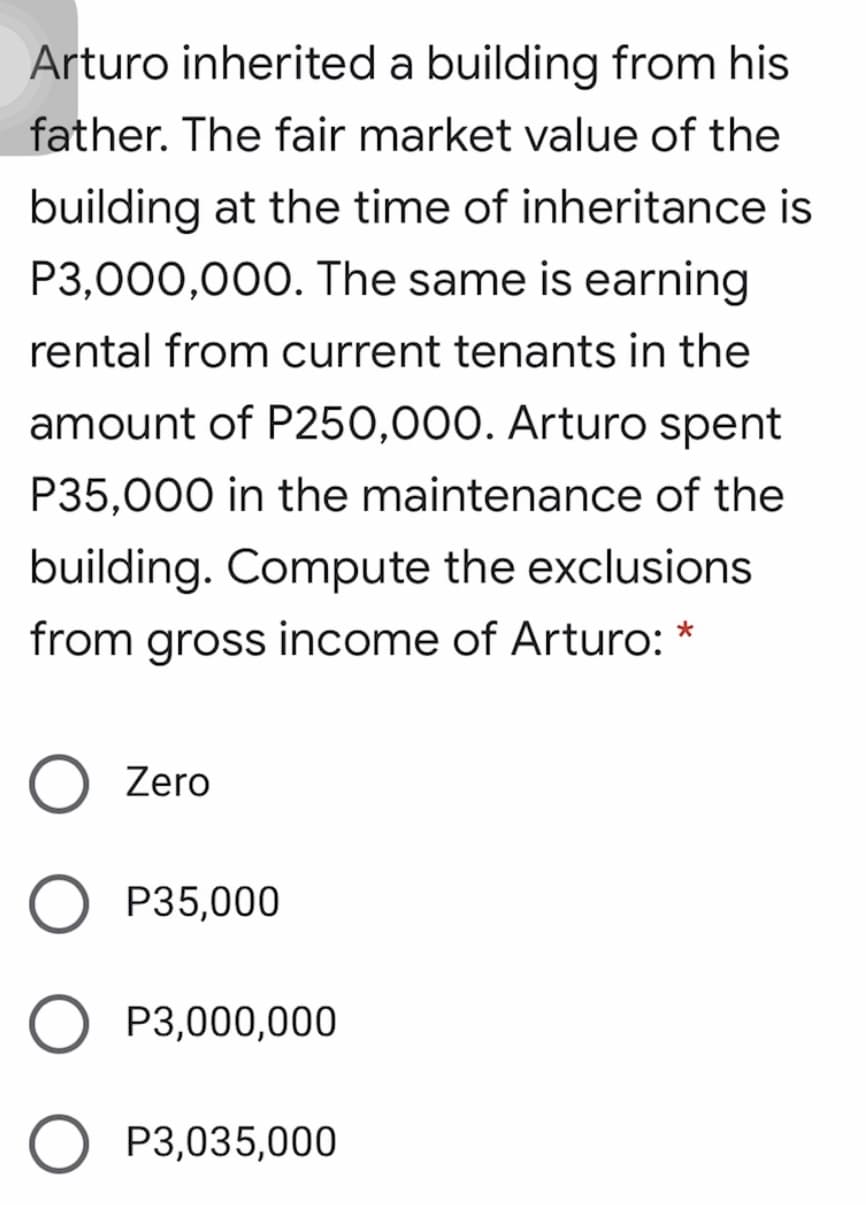

Transcribed Image Text:Arturo inherited a building from his

father. The fair market value of the

building at the time of inheritance is

P3,000,000. The same is earning

rental from current tenants in the

amount of P250,000. Arturo spent

P35,000 in the maintenance of the

building. Compute the exclusions

from gross income of Arturo: *

Zero

O P35,000

P3,000,000

P3,035,000

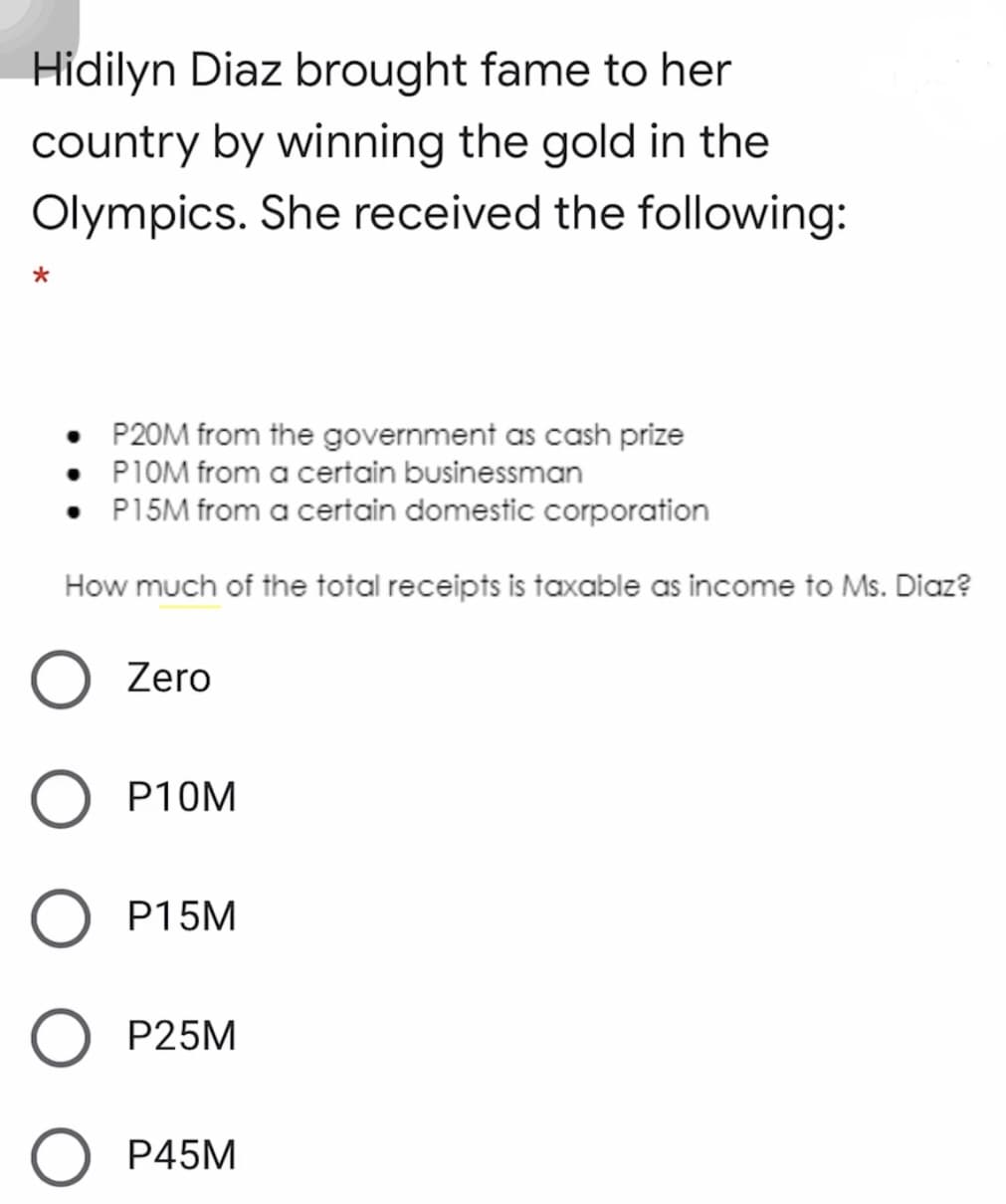

Transcribed Image Text:Hidilyn Diaz brought fame to her

country by winning the gold in the

Olympics. She received the following:

*

P20M from the government as cash prize

P1OM from a certain businessman

• P15M from a certain domestic corporation

How much of the total receipts is taxable as income to Ms. Diaz?

Zero

P10M

O P15M

O P25M

P45M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT