BUSINESS TRANSACTIONS FOR ACCOUNTING PROCESS In December of the current year, the following transactions took place. Mr. Ezekiel invested P70,000 to start his law practice. One-year insurance effective December 1 was paid, P7,000. Dec 2 4 Office furniture worth P15,000 was purchased on account from EZ ABC Furniture Company Office and computer supplies costing P2,500 was bought for cash. Received from City Bank P60,000 for Loan applied to be used in his law practice. 8 11 14 Purchased on credit a desktop computer and printer for office use worth P60,000 for Micro System Inc. 16 Received P12,500 cash for legal service rendered to Jose Lopez. 18 Paid P1,000 for Miscellaneous expenses incurred 20 Received P10,500cashfor legal services rendered to clients. 22 Advertising place on a local paper for three months effective December 1, was paid, P3,600. 24 Various clients were billed for professional services, P16,400. 25 Micro System Inc. was partially paid, P45,000. 26 Collected accounts from various clients, P7,500. Lights, water, and telephone use for the month December was Paid to property owner, P1,500. (Utilities Expense) 27 28 The salary of the legal secretary was paid, P5,500. Mr. Ezekiel withdrew P12,000 for personal use. Received P5,000 as advance fees for legal services to be rendered the next year. 29 30 Required: FINANCIAL STATEMENTS ACCOUNTING PROCESS to do... 1. Chart of Accounts 2. Journalization w/ explanation 3. Posting - T accounts and General Ledger 4. Trial Balance 5. Preparation of Financial Statement a. Statement of comprehensive Income/INCOME STATEMENT b. Statement of Changes in Equity c. Statement of Financial Position/BALANCE SHEET d. Statement of Cash Flow (from Cash Ledger)

BUSINESS TRANSACTIONS FOR ACCOUNTING PROCESS In December of the current year, the following transactions took place. Mr. Ezekiel invested P70,000 to start his law practice. One-year insurance effective December 1 was paid, P7,000. Dec 2 4 Office furniture worth P15,000 was purchased on account from EZ ABC Furniture Company Office and computer supplies costing P2,500 was bought for cash. Received from City Bank P60,000 for Loan applied to be used in his law practice. 8 11 14 Purchased on credit a desktop computer and printer for office use worth P60,000 for Micro System Inc. 16 Received P12,500 cash for legal service rendered to Jose Lopez. 18 Paid P1,000 for Miscellaneous expenses incurred 20 Received P10,500cashfor legal services rendered to clients. 22 Advertising place on a local paper for three months effective December 1, was paid, P3,600. 24 Various clients were billed for professional services, P16,400. 25 Micro System Inc. was partially paid, P45,000. 26 Collected accounts from various clients, P7,500. Lights, water, and telephone use for the month December was Paid to property owner, P1,500. (Utilities Expense) 27 28 The salary of the legal secretary was paid, P5,500. Mr. Ezekiel withdrew P12,000 for personal use. Received P5,000 as advance fees for legal services to be rendered the next year. 29 30 Required: FINANCIAL STATEMENTS ACCOUNTING PROCESS to do... 1. Chart of Accounts 2. Journalization w/ explanation 3. Posting - T accounts and General Ledger 4. Trial Balance 5. Preparation of Financial Statement a. Statement of comprehensive Income/INCOME STATEMENT b. Statement of Changes in Equity c. Statement of Financial Position/BALANCE SHEET d. Statement of Cash Flow (from Cash Ledger)

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Topic Video

Question

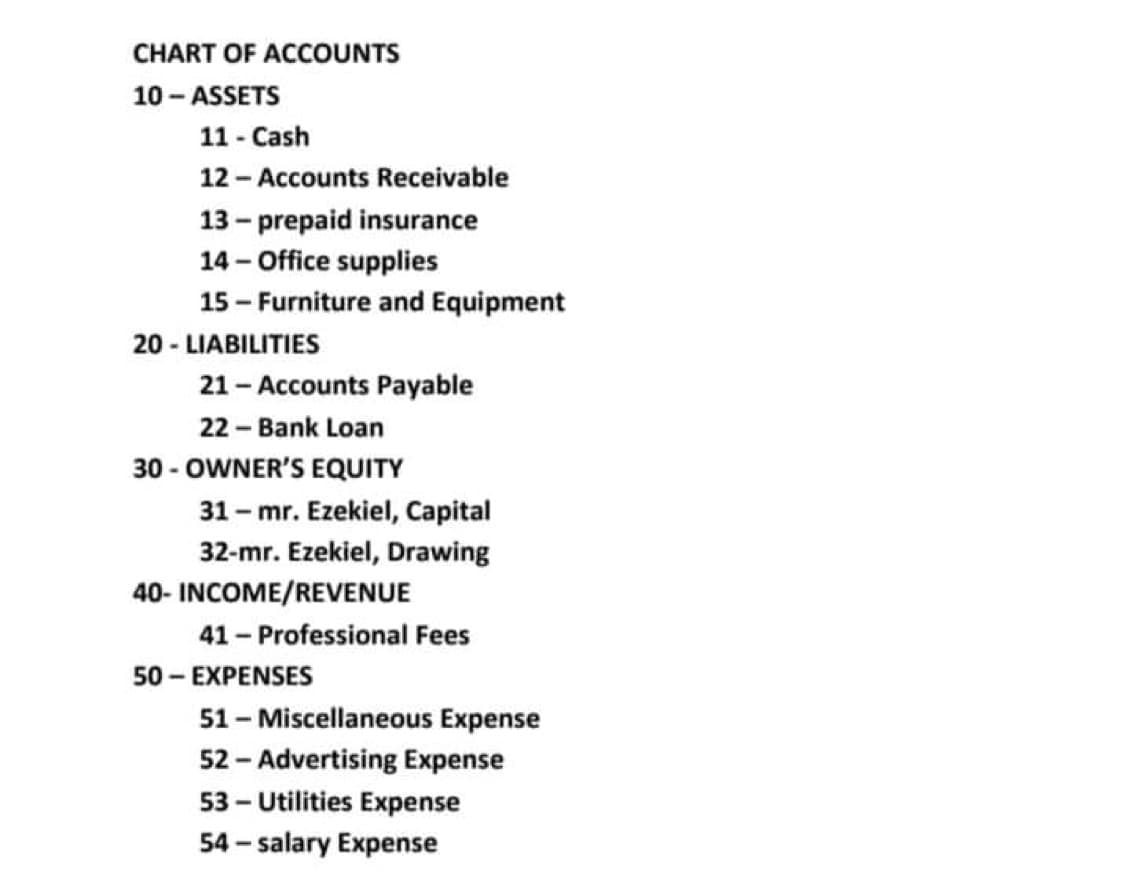

Transcribed Image Text:CHART OF ACCOUNTS

10 - ASSETS

11 - Cash

12 - Accounts Receivable

13 - prepaid insurance

14 - Office supplies

15 - Furniture and Equipment

20 - LIABILITIES

21 - Accounts Payable

22 - Bank Loan

30 - OWNER'S EQUITY

31 - mr. Ezekiel, Capital

32-mr. Ezekiel, Drawing

40- INCOME/REVENUE

41- Professional Fees

50 - EXPENSES

51- Miscellaneous Expense

52 - Advertising Expense

53 - Utilities Expense

54 - salary Expense

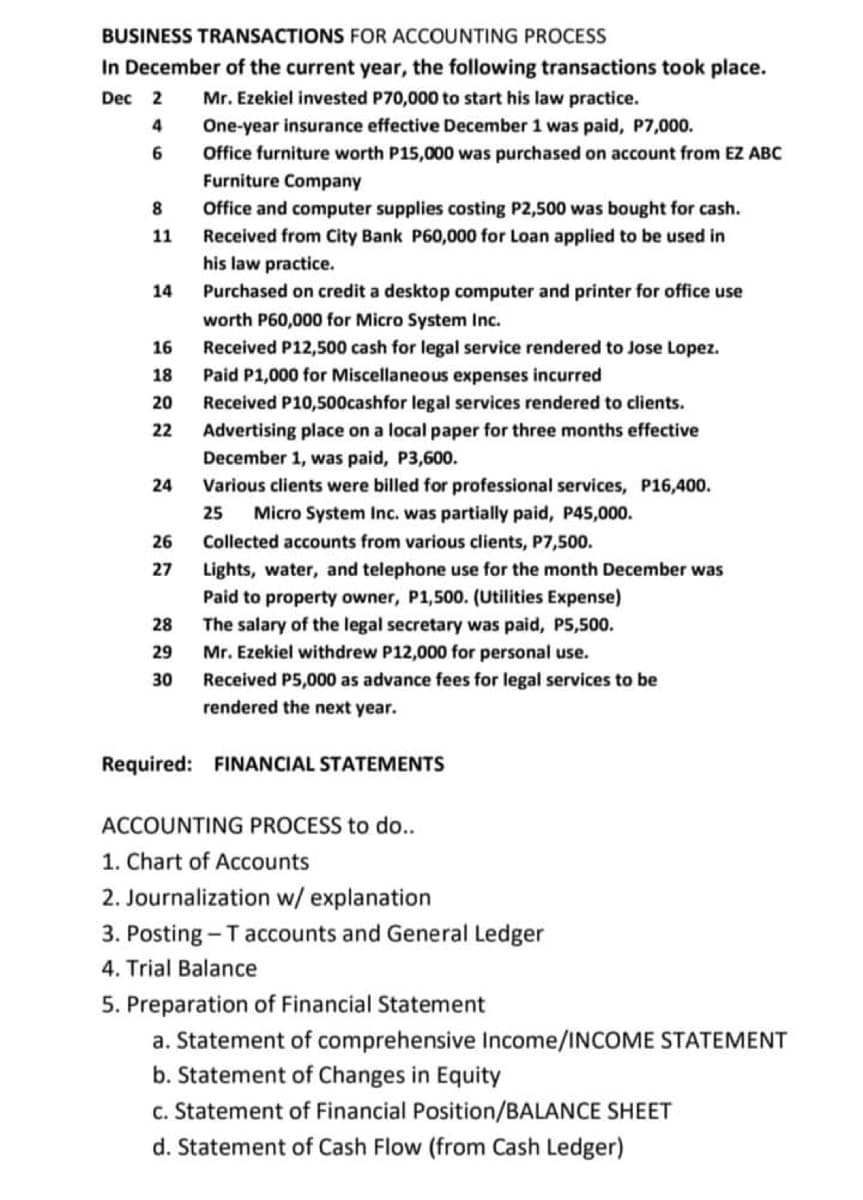

Transcribed Image Text:BUSINESS TRANSACTIONS FOR ACCOUNTING PROCESS

In December of the current year, the following transactions took place.

Dec 2

Mr. Ezekiel invested P70,000 to start his law practice.

One-year insurance effective December 1 was paid, P7,000.

Office furniture worth P15,000 was purchased on account from EZ ABC

4

6

Furniture Company

8

Office and computer supplies costing P2,500 was bought for cash.

Received from City Bank P60,000 for Loan applied to be used in

his law practice.

11

14

Purchased on credit a desktop computer and printer for office use

worth P60,000 for Micro System Inc.

16

Received P12,500 cash for legal service rendered to Jose Lopez.

18

Paid P1,000 for Miscellaneous expenses incurred

20

Received P10,500cashfor legal services rendered to clients.

22

Advertising place on a local paper for three months effective

December 1, was paid, P3,600.

24

Various clients were billed for professional services, P16,400.

25

Micro System Inc. was partially paid, P45,000.

26

Collected accounts from various clients, P7,500.

27

Lights, water, and telephone use for the month December was

Paid to property owner, P1,500. (Utilities Expense)

The salary of the legal secretary was paid, P5,500.

Mr. Ezekiel withdrew P12,000 for personal use.

28

29

30

Received P5,000 as advance fees for legal services to be

rendered the next year.

Required: FINANCIAL STATEMENTS

ACCOUNTING PROCESS to do...

1. Chart of Accounts

2. Journalization w/ explanation

3. Posting - T accounts and General Ledger

4. Trial Balance

5. Preparation of Financial Statement

a. Statement of comprehensive Income/INCOME STATEMENT

b. Statement of Changes in Equity

c. Statement of Financial Position/BALANCE SHEET

d. Statement of Cash Flow (from Cash Ledger)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,