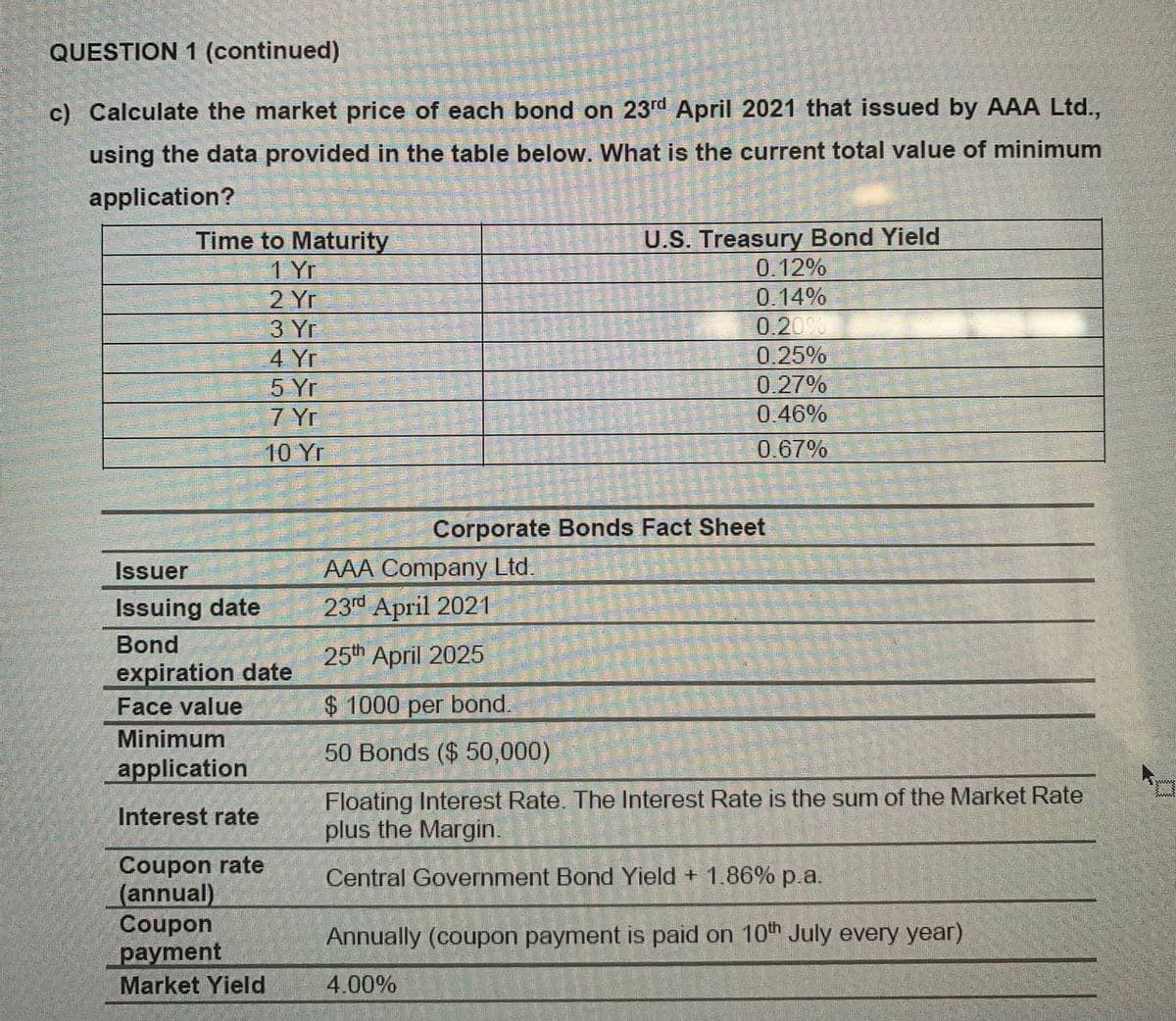

c) Calculate the market price of each bond on 23d April 2021 that issued by AAA Ltd., using the data provided in the table below. What is the current total value of minimum application? Time to Maturity 1 Yr U.S. Treasury Bond Yield 0.12% 0.14% 0.20% 2 Yr 3 Yr 4 Yr 0.25% 0.27% 5 Yr 7 Yr 0.46% 10 Yr 0.67% Corporate Bonds Fact Sheet AAA Company Ltd. 23rd April 2021 Issuer Issuing date Bond 25th April 2025 expiration date Face value $ 1000 per bond. Minimum 50 Bonds ($ 50,000) application Floating Interest Rate. The Interest Rate is the sum of the Market Rate plus the Margin. Interest rate Coupon rate (annual) Coupon payment Central Government Bond Yield + 1.86% p.a. Annually (coupon payment is paid on 10th July every year) Market Yield 4.00%

c) Calculate the market price of each bond on 23d April 2021 that issued by AAA Ltd., using the data provided in the table below. What is the current total value of minimum application? Time to Maturity 1 Yr U.S. Treasury Bond Yield 0.12% 0.14% 0.20% 2 Yr 3 Yr 4 Yr 0.25% 0.27% 5 Yr 7 Yr 0.46% 10 Yr 0.67% Corporate Bonds Fact Sheet AAA Company Ltd. 23rd April 2021 Issuer Issuing date Bond 25th April 2025 expiration date Face value $ 1000 per bond. Minimum 50 Bonds ($ 50,000) application Floating Interest Rate. The Interest Rate is the sum of the Market Rate plus the Margin. Interest rate Coupon rate (annual) Coupon payment Central Government Bond Yield + 1.86% p.a. Annually (coupon payment is paid on 10th July every year) Market Yield 4.00%

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter7: Percents

Section7.7: Simple And Compound Interest

Problem 1E

Related questions

Question

Transcribed Image Text:QUESTION 1 (continued)

c) Calculate the market price of each bond on 23rd April 2021 that issued by AAA Ltd.,

using the data provided in the table below. What is the current total value of minimum

application?

Time to Maturity

1 Yr

U.S. Treasury Bond Yield

0.12%

2 Yr

0.14%

0.20%

0.25%

3 Yr

4 Yr

5 Yr

0.27%

7 Yr

0.46%

10 Yr

0.67%

Corporate Bonds Fact Sheet

AAA Company Ltd.

23г Арril 2021

Issuer

Issuing date

Bond

25th April 2025

expiration date

Face value

$1000 per bond.

Minimum

50 Bonds ($ 50,000)

application

Floating Interest Rate. The Interest Rate is the sum of the Market Rate

plus the Margin.

Interest rate

Coupon rate

(annual)

Coupon

payment

Central Government Bond Yield + 1.86% p.a.

Annually (coupon payment is paid on 10th July every year)

Market Yield

4.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL