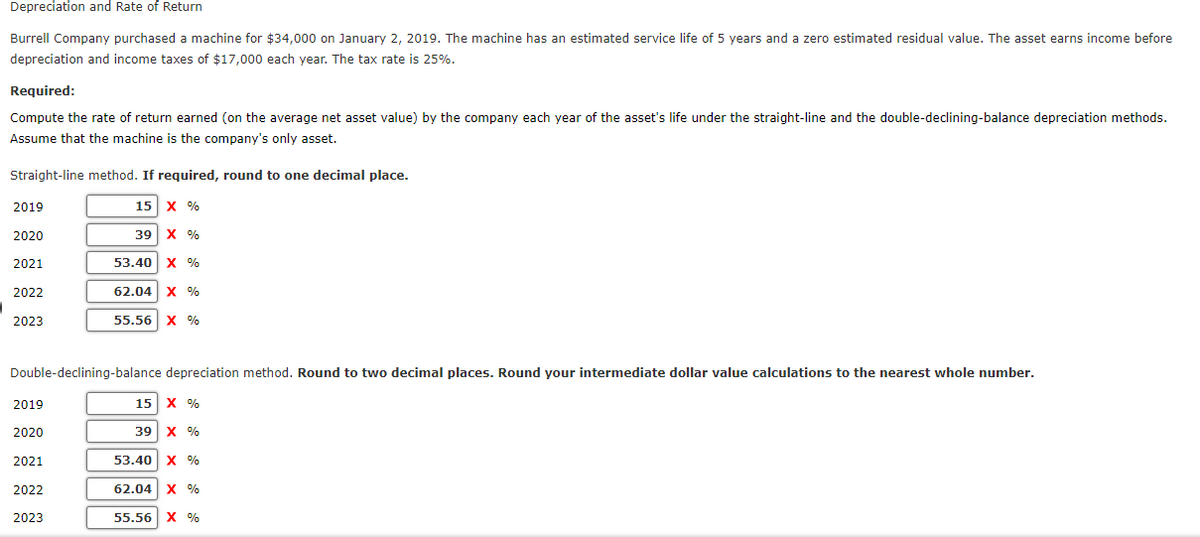

Burrell Company purchased a machine for $34,000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $17,000 each year. The tax rate is 25%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double-declining-balance depreciation methods. Assume that the machine is the company's only asset. Straight-line method. If required, round to one decimal place. 2019 15 X % 2020 39 х % 2021 53.40 x % 2022 62.04 x % 2023 55.56 X %

Burrell Company purchased a machine for $34,000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $17,000 each year. The tax rate is 25%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double-declining-balance depreciation methods. Assume that the machine is the company's only asset. Straight-line method. If required, round to one decimal place. 2019 15 X % 2020 39 х % 2021 53.40 x % 2022 62.04 x % 2023 55.56 X %

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 2E: Depreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The...

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

Transcribed Image Text:Depreciation and Rate of Return

Burrell Company purchased a machine for $34,000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before

depreciation and income taxes of $17,000 each year. The tax rate is 25%.

Required:

Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double-declining-balance depreciation methods.

Assume that the machine is the company's only asset.

Straight-line method. If required, round to one decimal place.

2019

15

X %

2020

39

X %

2021

53.40 x %

2022

62.04 x %

2023

55.56 х %

Double-declining-balance depreciation method. Round to two decimal places. Round your intermediate dollar value calculations to the nearest whole number.

2019

15| х %

2020

39| х %

2021

53.40 x %

2022

62.04 х %6

2023

55.56 | Х %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT