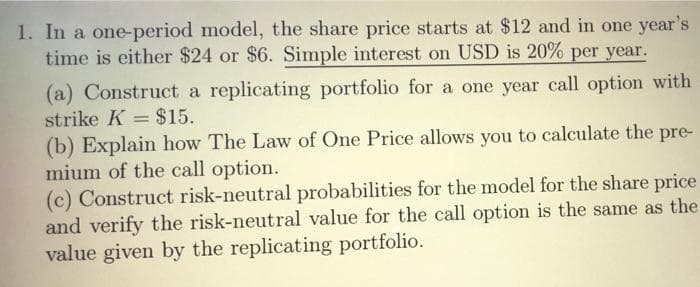

(c) Construct risk-neutral probabilitiès för and verify the risk-neutral value for the call option is the same as the value given by the replicating portfolio.

Q: Hudson Corporation is considering three options for managing its data processing operation:…

A: HI student, Thanks for posting the question. As per the guideline we are providing answer for the…

Q: PATTS is deciding which of the two investments to take. Option A, total costs = $75,000,000 and the…

A: let's solve this with the helo of the Benefit-Cost ratio. Assumption Here we assume that bother the…

Q: Which decision rule is most concerned with downside risk? A) Expected monetary value B)…

A: Downside risk in financial economics is described as a probability associated with security will…

Q: As the health of the financial sector is tied to the wider economy, it is crucial that the banking…

A: The COVID-19 pandemic is a health emergency, just as a financial shock. Banks play a vital part to…

Q: If a trader sells an option at an implied volatility of 10%, and plans to delta hedge it, over the…

A: Delta's hedging options trading strategy restricts or mitigates the directional risk of underlying…

Q: The best way to increase margin from customers is to: Group of answer choices: a. Ensure that the…

A: This question is MCQ type

Q: In a DBOMF contract arrangement, the contractor is responsible for managing the cash flow to support…

A: Note:- Since we can only answer one question at a time, we'll answer the first one. Please repost…

Q: Consider the two options in the following table, both of which have random outcomes: a. Determine…

A: a. Expected Value of option 1 (EV1) Expected Value of option 2 (EV2)

Q: 1-year HPR on a 30-year U.S. Treasury bond with a coupon of 4.0% if it is curr par and the…

A: Treasury bonds (T-bonds) are government debt securities given by the American National government…

Q: I am in possession of two coins. One is fair so that it lands heads (H) and tails (T) with equal…

A: Hi, since you have asked a question with multiple sub-parts we will answer only first three parts…

Q: A company is planning to raise savings with associated probabilities shown in the table below. The…

A: MARR The minimum acceptable rate of return (MARR), or hurdle rate, is the minimal rate of return a…

Q: A put option that expires in 9 months with an exercise price of $ 55 sells for $ 7 . The stock is…

A: Expire in 9 month Exercise price $=55 As per bartleby guidelines i only have to be answered 1 only

Q: The owner of a furniture factory wishes to install a new production plant, for which he has three…

A: Given information Alternative 1: Land cost=1,100,000.00 Construction cost=1,055,000.00 Machinery…

Q: Because of the time value of money, the longer before an option expires, the less valuable the…

A: The time value of money (TVM) is the concept that money you have now is worth more than the…

Q: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a…

A: Given Expected return Standard Deviation Stock Funds 23 29 Bond Funds 14 17

Q: I am in possession of two coins. One is fair so that it lands heads (H) and tails (T) with equal…

A: Since one coin is fair the probability of the Head and tail coming is half each whereas on the…

Q: P(A) = 0.2 P(B)= 0.3 Find P(A and B) when events are mutually exclusive.

A: It has been given that, P(A) = 0.2 P(B)= 0.3 Events A and B are mutually exclusive.

Q: While drilling a wildcat well, a tool is stuck. The engineers have two options: (1) to fish for the…

A: Expected value analysis is the calculation of the anticipated costs incurred for the completion of a…

Q: Greta, an elderly investor, has a degree of risk aversion of A= 4 when applied to return on wealth…

A: Part 1) The 3-year risk premium for S&P Portfolio and Hedge Fund Portfolio is calculated as…

Q: ity bank has six-year zero coupon bonds with a total face value of $20 million. The current market…

A: A zero-coupon bond is a class of bonds that has no interest installment structure. Not at all like…

Q: An FI has a $100 million portfolio of six-year Eurodollar bonds that have an 8 percent coupon. The…

A: An Overview of the Hedge's Functions Taking out an insurance policy is a lot like hedging, in a…

Q: I am in possession of two coins. One is fair so that it lands heads (H) and tails (T)with equal…

A: 1:For a fair coin, the chance for getting a Head H as well as chance for getting a tail T is the…

Q: A generating system has a total capacity of 600 MW. The operating probability of all the units in…

A: Given: Q= 0.YY*

Q: The potential percent gain or loss in changes of variable is taken into account by: a. sensitive…

A: Gain refers to getting something more gradually.

Q: over the next three months is 1.2% per annum. The six-month risk-free rate is 3.5% per annum and the…

A: * SOLUTION :-

Q: Suppose that you have a stock with a market beta of zero. This means that: a) the stock has no risk…

A: Ans in step 2

Q: NewTech

A: Making a arboreous diagram to sketch out a course of action or a applied math likelihood analysis is…

Q: In net present worth analysis over a period, if the net present worth value is equal to zero, the…

A: "Since you have asked multiple questions, we will solve first question for you .. If you want any…

Q: In the case of a business with more than one product, a. it cannot use CVP analysis as such would…

A: CVP analysis is a method of determining how changes in variable and fixed costs affect a company's…

Q: "A financial investor has $31,000 to invest. The choices have been narrowed down to the following…

A: The return on investing in foreign bond can be calculated as follows;

Q: The estimated beta (/3) of a firm is 1.7. The market return (rm) is 14 %, and the risk-free rate…

A:

Q: The following are estimates for two stocks. Firm-Specific Standard Deviation Stock A B Expected…

A: A standard deviation (symbol σ) is a proportion of how distributed the information/data is…

Q: The following two assets and payout data are given below: Asset A: Pays a return of $2,000 20% of…

A: Risk averse:- The word "risk-averse" refers to an investor who prioritizes preservation of capital…

Q: Max-Fly Aviation Ltd is an aerospace company that makes commercial drones. They are currently…

A: Firms undertake risk management with the motive of identifying risks that could be associated with…

Q: Assume that you are the team leader of strategic planning and advisory board of M/S XYZ company. The…

A:

Q: A bottling plant i lls 2,400 bottles every two hours. The lead time is 40 minutes and a container…

A:

Q: Risky Prospect Y is defined as: Y = ($7,0.25 ; $12,0.50; $25,0.25) What is the expected value of…

A: The expected value of a prospect is based on the return it generates corresponding to the…

Q: The information contained in the table below shows the expected return and standard deviation for…

A: Risk refers to the uncertainty attached to the outcome of an event. According to the risk-bearing…

Q: An automobile parts manufacturer is considering whether they should invest in an automatic or…

A:

Q: You are considering investing in one of two projects, which have the following returns and…

A: Part (a) Mean return of project A = Σ X p(X) Mean of project A = 0.1(-0.2) + 0.25(0.1) +0.3(0.15) +…

Q: The accounting department head of MOOG Controls Phils. has asked his financial manager to provide a…

A: The Value of the firm can calculate by using the following formula PV = Current profits x (1 + i)(i…

Q: Helton Hotels, a major hotel chain, and Beautiful Burgers, a popular chain of burger restaurants,…

A: Note: Since you've asked multiple question, we will solve the first question for you. If you want…

Q: Stock ABC has a Forward for December at: $450, Is it reasonable that A PUT option on ABC, with a…

A: A forward contract allows you to buy or sell an asset at a predetermined price in the future. An…

Q: Company A expects to generate K150, 000 cash flows per year in perpetuity and the risk adjusted…

A: The certainty equivalent could be a bonded reward that somebody would take currently instead of…

Q: A stock is currently at $20. It can go to $22 or $18 in 3 months. The risk free rate is 12% per…

A: To find the value of the option, there are different methods to calculate; binomial trees, the…

Q: An investor believes that the U.S. dollar will rise in value relative to the Japanese yen. The same…

A: The value of a currency in the foreign exchange market is determined by the demand and supply for…

Q: Suppose the following cost/benefit matrix is given by the domain expert. Calculate the expected…

A: Given:- P N T…

Step by step

Solved in 2 steps with 1 images

- "Mary is in contract negotiations with a publishing house for her new novel. She has two options. OPTION 1: She may be paid $90000 up front, and receive royalties that are expected to total $30000 at the end of each of the next 6 years. Alternatively, OPTION 2: she can receive $100000 up front and no royalties. Which of the following investment rules would indicate that she should take Option 1, given a discount rate of 5%? Rule I: The Net Present Value rule; Rule II: The Payback Rule with a payback period of 2 years.1. Coal provide a cheap source of energy and it is a major source of energy for the world. Coal consumption is hampered mainly by a. Environmental concerns b. Technological concerns c. Political concerns d. Financial concerns 2. JJ Alfred Ltd. Is an energy company and their financing comes from 60% equity and 40% debt, risk free rate is 3% and expected market rate is 10%, loan interest is 8% and tax deductible under a tax rate of 28%, beta (β) is 1.4 showing higher risk. What is the WEIGHTED AVERAGE COST OF CAPITAL a. 9.3% b. 9.2% c. 9.1% d. 9.0.% 4. A producer holding a commodity is said to be _______________ and could hedge by going __________ a futures contract a. Long long b. Long short c. Short short d. Short long 5. __________________refers to the benefits of holding some inventory rather than completely depending on the futures market for supply a. Contract yield b. Convenience yield c. Storage benefit d. Holding benefit 5. In the LNG business value chain, which of the…5) Factoring in the market price of oil (as a random event, depicted by a circle) to determine revenues. Planners might use a continuous random variable, like a normal distribution with a known mean and standard deviation. They also might use a limited set of discrete values to approximate a continuous random variable. For this example, we'll assume that, for the expected distribution of oil prices, the planners would select an extraction option giving an expected payoff of $120M. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.

- A share of stock of A-Star Inc. is now selling for $23.50. A financial analyst summarizes the uncertainty about the rate of return on the stock by specifying three possible scenarios: Business Condition Scenario, s Probability, p(s) End of Year Price Annual Dividend High growth 1 0.35 $35 $ 4.40 Normal growth 2 0.30 27 4.00 No growth 3 0.35 15 4.00 What are the holding-period returns for a one-year investment in the stock of A-Star Inc. for each of the three scenarios? Calculate the expected HPR and standard deviation of the HPR.What are the economic risk in the Philippines for a U.S multinational company? Note:- Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism. Answer completely and accurate answer. Rest assured, you will receive an upvote if the answer is accurate.For Stock ABC the December next year Forward is $450. A call option on ABC, has a Strike of $420 and costs (premium) $50. What is the intrinsic and extrinsic value? A. Intrinsic $30, Extrinsic $30 B. Intrinsic $40, Extrinsic $10 C. Intrinsic $0, Extrinsic $30 D. Intrinsic $30, Extrinsic $20

- A foundation is holding a fund-raising campaign in a form of a raffle. A raffle ticket costs 120 php and there are 5,000 tickets to be sold. The ticket drawn in the raffle will win for its holder the price of 100,000 php. Compute the expected profit or loss for joining this raffle. A. -120 php B. -88.98php C. -99.98php D. -100phpExercise 9.2 (start-up and venture capitalist exit strategy). There are three periods, t = 0, 1, 2. The rate of interest in the economy is equal to 0, and ev- eryone is risk neutral. A start-up entrepreneur with initial cash A and protected by limited liability wants to invest in a fixed-size project. The cost of invest- ment, incurred at date 0, is I > A. The project yields, at date 2, R > 0 with probability p and 0 with prob- ability 1 − p. The probability of success is p = pH if the entrepreneur works and p = pL = pH − ∆p (∆p > 0) if the entrepreneur shirks. The entrepre- neur’s effort decision is made at date 0. Left unmon- itored, the entrepreneur obtains private benefit B if she shirks and 0 otherwise. If monitored (at date 0), the private benefit from shirking is reduced to b B. There is a competitive industry of venture capi- talists (monitors). A venture capitalist (general part- ner) has no fund to…NPV. A proposed nuclear power plant will cost $2.2 billion to build and then will produce cash flows of $300 million a year for 15 years. After that period (in year 15), it must be decommissioned at a cost of $900 million. a.What is project NPV if the discount rate is 5%? b. What if the discount rate is 18%? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.

- Pls do fast and i will rate instantly for sure Solution must be in typed form Calculate the covariance for the returns of stock 1 and stock 2 given the six years of historical returns presented below: Given that the standard deviation of stock 1 and stock 2 in the table above is 0.2236 and 0.3225, respectively, use your answer in (A) to calculate and interpret the correlation between the 2 assets. Based on the characteristics of NSC and JSE above you are considering forming a portfolio comprising the two stocks such that you invest the following amounts: i. $40000 and $60000 in company NSC and JSE respectively in the first instance, and alternatively ii. $70000 and $30000 in company NSC and JSE respectively. C. What is the expected return and standard deviation of the portfolio in the two instances above? What is the expected return and standard deviation of the portfolio in the two instances above?You are working as an investment consultant in a firm. You have been provided data for the past 7 years in the Table 4 as follows: Table 4: Investment Data Yr. Investment (Rs. Millions) Returns (Rs. Millions) 1 185 17 2 128 37 3 75 63 4 98 54 5 155 36 6 63 72 7 112 36 Assume your client plans to investment 30 million rupees. Based on this data will you recommend your client to invest. Why or why not? Your recommendations must be supported by complete workings including model(s), relationships between variables (correlations, coefficient of determinations) and graphical visualizations (such as scatter charts).Your firm uses a continuous review system and operates52 weeks per year. One of the SKUs has the followingcharacteristics.Demand 1D2 = 20,000 units>yearOrdering cost 1S2 = $40>orderHolding cost 1H2 = $2>unit>yearLead time 1L2 = 2 weeksCycle@service level = 95 percentDemand is normally distributed, with a standard deviation ofweekly demand of 100 units.Current on-hand inventory is 1,040 units, with no scheduledreceipts and no backorders.a. Calculate the item’s EOQ. What is the average time, inweeks, between orders?b. Find the safety stock and reorder point that provide a95 percent cycle-service level c. For these policies, what are the annual costs of (i) holdingthe cycle inventory and (ii) placing orders?d. A withdrawal of 15 units just occurred. Is it time to reor-der? If so, how much should be ordered?