What is the corrected net income for the year ended December 31, 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 4RE: Refer to RE22-2. Assume Heller Company had sales revenue of 510,000 in 2019 and 650,000 in 2020....

Related questions

Question

What is the corrected net income for the year ended December 31, 2021?

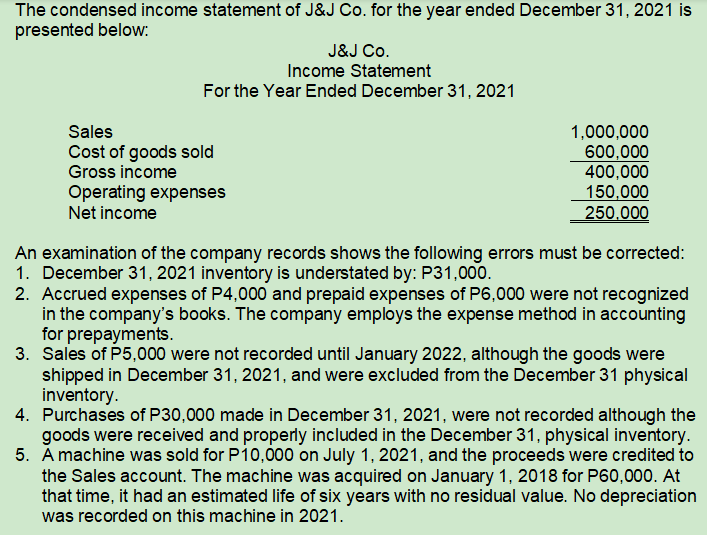

Transcribed Image Text:The condensed income statement of J&J Co. for the year ended December 31, 2021 is

presented below:

J&J Co.

Income Statement

For the Year Ended December 31, 2021

Sales

Cost of goods sold

Gross income

Operating expenses

Net income

1,000,000

600,000

400,000

150,000

250.000

An examination of the company records shows the following errors must be corrected:

1. December 31, 2021 inventory is understated by: P31,000.

2. Accrued expenses of P4,000 and prepaid expenses of P6,000 were not recognized

in the company's books. The company employs the expense method in accounting

for prepayments.

3. Sales of P5,000 were not recorded until January 2022, although the goods were

shipped in December 31, 2021, and were excluded from the December 31 physical

inventory.

4. Purchases of P30,000 made in December 31, 2021, were not recorded although the

goods were received and properly included in the December 31, physical inventory.

5. A machine was sold for P10,000 on July 1, 2021, and the proceeds were credited to

the Sales account. The machine was acquired on January 1, 2018 for P60,000. At

that time, it had an estimated life of six years with no residual value. No depreciation

was recorded on this machine in 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning