College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 3PB

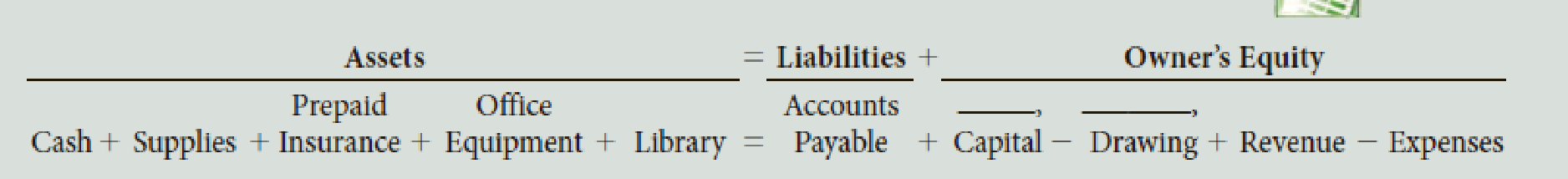

P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow.

- a. Schwartz deposited $25,000 in a bank account in the name of the business.

- b. Bought office equipment on account from QuipCo, $9,670.

- c. Schwartz invested his personal law library, which cost $2,800.

- d. Paid the office rent for the month, $1,700, Ck. No. 2000.

- e. Bought office supplies for cash, $418, Ck. No. 2001.

- f. Bought insurance for two years, $944, Ck. No. 2002.

- g. Sold legal services for cash, $8,518.

- h. Paid the salary of the part-time receptionist, $1,820, Ck. No. 2003.

- i. Received and paid the telephone bill, $388, Ck. No. 2004.

- j. Received and paid the bill for utilities, $368, Ck. No. 2005.

- k. Sold legal services for cash, $9,260.

- l. Paid on account to QuipCo, $2,670, Ck. No. 2006.

- m. Schwartz withdrew cash for personal use, $2,500, Ck. No. 2007.

Required

- 1. Record the transactions and the balance after each transaction.

- 2. Total the left side of the

accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

College Accounting (Book Only): A Career Approach

Ch. 1 - Prob. 1QYCh. 1 - Prob. 2QYCh. 1 - Which of the following accounts would increase...Ch. 1 - Which of the following statements is true? a....Ch. 1 - M. Parish purchased supplies on credit. What is...Ch. 1 - Define assets, liabilities, owners equity,...Ch. 1 - Prob. 2DQCh. 1 - How do Accounts Payable and Accounts Receivable...Ch. 1 - Describe two ways to increase owners equity and...Ch. 1 - What is the effect on the fundamental accounting...

Ch. 1 - When an owner withdraws cash or goods from the...Ch. 1 - Define chart of accounts and identify the...Ch. 1 - What account titles would you suggest for the...Ch. 1 - Prob. 1ECh. 1 - Determine the following amounts: a. The amount of...Ch. 1 - Dr. L. M. Patton is an ophthalmologist. As of...Ch. 1 - Describe a business transaction that will do the...Ch. 1 - Describe a transaction that resulted in each of...Ch. 1 - Label each of the following accounts as asset (A),...Ch. 1 - Describe a transaction that resulted in the...Ch. 1 - Describe the transactions that are recorded in the...Ch. 1 - On June 1 of this year, J. Larkin, Optometrist,...Ch. 1 - On July 1 of this year, R. Green established the...Ch. 1 - S. Davis, a graphic artist, opened a studio for...Ch. 1 - On March 1 of this year, B. Gervais established...Ch. 1 - In April, J. Rodriguez established an apartment...Ch. 1 - In July of this year, M. Wallace established a...Ch. 1 - In March, K. Haas, M.D., established the Haas...Ch. 1 - P. Schwartz, Attorney at Law, opened his office on...Ch. 1 - In March, T. Carter established Carter Delivery...Ch. 1 - In October, A. Nguyen established an apartment...Ch. 1 - Why Does It Matter? MACS CUSTOM CATERING, Eugene,...Ch. 1 - What Would You Say? A friend of yours wants to...Ch. 1 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

The amount that should be recorded by Company R for building under historical cost principle.

Financial Accounting (11th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals Of Cost Accounting (6th Edition)

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals of Cost Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardOn June 1 of this year, J. Larkin, Optometrist, established the Larkin Eye Clinic. The clinics account names are presented below. Transactions completed during the month follow. a. Larkin deposited 25,000 in a bank account in the name of the business. b. Paid the office rent for the month, 950, Ck. No. 1001. c. Bought supplies for cash, 357, Ck. No. 1002. d. Bought office equipment on account from NYC Office Equipment Store, 8,956. e. Bought a computer from Wardens Office Outfitters, 1,636, paying 750 in cash and placing the balance on account, Ck. No. 1003. f. f. Sold professional services for cash, 3,482. g. Paid on account to Wardens Office Outfitters, 886, Ck. No. 1004. h. Received and paid the bill for utilities, 382, Ck. No. 1005. i. Paid the salary of the assistant, 1,050, Ck. No. 1006. j. Sold professional services for cash, 3,295. k. Larkin withdrew cash for personal use, 1,250, Ck. No. 1007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardS. Davis, a graphic artist, opened a studio for her professional practice on August 1. The account headings are presented below. Transactions completed during the month follow. a. Davis deposited 20,000 in a bank account in the name of the business. b. Bought office equipment on account from Starkey Equipment Company, 4,120. c. Davis invested her personal photographic equipment, 5,370, in the business. d. Paid the rent for the month, 1,500, Ck. No. 1000. e. Bought supplies for cash, 215, Ck. No. 1001. f. Bought insurance for two years, 1,840, Ck. No. 1002. g. Sold graphic services for cash, 3,616. h. Paid the salary of the part-time assistant, 982, Ck. No. 1003. i. Received and paid the bill for telephone service, 134, Ck. No. 1004. j. Paid cash for minor repairs to graphics equipment, 185, Ck. No. 1005. k. Sold graphic services for cash, 3,693. l. Paid on account to Starkey Equipment Company, 650, Ck. No. 1006. m. Davis withdrew cash for personal use, 1,800, Ck. No. 1007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

- On July 1, K. Resser opened Ressers Business Services. Ressers accountant listed the following chart of accounts: The following transactions were completed during July: a. Resser deposited 25,000 in a bank account in the name of the business. b. Bought tables and chairs for cash, 725, Ck. No. 1200. c. Paid the rent for the current month, 1,750, Ck. No. 1201. d. Bought computers and copy machines from Ferber Equipment, 15,700, paying 4,000 in cash and placing the balance on account, Ck. No. 1202. e. Bought supplies on account from Wigginss Distributors, 535. f. Sold services for cash, 1,742. g. Bought insurance for one year, 1,375, Ck. No. 1203. h. Paid on account to Ferber Equipment, 700, Ck. No. 1204. i. Received and paid the electric bill, 438, Ck. No. 1205. j. Paid on account to Wigginss Distributors, 315, Ck. No. 1206. k. Sold services to customers for cash for the second half of the month, 820. l. Received and paid the bill for the business license, 75, Ck. No. 1207. m. Paid wages to an employee, 1,200, Ck. No. 1208. n. Resser withdrew cash for personal use, 700, Ck. No. 1209. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of July 31, 20--. 6. Prepare an income statement for July 31, 20--. 7. Prepare a statement of owners equity for July 31, 20--. 8. Prepare a balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6arrow_forwardOn June 1 of this year, J. Larkin, Optometrist, established the Larkin Eye Clinic. The clinics account names are presented below. Transactions completed during the month follow. a. Larkin deposited 25,000 in a bank account in the name of the business. b. Paid the office rent for the month, 950, Ck. No. 1001 (Rent Expense). c. Bought supplies for cash, 357, Ck. No. 1002. d. Bought office equipment on account from NYC Office Equipment Store, 8,956. e. Bought a computer from Wardens Office Outfitters, 1,636, paying 750 in cash and placing the balance on account, Ck. No. 1003. f. Sold professional services for cash, 3,482 (Professional Fees). g. Paid on account to Wardens Office Outfitters, 886, Ck. No. 1004. h. Received and paid the bill for utilities, 382, Ck. No. 1005 (Utilities Expense). i. Paid the salary of the assistant, 1,050, Ck. No. 1006 (Salary Expense). j. Sold professional services for cash, 3,295 (Professional Fees). k. Larkin withdrew cash for personal use, 1,250, Ck. No. 1007. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardIn April, J. Rodriguez established an apartment rental service. The account headings are presented below. Transactions completed during the month of April follow. a. Rodriguez deposited 70,000 in a bank account in the name of the business. b. Paid the rent for the month, 2,000, Ck. No. 101 (Rent Expense). c. Bought supplies on account, 150. d. Bought a truck for 23,500, paying 2,500 in cash and placing the remainder on account. e. Bought insurance for the truck for the year, 2,400, Ck. No. 102. f. Sold services on account, 4,700. g. Bought office equipment on account from Stern Office Supply, 1,250. h. Sold services for cash for the first half of the month, 8,250. i. Received and paid the bill for utilities, 280, Ck. No. 103. j. Received a bill for gas and oil for the truck, 130. k. Paid wages to the employees, 2,680, Ck. Nos. 104106. l. Sold services for cash for the remainder of the month, 3,500. m. Rodriguez withdrew cash for personal use, 4,000, Ck. No. 107. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

- On July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account headings are presented below. Transactions completed during the month of July follow. a. Green deposited 30,000 in a bank account in the name of the business. b. Paid the office rent for the month, 1,800, Ck. No. 2001. c. Bought supplies for cash, 362, Ck. No. 2002. d. Bought professional equipment on account from Rehab Equipment Company, 18,000. e. Bought office equipment from Hi-Tech Computers, 2,890, paying 890 in cash and placing the balance on account, Ck. No. 2003. f. Sold professional services for cash, 4,600. g. Paid on account to Rehab Equipment Company, 700, Ck. No. 2004. h. Received and paid the bill for utilities, 367, Ck. No. 2005. i. Paid the salary of the assistant, 1,150, Ck. No. 2006. j. Sold professional services for cash, 3,868. k. Green withdrew cash for personal use, 1,800, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardS. Davis, a graphic artist, opened a studio for her professional practice on August 1. The account headings are presented below. Transactions completed during the month follow. a. Davis deposited 20,000 in a bank account in the name of the business. b. Bought office equipment on account from Starkey Equipment Company, 4,120. c. Davis invested her personal photographic equipment, 5,370. (Increase the account Photo Equipment and increase the account S. Davis, Capital.) d. Paid the rent for the month, 1,500, Ck. No. 1000 (Rent Expense). e. Bought supplies for cash, 215, Ck. No. 1001. f. Bought insurance for two years, 1,840, Ck. No. 1002. g. Sold graphic services for cash, 3,616 (Professional Fees). h. Paid the salary of the part-time assistant, 982, Ck. No. 1003 (Salary Expense). i. Received and paid the bill for telephone service, 134, Ck. No. 1004 (Telephone Expense). j. Paid cash for minor repairs to graphics equipment, 185, Ck. No. 1005 (Repair Expense). k. Sold graphic services for cash, 3,693 (Professional Fees). l. Paid on account to Starkey Equipment Company, 650, Ck. No. 1006. m. Davis withdrew cash for personal use, 1,800, Ck. No. 1007. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardOn March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardIn March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardOn July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account headings are presented below. Transactions completed during the month of July follow. a. Green deposited 30,000 in a bank account in the name of the business. b. Paid the office rent for the month, 1,800, Ck. No. 2001 (Rent Expense). c. Bought supplies for cash, 362, Ck. No. 2002. d. Bought professional equipment on account from Rehab Equipment Company, 18,000. e. Bought office equipment from Hi-Tech Computers, 2,890, paying 890 in cash and placing the balance on account, Ck. No. 2003. f. Sold professional services for cash, 4,600 (Professional Fees). g. Paid on account to Rehab Equipment Company, 700, Ck. No. 2004. h. Received and paid the bill for utilities, 367, Ck. No. 2005 (Utilities Expense). i. Paid the salary of the assistant, 1,150, Ck. No. 2006 (Salary Expense). j. Sold professional services for cash, 3,868 (Professional Fees). k. Green withdrew cash for personal use, 1,800, Ck. No. 2007. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License