(c) Internal Rate of Return (IRR);

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 3PROB

Related questions

Question

Calculate for both projects A and B the:

(a) Payback period;

(b)

(c)

(d) State which project you would recommend to Dreamon Corporation if ONE project can be selected (i.e. mutually exclusive). Give reason to support your decision.

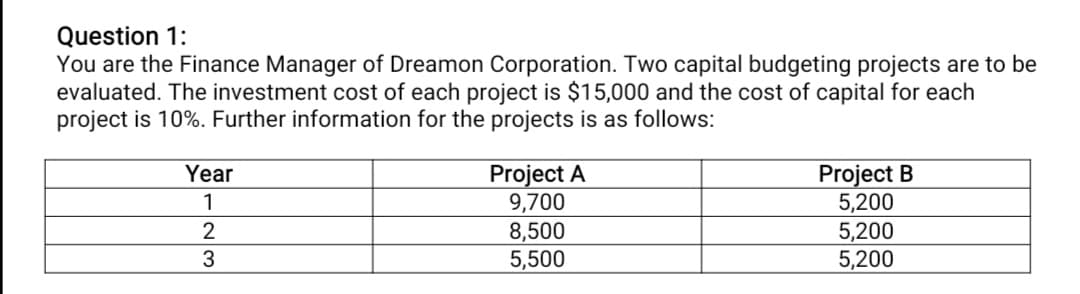

Transcribed Image Text:Question 1:

You are the Finance Manager of Dreamon Corporation. Two capital budgeting projects are to be

evaluated. The investment cost of each project is $15,000 and the cost of capital for each

project is 10%. Further information for the projects is as follows:

Project A

9,700

8,500

5,500

Project B

5,200

5,200

5,200

Year

1

2

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning