By how much would the December 31, 2021 retained earnings be misstated if no adjustments were made for the above errors? Compute for the adjusted net income for the year 2021.

By how much would the December 31, 2021 retained earnings be misstated if no adjustments were made for the above errors? Compute for the adjusted net income for the year 2021.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter15: Audit Reports For Financial Statement Audits

Section: Chapter Questions

Problem 33RQSC

Related questions

Question

By how much would the December 31, 2021

Compute for the adjusted net income for the year 2021.

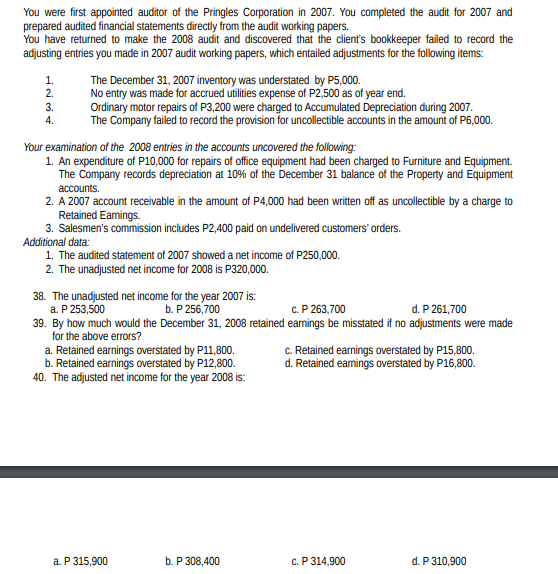

Transcribed Image Text:You were first appointed auditor of the Pringles Corporation in 2007. You completed the audit for 2007 and

prepared audited financial statements directly from the audit working papers.

You have returned to make the 2008 audit and discovered that the client's bookkeeper failed to record the

adjusting entries you made in 2007 audit working papers, which entailed adjustments for the following items:

The December 31, 2007 inventory was understated by P5,000.

No entry was made for accrued utilities expense of P2,500 as of year end.

Ordinary motor repairs of P3,200 were charged to Accumulated Depreciation during 2007.

The Company failed to record the provision for uncollectible accounts in the amount of P6,000.

1.

2.

3.

4.

Your examination of the 2008 entries in the accounts uncovered the following:

1. An expenditure of P10,000 for repairs of office equipment had been charged to Furniture and Equipment.

The Company records depreciation at 10% of the December 31 balance of the Property and Equipment

accounts.

2. A 2007 account receivable in the amount of P4,000 had been written off as uncollectible by a charge to

Retained Eamings.

3. Salesmen's commission includes P2,400 paid on undelivered customers' orders.

Additional data:

1. The audited statement of 2007 showed a net income of P250,000.

2. The unadjusted net income for 2008 is P320,000.

38. The unadjusted net income for the year 2007 is:

a. P 253,500

39. By how much would the December 31, 2008 retained earnings be misstated if no adjustments were made

for the above errors?

a. Retained earnings overstated by P11,800.

Retained earnings overstated by P12,800.

40. The adjusted net income for the year 2008 is:

b. P 256,700

с. Р263,700

d. P 261,700

C. Retained earnings overstated by P15,800.

d. Retained eamings overstated by P16,800.

a. P 315,900

b. P 308,400

с. Р 314,900

d. P 310,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub