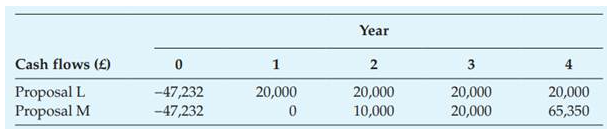

Your firm uses the IRR method and asks you to evaluate the following mutually exclusive projects: Using the appropriate IRR method, evaluate these proposals assuming a required rate of return of 10 per cent. Compare your answer with the net present value method.

Your firm uses the IRR method and asks you to evaluate the following mutually exclusive projects: Using the appropriate IRR method, evaluate these proposals assuming a required rate of return of 10 per cent. Compare your answer with the net present value method.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 16P: Tenth National Bank has a 200,000, 12% note receivable from Priday Company that is due on December...

Related questions

Question

Your firm uses the

Using the appropriate IRR method, evaluate these proposals assuming a required

Transcribed Image Text:Year

Cash flows (£)

1

2

3

Proposal L

Proposal M

-47,232

-47,232

20,000

20,000

10,000

20,000

20,000

65,350

20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning