by 4 000 units in the next year only. However, this forecast reduction in sales of YY would enable fixed factory overheads of NS58 000 to be avoided. Information on Per unit Sales NS70 Labour- Grade 2 4 hours Materials-relevant variable costs NS12 Required: Calculate the relevant variable cost related to the contract. NB: You are not required to enter the unit or currency symbol.

by 4 000 units in the next year only. However, this forecast reduction in sales of YY would enable fixed factory overheads of NS58 000 to be avoided. Information on Per unit Sales NS70 Labour- Grade 2 4 hours Materials-relevant variable costs NS12 Required: Calculate the relevant variable cost related to the contract. NB: You are not required to enter the unit or currency symbol.

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 21P

Related questions

Question

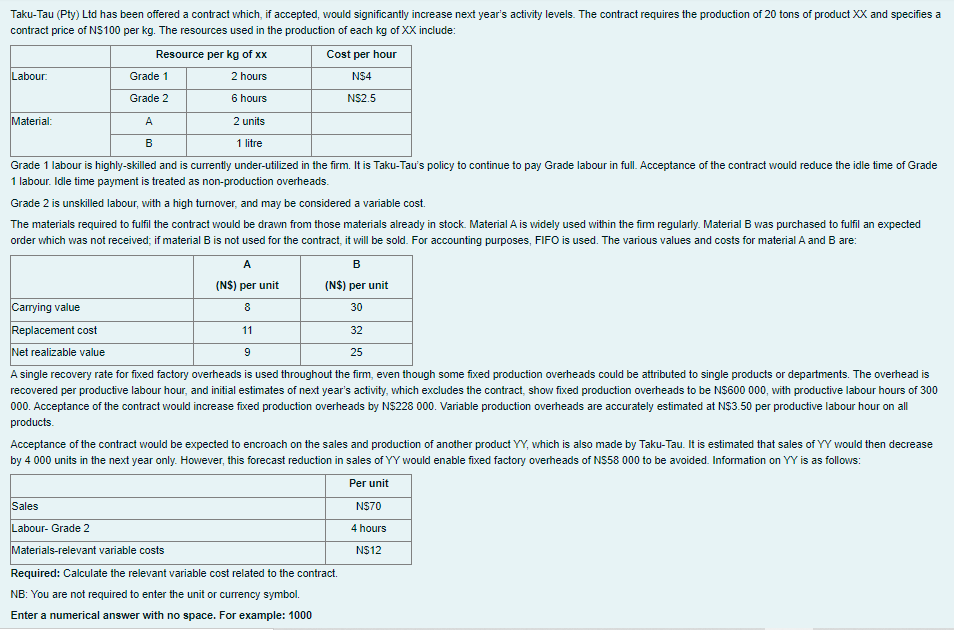

Transcribed Image Text:Taku-Tau (Pty) Ltd has been offered a contract which, if accepted, would significantly increase next year's activity levels. The contract requires the production of 20 tons of product XX and specifies a

contract price of NS100 per kg. The resources used in the production of each kg of XX include:

Resource per kg of xx

Cost per hour

Labour.

Grade 1

2 hours

N$4

Grade 2

6 hours

NS2.5

Material:

A

2 units

B

1 litre

Grade 1 labour is highly-skilled and is currently under-utilized in the firm. It is Taku-Tau's policy to continue to pay Grade labour in ful. Acceptance of the contract would reduce the idle time of Grade

1 labour. Idle time payment is treated as non-production overheads.

Grade 2 is unskilled labour, with a high turnover, and may be considered a variable cost.

The materials required to fulfil the contract would be drawn from those materials already in stock. Material A is widely used within the firm regularly. Material B was purchased to fulfil an expected

order which was not received; if material B is not used for the contract, it will be sold. For accounting purposes, FIFO is used. The various values and costs for material A and B are:

A

B

(NS) per unit

(N$) per unit

Carying value

Replacement cost

8

30

11

32

Net realizable value

25

A single recovery rate for fixed factory overheads is used throughout the firm, even though some fixed production overheads could be attributed to single products or departments. The overhead is

recovered per productive labour hour, and initial estimates of next year's activity, which excludes the contract, show fixed production overheads to be NS600 000, with productive labour hours of 300

000. Acceptance of the contract would increase fixed production overheads by NS228 000. Variable production overheads are accurately estimated at NS3.50 per productive labour hour on all

products.

Acceptance of the contract would be expected to encroach on the sales and production of another product YY, which is also made by Taku-Tau. It is estimated that sales of YY would then decrease

by 4 000 units in the next year only. However, this forecast reduction in sales of YY would enable fixed factory overheads of NS58 000 to be avoided. Information on YY is as follows:

Per unit

Sales

NS70

Labour- Grade 2

4 hours

Materials-relevant variable costs

N$12

Required: Calculate the relevant variable cost related to the contract.

NB: You are not required to enter the unit or currency symbol.

Enter a numerical answer with no space. For example: 1000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,