A2 Equity transactions: An examination of the ledger of Goodrich Metals revealed the iollowng b Prepare the stockholders' equity section of Goodrich's December 31 balance sheet, along with any appropriate notes to the financial state- (LO. 1, 2) sectin Dec. 31 Net income for the year amounted to $98,000. Closed the accounts on January 1: Common stock, $1 par, 50,000 shares authorized, 30,000 shares issued, 29,500 shares outstanding S 30,000 Paid-in capital in excess of par value Retained earnings Treasury stock, 500 shares at cost * Goodrich is required by state law to restrict retained eamings at an amount equal to the cost of any treasury shares held by the firm 270,000 370,500 6,000 The following transactions and events occurred during the year: Jan. 7 Declared a $0.20 dividend per share to stockholders of recort on January 23. The dividend will be distributed on February ! Feb. 8 Paid the dividend declared on January 7. Apr. 15 Sold 300 shares of treasury stock for $4,500. June 30 Declared a 10% stock dividend on the shares outstanding t stockholders of record on July 15. The dividend will be d tributed on August 15. Fair market value on the date of decir ration was $14 per share. Aug. 15 Issued the stock dividend declared on June 30. to Income Summary account to Retained Earnings. Instructions Prepare journal entries to record Goodrich's transactions and even ments.

A2 Equity transactions: An examination of the ledger of Goodrich Metals revealed the iollowng b Prepare the stockholders' equity section of Goodrich's December 31 balance sheet, along with any appropriate notes to the financial state- (LO. 1, 2) sectin Dec. 31 Net income for the year amounted to $98,000. Closed the accounts on January 1: Common stock, $1 par, 50,000 shares authorized, 30,000 shares issued, 29,500 shares outstanding S 30,000 Paid-in capital in excess of par value Retained earnings Treasury stock, 500 shares at cost * Goodrich is required by state law to restrict retained eamings at an amount equal to the cost of any treasury shares held by the firm 270,000 370,500 6,000 The following transactions and events occurred during the year: Jan. 7 Declared a $0.20 dividend per share to stockholders of recort on January 23. The dividend will be distributed on February ! Feb. 8 Paid the dividend declared on January 7. Apr. 15 Sold 300 shares of treasury stock for $4,500. June 30 Declared a 10% stock dividend on the shares outstanding t stockholders of record on July 15. The dividend will be d tributed on August 15. Fair market value on the date of decir ration was $14 per share. Aug. 15 Issued the stock dividend declared on June 30. to Income Summary account to Retained Earnings. Instructions Prepare journal entries to record Goodrich's transactions and even ments.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter11: Accounting For Transactions Using A General Journal

Section11.3: Accounting For The Declaration And Payment Of A Dividend

Problem 1WT

Related questions

Question

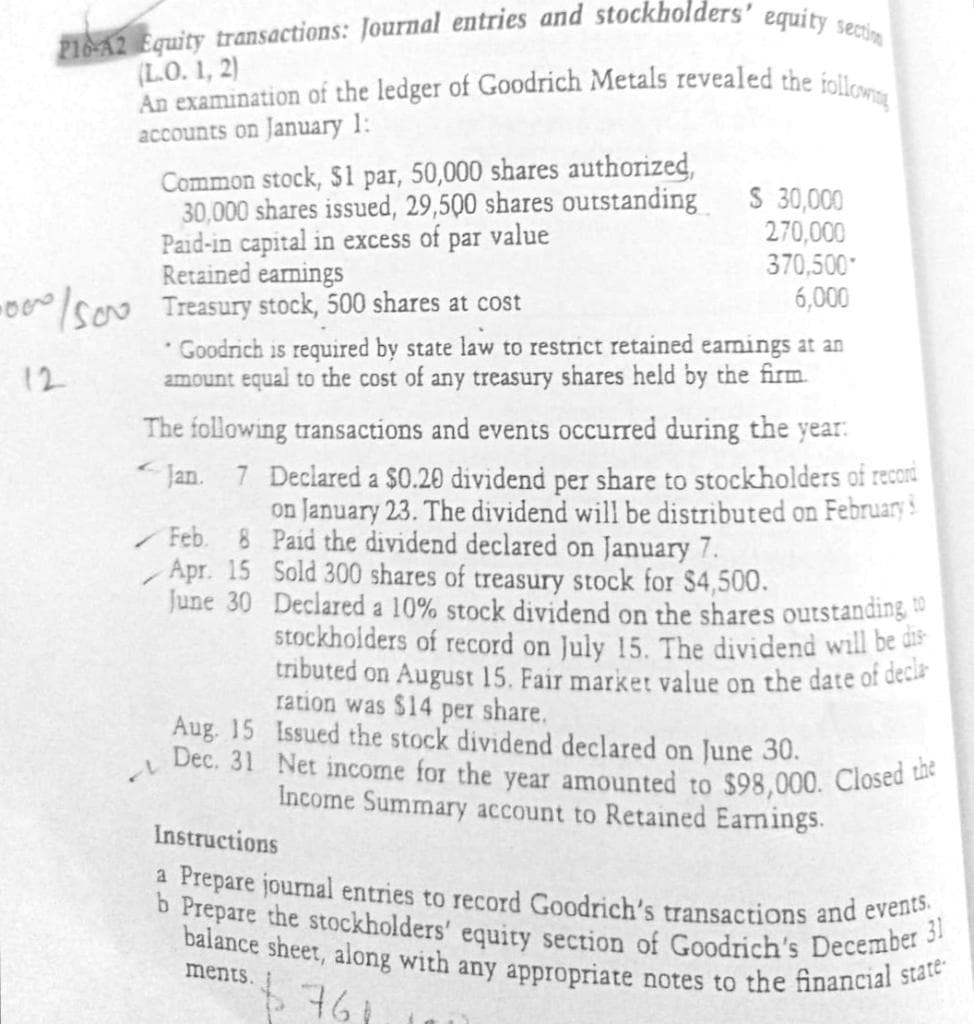

Transcribed Image Text:210-42 Equity transactions: Journal entries and stockholders' equity sectim

An examination of the ledger of Goodrich Metals revealed the iollowng

b Prepare the stockholders' equity section of Goodrich's December 31

balance sheet, along with any appropriate notes to the financial state-

Dec. 31 Net income for the year amounted to $98,000. Closed the

(L.O. 1, 2)

accounts on January 1:

Common stock, $1 par, 50,000 shares authorized,

30,000 shares issued, 29,500 shares outstanding

Paid-in capital in excess of par value

Retained earnings

Treasury stock, 500 shares at cost

* Goodrich is required by state law to restrict retained eamings at an

amount equal to the cost of any treasury shares held by the firm.

S 30,000

270,000

370,500

6,000

12

The following transactions and events occurred during the year:

Jan. 7 Declared a $0.20 dividend per share to stockholders of recori

on January 23. The dividend will be distributed on February

Feb. 8 Paid the dividend declared on January 7.

Apr. 15 Sold 300 shares of treasury stock for $4,500.

June 30 Declared a 10% stock dividend on the shares outstanding

stockholders of record on July 15. The dividend will be dis

tributed on August 15. Fair market value on the date of decl

ration was $14 per share.

Aug. 15 Issued the stock dividend declared on June 30.

Income Summary account to Retained Earnings.

Instructions

a Prepare journal entries to record Goodrich's transactions and evene

ments.

761

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,