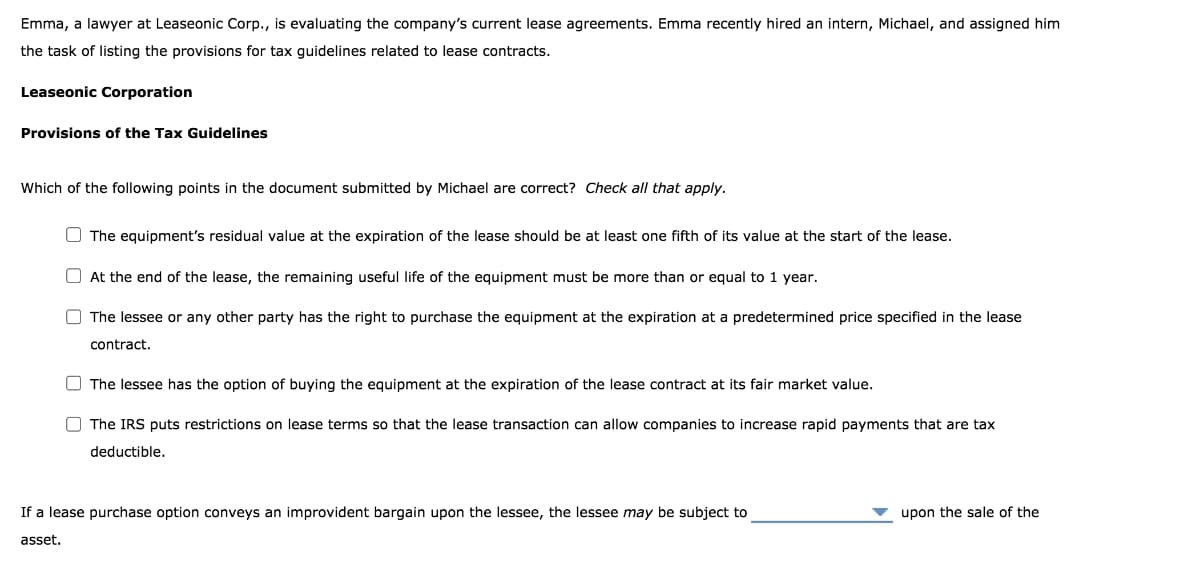

Emma, a lawyer at Leaseonic Corp., is evaluating the company's current lease agreements. Emma recently hired an intern, Michael, and assigned him the task of listing the provisions for tax guidelines related to lease contracts. Leaseonic Corporation Provisions of the Tax Guidelines Which of the following points in the document submitted by Michael are correct? Check all that apply. O The equipment's residual value at the expiration of the lease should be at least one fifth of its value at the start of the lease. O At the end of the lease, the remaining useful life of the equipment must be more than or equal to 1 year. O The lessee or any other party has the right to purchase the equipment at the expiration at a predetermined price specified in the lease contract. The lessee has the option of buying the equipment at the expiration of the lease contract at its fair market value. The IRS puts restrictions on lease terms so that the lease transaction can allow companies to increase rapid payments that are tax deductible. If a lease purchase option conveys an improvident bargain upon the lessee, the lessee may be subject to upon the sale of the accot

Emma, a lawyer at Leaseonic Corp., is evaluating the company's current lease agreements. Emma recently hired an intern, Michael, and assigned him the task of listing the provisions for tax guidelines related to lease contracts. Leaseonic Corporation Provisions of the Tax Guidelines Which of the following points in the document submitted by Michael are correct? Check all that apply. O The equipment's residual value at the expiration of the lease should be at least one fifth of its value at the start of the lease. O At the end of the lease, the remaining useful life of the equipment must be more than or equal to 1 year. O The lessee or any other party has the right to purchase the equipment at the expiration at a predetermined price specified in the lease contract. The lessee has the option of buying the equipment at the expiration of the lease contract at its fair market value. The IRS puts restrictions on lease terms so that the lease transaction can allow companies to increase rapid payments that are tax deductible. If a lease purchase option conveys an improvident bargain upon the lessee, the lessee may be subject to upon the sale of the accot

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.6DC

Related questions

Question

Transcribed Image Text:Emma, a lawyer at Leaseonic Corp., is evaluating the company's current lease agreements. Emma recently hired an intern, Michael, and assigned him

the task of listing the provisions for tax guidelines related to lease contracts.

Leaseonic Corporation

Provisions of the Tax Guidelines

Which of the following points in the document submitted by Michael are correct? Check all that apply.

O The equipment's residual value at the expiration of the lease should be at least one fifth of its value at the start of the lease.

O At the end of the lease, the remaining useful life of the equipment must be more than or equal to 1 year.

O The lessee or any other party has the right to purchase the equipment at the expiration at a predetermined price specified in the lease

contract.

The lessee has the option of buying the equipment at the expiration of the lease contract at its fair market value.

The IRS puts restrictions on lease terms so that the lease transaction can allow companies to increase rapid payments that are tax

deductible.

If a lease purchase option conveys an improvident bargain upon the lessee, the lessee may be subject to

upon the sale of the

asset.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT