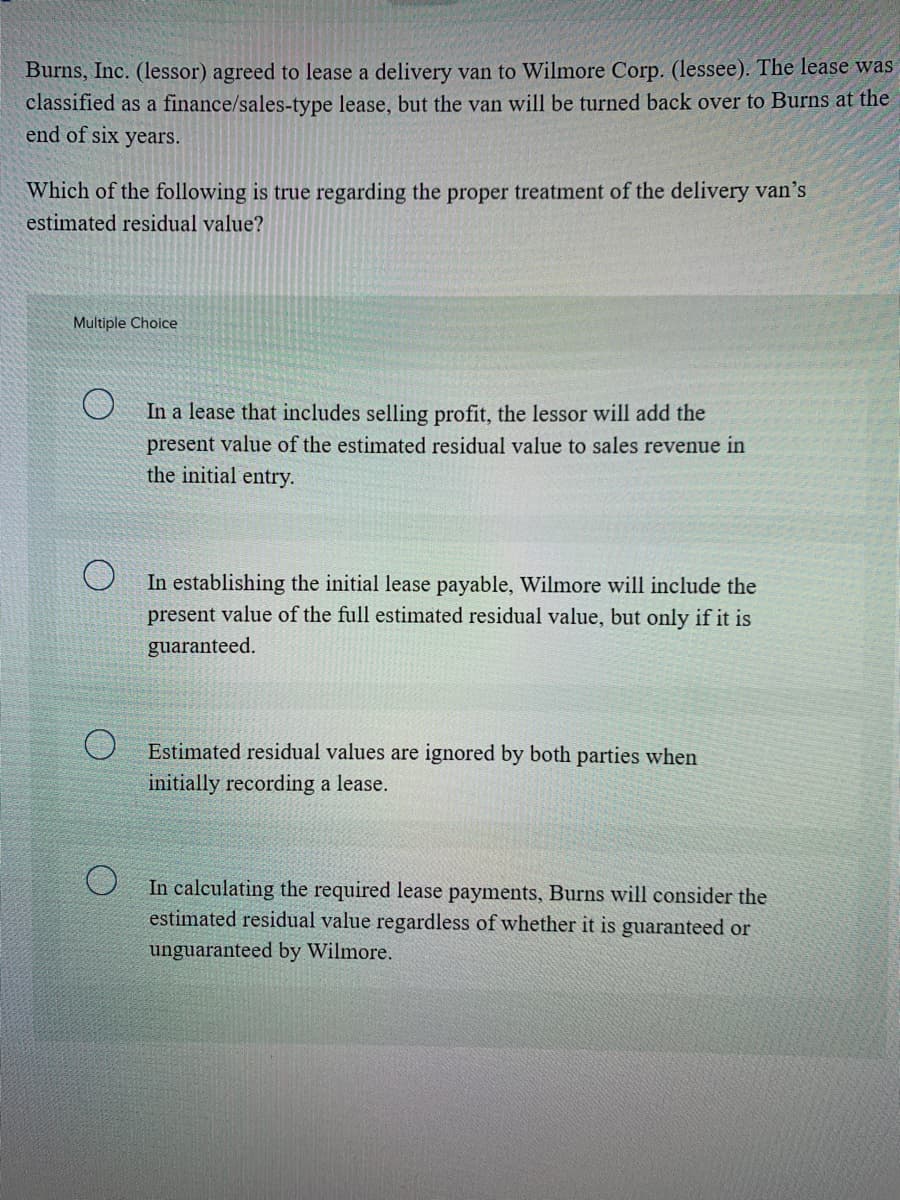

Burns, Inc. (lessor) agreed to lease a delivery van to Wilmore Corp. (lessee). The lease wa classified as a finance/sales-type lease, but the van will be turned back over to Burns at the end of six years. Which of the following is true regarding the proper treatment of the delivery van's estimated residual value? Multiple Choice In a lease that includes selling profit, the lessor will add the present value of the estimated residual value to sales revenue in the initial entry. In establishing the initial lease payable, Wilmore will include the present value of the full estimated residual value, but only if it is guaranteed. Estimated residual values are ignored by both parties when initially recording a lease. In calculating the required lease payments, estimated residual value regardless of whether it is guaranteed or rns will consider the unguaranteed by Wilmore.

Burns, Inc. (lessor) agreed to lease a delivery van to Wilmore Corp. (lessee). The lease wa classified as a finance/sales-type lease, but the van will be turned back over to Burns at the end of six years. Which of the following is true regarding the proper treatment of the delivery van's estimated residual value? Multiple Choice In a lease that includes selling profit, the lessor will add the present value of the estimated residual value to sales revenue in the initial entry. In establishing the initial lease payable, Wilmore will include the present value of the full estimated residual value, but only if it is guaranteed. Estimated residual values are ignored by both parties when initially recording a lease. In calculating the required lease payments, estimated residual value regardless of whether it is guaranteed or rns will consider the unguaranteed by Wilmore.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6P: Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a...

Related questions

Question

Transcribed Image Text:Burns, Inc. (lessor) agreed to lease a delivery van to Wilmore Corp. (lessee). The lease was

classified as a finance/sales-type lease, but the van will be turned back over to Burns at the

end of six years.

Which of the following is true regarding the proper treatment of the delivery van's

estimated residual value?

Multiple Choice

In a lease that includes selling profit, the lessor will add the

present value of the estimated residual value to sales revenue in

the initial entry.

U In establishing the initial lease payable, Wilmore will include the

present value of the full estimated residual value, but only if it is

guaranteed.

Estimated residual values are ignored by both parties when

initially recording a lease.

In calculating the required lease payments, Burns will consider the

estimated residual value regardless of whether it is guaranteed or

unguaranteed by Wilmore.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning