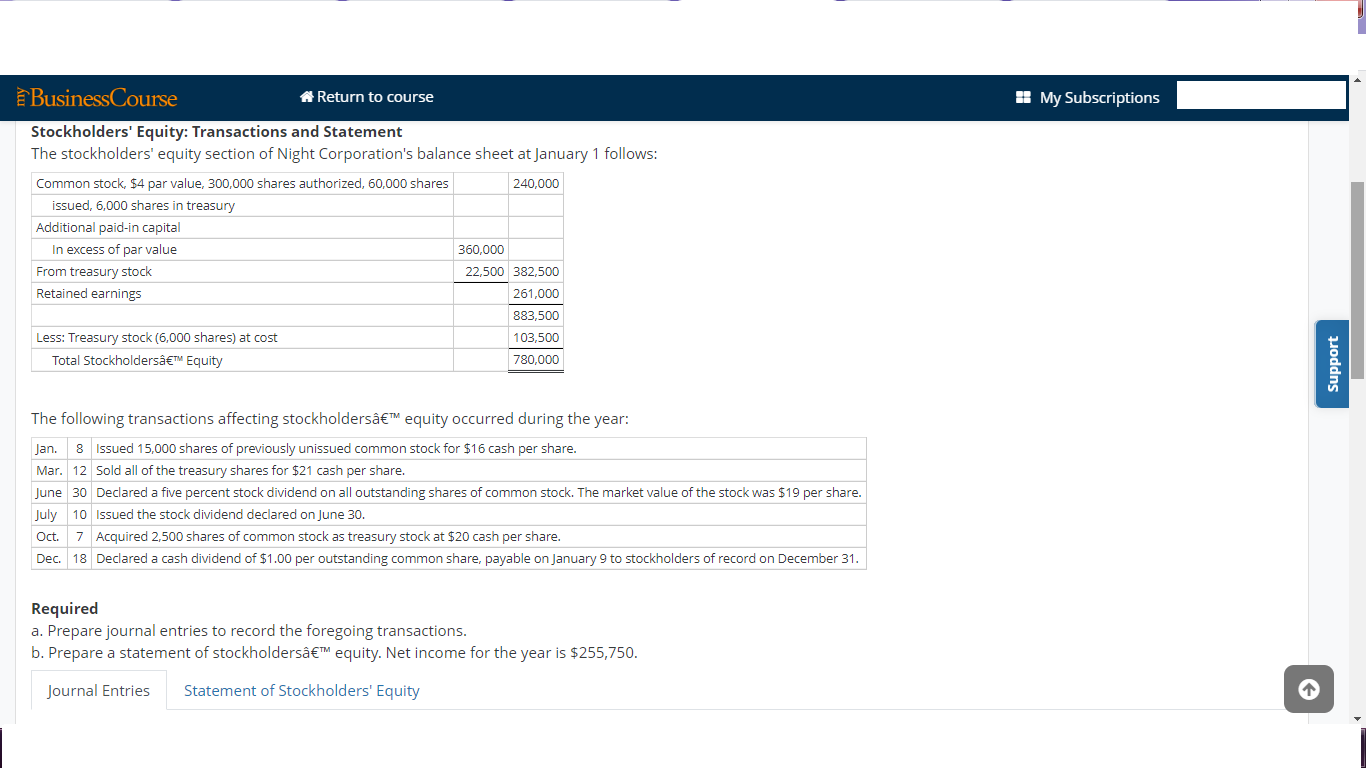

Stockholders' Equity: Transactions and Statement The stockholders' equity section of Night Corporation's balance sheet at January 1 follows: 240,000 Common stock, $4 par value, 300,000 shares authorized, 60,000 shares issued, 6,000 shares in treasury Additional paid-in capital In excess of par value From treasury stock Retained earnings Less: Treasury stock (6,000 shares) at cost Total Stockholders’ Equity 360,000 22,500 382,500 261,000 883,500 103,500 780,000 The following transactions affecting stockholders’ equity occurred during the year: Jan. 8 Issued 15,000 shares of previously unissued common stock for $16 cash per share. Mar. 12 Sold all of the treasury shares for $21 cash per share. June 30 Declared a five percent stock dividend on all outstanding shares of common stock. The market value of the stock was $19 per share. July 10 Issued the stock dividend declared on June 30. Oct. 7 Acquired 2,500 shares of common stock as treasury stock at $20 cash per share. Dec. 18 Declared a cash dividend of $1.00 per outstanding common share, payable on January 9 to stockholders of record on December 31.

Stockholders' Equity: Transactions and Statement The stockholders' equity section of Night Corporation's balance sheet at January 1 follows: 240,000 Common stock, $4 par value, 300,000 shares authorized, 60,000 shares issued, 6,000 shares in treasury Additional paid-in capital In excess of par value From treasury stock Retained earnings Less: Treasury stock (6,000 shares) at cost Total Stockholders’ Equity 360,000 22,500 382,500 261,000 883,500 103,500 780,000 The following transactions affecting stockholders’ equity occurred during the year: Jan. 8 Issued 15,000 shares of previously unissued common stock for $16 cash per share. Mar. 12 Sold all of the treasury shares for $21 cash per share. June 30 Declared a five percent stock dividend on all outstanding shares of common stock. The market value of the stock was $19 per share. July 10 Issued the stock dividend declared on June 30. Oct. 7 Acquired 2,500 shares of common stock as treasury stock at $20 cash per share. Dec. 18 Declared a cash dividend of $1.00 per outstanding common share, payable on January 9 to stockholders of record on December 31.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 57E: Outstanding Stock Lars Corporation shows the following information in the stockholders equity...

Related questions

Question

I am stuck on June 30th. Declared a five percent stock divided on all outstanding shares of common sotck. The market value of the stock was $19 per share.

I included screenshots of the whole thing.

To figure this out I thought we had to take all stocks issued which was 60,000 and then another 15,000 equalling 75,000 then multiply 75,000 by $19 then multiply by .05.

Im not sure what I am doing wrong. Can you point me in the right direction please.

Transcribed Image Text:BusinessCourse

A Return to course

H My Subscriptions

Stockholders' Equity: Transactions and Statement

The stockholders' equity section of Night Corporation's balance sheet at January 1 follows:

Common stock, $4 par value, 300,000 shares authorized, 60,000 shares

240,000

issued, 6,000 shares in treasury

Additional paid-in capital

In excess of par value

360,000

From treasury stock

22,500 382.500

Retained earnings

261,000

883.500

Less: Treasury stock (6,000 shares) at cost

103,500

Total Stockholdersâ€TM Equity

780,000

The following transactions affecting stockholders’ equity occurred during the year:

Jan.

8 Issued 15,000 shares of previously unissued common stock for $16 cash per share.

Mar. 12 Sold all of the treasury shares for $21 cash per share.

June 30 Declared a five percent stock dividend on all outstanding shares of common stock. The market value of the stock was $19 per share.

July 10 Issued the stock dividend declared on June 30.

Oct.

7 Acquired 2,500 shares of common stock as treasury stock at $20 cash per share.

Dec. 18 Declared a cash dividend of $1.00 per outstanding common share, payable on January 9 to stockholders of record on December 31.

Required

a. Prepare journal entries to record the foregoing transactions.

b. Prepare a statement of stockholders†equity. Net income for the year is $255,750.

Journal Entries

Statement of Stockholders' Equity

Support

Transcribed Image Text:BusinessCourse

A Return to course

H My Subscriptions

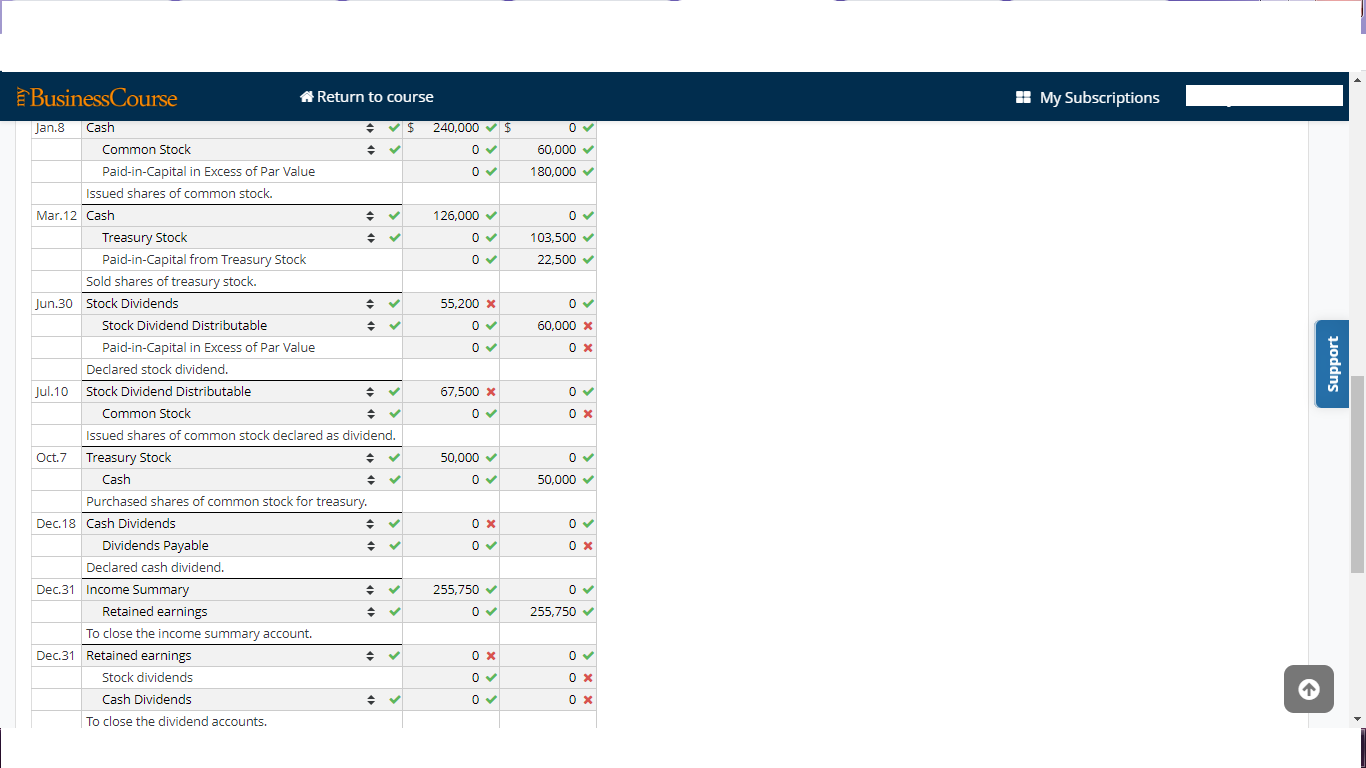

Jan.8

Cash

240,000 v $

Common Stock

60,000 v

Paid-in-Capital in Excess of Par Value

180,000 v

Issued shares of common stock.

Mar.12 Cash

126,000 v

Treasury Stock

103,500 v

Paid-in-Capital from Treasury Stock

22,500 v

Sold shares of treasury stock.

Jun.30 Stock Dividends

55.200 x

Stock Dividend Distributable

60,000 x

Paid-in-Capital in Excess of Par Value

Declared stock dividend.

Jul.10 Stock Dividend Distributable

67,500 x

Common Stock

Issued shares of common stock declared as dividend.

Oct.7

Treasury Stock

50,000 v

Cash

50,000

v

Purchased shares of common stock for treasury.

Dec.18 Cash Dividends

Dividends Payable

Declared cash dividend.

Dec.31 Income Summary

255.750

v

Retained earnings

255,750 v

To close the income summary account.

Dec.31 Retained earnings

Stock dividends

Cash Dividends

To close the dividend accounts.

Support

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning