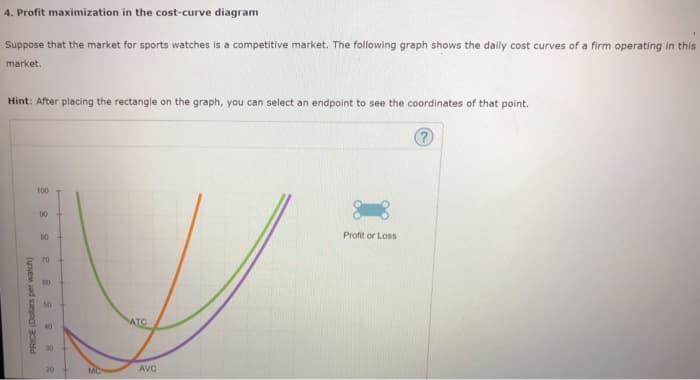

4. Profit maximization in the cost-curve diagram Suppose that the market for sports watches is a competitive market. The following graph shows the daily cost curves of a firm operating in this market. Hint: After placing the rectangle on the graph, you can select an endpoint to see the coordinates of that point. PRICE (Dollars per watch) 100 90 80 70 60 50 30 ४ MC ATC AVC Profit or Loss ? PRICE (Dollars p 8 8 30 20 10 0 4 0 MC ATC AVC 10 20 30 40 50 60 70 80 90 100 QUANTITY (Thousands of watches) In the short run, at a market price of $80 per watch, this firm will choose to produce watches per day. On the preceding graph, use the blue rectangle (circle symbols) to shade the area representing the firm's profit or loss if the market price is $80 and the firm chooses to produce the quantity you already selected. Note: In the following question, enter a positive number, even if it represents a loss. The area of this rectangle indicates that the firm's would be s per day.

4. Profit maximization in the cost-curve diagram Suppose that the market for sports watches is a competitive market. The following graph shows the daily cost curves of a firm operating in this market. Hint: After placing the rectangle on the graph, you can select an endpoint to see the coordinates of that point. PRICE (Dollars per watch) 100 90 80 70 60 50 30 ४ MC ATC AVC Profit or Loss ? PRICE (Dollars p 8 8 30 20 10 0 4 0 MC ATC AVC 10 20 30 40 50 60 70 80 90 100 QUANTITY (Thousands of watches) In the short run, at a market price of $80 per watch, this firm will choose to produce watches per day. On the preceding graph, use the blue rectangle (circle symbols) to shade the area representing the firm's profit or loss if the market price is $80 and the firm chooses to produce the quantity you already selected. Note: In the following question, enter a positive number, even if it represents a loss. The area of this rectangle indicates that the firm's would be s per day.

Principles of Microeconomics

7th Edition

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter4: The Market Forces Of Supply And Demand

Section: Chapter Questions

Problem 5PA

Related questions

Question

Economics

Transcribed Image Text:4. Profit maximization in the cost-curve diagram

Suppose that the market for sports watches is a competitive market. The following graph shows the daily cost curves of a firm operating in this

market.

Hint: After placing the rectangle on the graph, you can select an endpoint to see the coordinates of that point.

PRICE (Dollars per watch)

100

90

80

70

60

50

30

४

MC

ATC

AVC

Profit or Loss

?

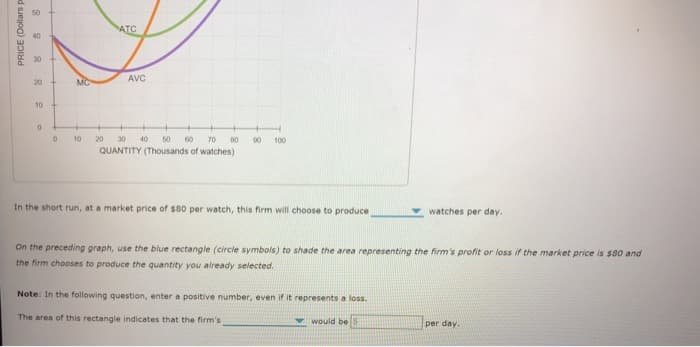

Transcribed Image Text:PRICE (Dollars p

8

8

30

20

10

0

4

0

MC

ATC

AVC

10 20 30 40 50 60 70 80 90 100

QUANTITY (Thousands of watches)

In the short run, at a market price of $80 per watch, this firm will choose to produce

watches per day.

On the preceding graph, use the blue rectangle (circle symbols) to shade the area representing the firm's profit or loss if the market price is $80 and

the firm chooses to produce the quantity you already selected.

Note: In the following question, enter a positive number, even if it represents a loss.

The area of this rectangle indicates that the firm's

would be s

per day.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax