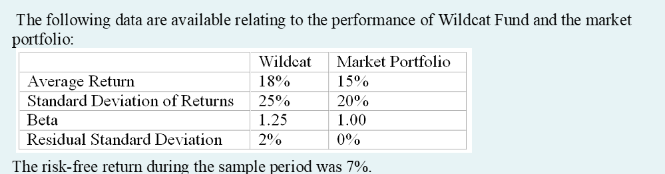

c) Calculate Jensen's measure of performance for Wildcat Fund. d) Assuming that the Wildcat fund is well diversified; which performance measure is best? Why?

Q: bbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and…

A: Internal growth rate: The maximum rate at which a company can grow without issuing additional equity…

Q: Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 22 years…

A: Yield to maturity can be calculated by following function in excel =RATE (nper, pmt, pv, [fv],…

Q: To go on a summer trip, Bill borrows $500. He makes no payments until the end of 2 years, when he…

A: Here, Borrowed Amount is $500 Time Period is 2 years Interest Rate is 6% Interest Type is Simple…

Q: 1. . . If you are saving money in a bank, which of the following is better for you? Bank A, which…

A: Effective Annual Rate: It is the effective annual rate on investment given the effects of…

Q: Monica wants to consolidate several loans she has into a single three-year loan for $150,000 that…

A: When making payments for loans the monthly payment amount is fixed. However the interest component…

Q: Intro You've assembled the following portfolio: Stock Exp. return Investment 1 6.9% 2 14.7% 3 16.3%…

A: As per the given information: StockExp. returnInvestment16.9%$5,000214.7%$12,000316.3%$7,000

Q: A stock is selling for R61, a 6-month put at R60 is selling for R1.70, a 6-month call at R60 is…

A: Here, Call Price (C0) is R2.20 Strike Price (X) is R60 Put Price (P0) is R1.70 Current Price (S0) is…

Q: a. Calculate the future growth rate for Solarpower's earnings. b. If the investor's required…

A: Dividend discount model refers to a stock valuation model which is used by the company for…

Q: ZBD Inc is issuing a 20-year bond with a par value of $1,000. The bond will pay its holders a…

A: The following information has been provided in the question: Life of bond = 20 years Par value=$1000…

Q: provide a 2 unique problem with own solution in YIELD performance ratio with explanation. Use this…

A: Dividend Yield is calculated by dividing Dividend per share by Market Price per share. It is…

Q: Mace Manufacturing is in the process of analyzing its investment decision-making procedures. Two…

A: The question is related to cost of capital. The cost of capital is always post tax. The Project will…

Q: 10. What is the estimated required rate of return for equity investors if a stock sells for $40 and…

A: The formula to calculate the value of common stock is: V0=D1/ks-g V0=Estimated value…

Q: Which of the following is a disadvantage of general partnerships? a) A partner who withdraws from a…

A: Partnership is one of the form of business organisation used. This is adopted by two or more than…

Q: When investing for a long term, investors care about the volatility of A. mean, average B. mean,…

A: Volatility is used to measure the tendency of security in stock exchange wherein the security price…

Q: You are considering buying common stock in Grow On, Inc. You have projected that the next dividend…

A: The price of stock can be found out from the constant growth of dividend model based on required…

Q: Not too long ago, interest rates were essentially zero. If interest rates fall to 1/100th of a basis…

A: When there is no interest than there would be no increase in value of money with time and there will…

Q: Ricardo recently spent a lot of money on the purchase of a new sports car. He thought he would…

A: In the world of finance, the concerned person who has made a financial decision is holding two…

Q: 40. Joel Embi, Inc. has an ROA (return on assets) of 15.2 percent, total assets of $4,500,000 and a…

A: Return on asset (ROA) ROA is calculated as shown below. ROA=Net incomeTotal assets Net profit…

Q: Compute the NPV for Project M if the appropriate cost of capital is 9 percent. (Negative amount…

A: Solution:- Net Present Value (NPV) means the net present value of cash inflows of project after…

Q: Question content area top Part 1 (Related to Checkpoint 9.2) (Yield to maturity) Hoyden Co.'s…

A: Yield to maturity can be calculated by following function in excel =RATE (nper, pmt, pv, [fv],…

Q: Joe plans to set aside money for his young daughter's college tuition. He will deposit money in an…

A: Future value of annuity = P * {[(1 + r / m)m*n – 1] / r / m} Future value of annuity = $72,000 P =…

Q: A property is being valued as if it will yield a perpetual annual stream of profits, starting 2…

A: Perpetuity is the stream of cash flows or payments that are made at equal intervals that do not have…

Q: A computer call center is going to replace all of its incandescent lamps with more energy efficient…

A: IRR is the Capital Budgeting techniques which shown the actual rate of return on the project earned…

Q: An investor buys a five-year, 7.5% annual coupon bond priced to yield 5%. The investor plans to sell…

A: Par Value of Bond is $1000 Coupon rate is 7.5% Yield is 5% Time to maturity is 5 years Bond is sold…

Q: The following table gives abbreviated balance sheets and income statements for Walmart. At the end…

A: (Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: ) Finance Which one is a financial risk? Select one: a. Uncertainty about demand b. uncertainty…

A: Meaning of Financial risk is diffrent for different category of person. In case of individual who is…

Q: Question Six: Two alternatives A and B are evaluated to select the most beneficial one. The details…

A: Here, To Find: Project to be selected =?

Q: The value of the preferred stock is $enter your response here per share

A: Preferred Stock: It refers to the type of stock issued by the company to raise preferred share…

Q: Calculate the amount of money William had to deposit in an investment fund growing at an interest…

A: Data given: PMT= $15000 n= 5 years nper=5*1 = 5 periods r=2.50% compounded annually Required:…

Q: At today's spot exchange rates 1 U.S. dollar can be exchanged for 10 Mexican pesos or for 110.75…

A: Foreign currency is that currency which is not home county currency. One currency can be exchanged…

Q: years. She opens a savings account with $800. The account pays simple interest at an annual rate of…

A: Simple Interest can be calculated using the formula given below Simple Interest = (Principle x Rate…

Q: An investor buys a five-year, 7.5% annual coupon bond priced to yield 5%. The investor plans to sell…

A: Par Value of Bond is $1000 Coupon rate is 7.5% Yield is 5% Time to maturity is 5 years Bond is sold…

Q: Bank ZLY is charging customers a loan rate of 9.2% APR compounded monthly. What is the equivalent…

A: Equivalent Effective Annual rate= It refers to that interest rate which is actually earned on a…

Q: On May 8, 2015, Mrs. Siega borrowed php 100,000 from Mr. Singh at 6% payable in 90 days. If the…

A: The present value of an amount received in the future stems from the concept of the time value of…

Q: Medwig Corporation has a DSO of 36 days. The company averages $8,000 in sales each day (all…

A: DSO means days sales outstanding. It means number of days it takes credit sales to be converted into…

Q: Given the following: January 1 inventory April 1 June 1 November 1 Cost of ending inventory Number…

A: Solution: Last-in-First-out (LIFO) method of inventory valuation assumes that the amount of goods…

Q: Discuss why company holds cash.

A: Cash by itself cannot create products or provide services. It serves as a vehicle for the purchase…

Q: Hahn Textiles has a tax loss carryforward of $800,000. Two firms are interested in acquiring Hahn…

A: Calculation of tax advantage of the merger for Webster: Year Net profit Before-tax Taxes Tax…

Q: Automotive Accessories needs to borrow $135,000 for 6 months for renovations. It is considering two…

A: Here, To Find: Part A. Effective annual rate of interest on each loan =? Part B. Decision to reduce…

Q: The table below shows the expected rates of return for three stocks and their weights in some…

A: Answer to part 1:- Expected return is the mean return calculated on the basis of the probability of…

Q: As an independent consultant, you just booked a client for $1,000 per month, with the first payment…

A: Given information:Monthly payment = $1000 Number of months = 60 Annual interest rate = 6.6%

Q: What is the present value of a $1,250 payment made in six years when the discount rate is 8 percent?…

A: To calculate the present value we will use the below formula Present value = FV/(1+r)n Where FV -…

Q: Jack borrowed $4239 at 7.8% to buy a used car. He paid the maturity value of $5460. Find the time of…

A: The question is related calculation of Duration or time. Simple Interest = Principal × Rate × Time

Q: How long will it take for a lender to discount ₱75,000 by 11.45% in order to gain ₱10,500 as his…

A: Simple interest is simple interest without compounding of interest and in discount we use the simple…

Q: t is a tax levied on an heir's inherited portion of an estate if the estate's value surpasses an…

A: Personal Income Tax is a form of direct tax levied on salaries, wages, other sources of income.…

Q: A firm's management wants to improve its cash flows with regard to working capital and wants to…

A: Working capital is very important in smooth operations of company and maintain the adequate…

Q: Green Valley Ltd currently has the following capital structure: Debt: $2,500,000 paying 8.5% coupon…

A: The following information is given: 1. Debt = $2,500,000, 8.5% coupon and before-tax yield to…

Q: A retailer ordered merchandise totaling $128,115.23 with terms 3.5%/10 net 40. What is the effective…

A: The discount of 3.5% can be availed if the payment will be made within 10 days. we will use that…

Q: This is a regional government's expenditure whose benefits exceed one fiscal year and will augment…

A: Solution: Government spends money from its treasuries to spend for various facilities for people in…

Q: Preference Shares, Definite Life: The 9%, 3-year P5,000,000 par value preference shares have a total…

A: Maximum amount one can pay for an investment is equal to what he is getting from that investment.…

c) Calculate Jensen's measure of performance for Wildcat Fund.

d) Assuming that the Wildcat fund is well diversified; which performance measure is best? Why?

Step by step

Solved in 3 steps

- The following data are available relating to the performance of Tiger Fund and the market portfolio: Tiger Market Portfolio Average return 18 % 15 % Standard deviations of returns 25 % 20 % Beta 1.25 1.00 Residual standard deviation 2 % 0 % The risk-free return during the sample period was 7%.Calculate Sharpe's measure of performance for Tiger Fund.The Performance Fund had returns of 19% over the evaluation period and the benchmark portfolio yielded a return of 17% over the same period. Over the evaluation period, the standard deviation of returns from the Fund was 23% and the standard deviation of returns from the benchmark portfolio was 21%. Assuming a risk-free rate of return of 8%, which one of the following is the calculation of the Sharpe index of performance for the fund over the evaluation period? 0.3913 0.4286 0.4783 0.5238 0.5870The following data are available relating to the performance of Long Horn Fund and the market portfolio: Long Horn Market Portfolio Average return 19% 12% Standard deviations of returns 35% 15% Beta 1.5 1.0 Residual standard deviation 3.0% 0.0% The risk-free return during the sample period was 6%. What is the Treynor measure of performance evaluation for Long Horn Fund ? Please answer fast i give you upvote.

- The following data are available relating to the performacne of Long Horn Stock Fund and the market portfolio: Long Horn Market Portfolio Average return 19% 12% Standard Deviation of returns 35% 15% Beta 1.5 1.0 Residual standard deviation 3.0% 0.0% The risk-free return during the sample period was 4%. A. What is the sharpe measure of performance evaluation for long horn stock fund? B. What is the treynor measure of performance evaluation for long horn stock fund? C. Calculate the jensen measure of performance evaluation for long horn stock fund. D. Calculate the information ratio of performance evaluation for long horn stock fund.You want to evaluate three mutual funds using the Sharpe measure for performance evaluation. The risk-free return during the sample period is 4%. The average returns, standard deviations, and betas for the three funds are given below, as are the data for the S&P 500 Index. Average Return Standard Deviation Beta Fund A 18 % 38 % 1.6 Fund B 15 % 27 % 1.3 Fund C 11 % 24 % 1.0 S&P 500 10 % 22 % 1.0 The fund with the highest Sharpe measure isThe average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 14.5% 24.6% 1.4 S&P 500 14.5% 21.3% 1 Risk-free 1% Calculate the Sharpe measure of performance for the S&P 500.

- Use the following data to answer the question regarding the performance of Guardian Stock Fund and the market portfolio. The risk-free return during the sample period was 4%. Guardian Market Portfolio Average return 14 % 10 % Standard deviation of returns 27 % 21 % Beta 1.5 1 Residual standard deviation 4 % 0 % Calculate the information ratio measure of performance for Guardian Stock Fund. (Round your answer to 2 decimal places. Do not round intermediate calculations.)Vega fund had return of 14%, a beta of 0.9, in a standard deviation of 27% last year 20 bills generated 3%. At the same time, the market portfolio generated return of 13% and the standard deviation of 22%. What is the information ratio of Vega fund ?The average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 12.5% 25.4% 1.27 S&P 500 14% 6% 1 Risk-free 1.2% Calculate the Sharpe measure of performance for Fund A.

- calculate the following M-squared measureT-squared measure, andAppraisal ratio (information ratio) Fund Average return Standard Deviation Beta coefficient Unsystematic Risk A 0.240 0.220 0.800 0.017 B 0.200 0.170 0.900 0.450 C 0.290 0.380 1.200 0.074 D 0.260 0.290 1.100 0.026 E 0.180 0.400 0.900 0.121 F 0.320 0.460 1.100 0.153 G 0.250 0.190 0.700 0.120 Market 0.220 0.180 1.000 0.000 Risk free return 0.050 0.000 Out of the performance measures you calculated in part a., which one would you use undereach of the following circumstances:i. You want to select one of the funds as your risky portfolio.ii. You want to select one of the funds to be mixed with the rest of your portfolio,currently composed solely of holdings in the market-index fund.iii. You want to select one of the funds to form an actively managed stock portfolioGiven the following sample data, calculate the performance measures for portfolio P and the market (Sharpe, Jensen/Alpha and Treynor. The T-bill rate during the period was 6 %). By which measure did portfolio P outperform the market? Portfolio P Market M Average return 35 % 28 % Beta 1.2 1.0 Standard deviation 42 % 30 %A fund achieved a return of 9.5%; the risk free rate was 1.5% and the market portfolio achieved 6%. The fund had a target Beta of 0.8, but was actually 1.25. The fund had a standard deviation of 28%, and the market had a standard deviation of 16%. (a) Calculate the following performance measures for the fund: • Sharpe ratio • Jensen’s alpha • Treynor ratio (b) Calculate whether the fund or the market portfolio would have provided more utility to an investor with a risk aversion coefficient, A, of 1.0