C corporation,

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 32CE

Related questions

Question

1

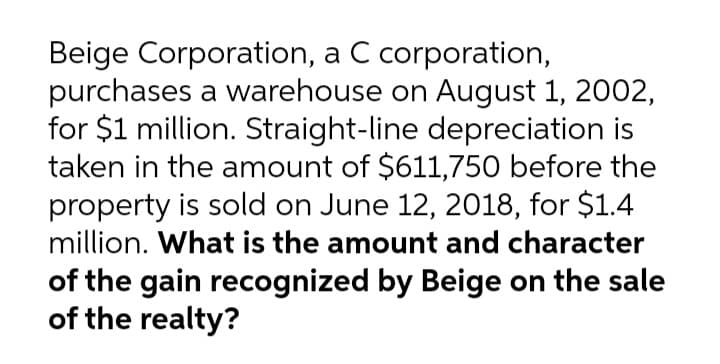

Transcribed Image Text:Beige Corporation, a C corporation,

purchases a warehouse on August 1, 2002,

for $1 million. Straight-line depreciation is

taken in the amount of $611,750 before the

property is sold on June 12, 2018, for $1.4

million. What is the amount and character

of the gain recognized by Beige on the sale

of the realty?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning