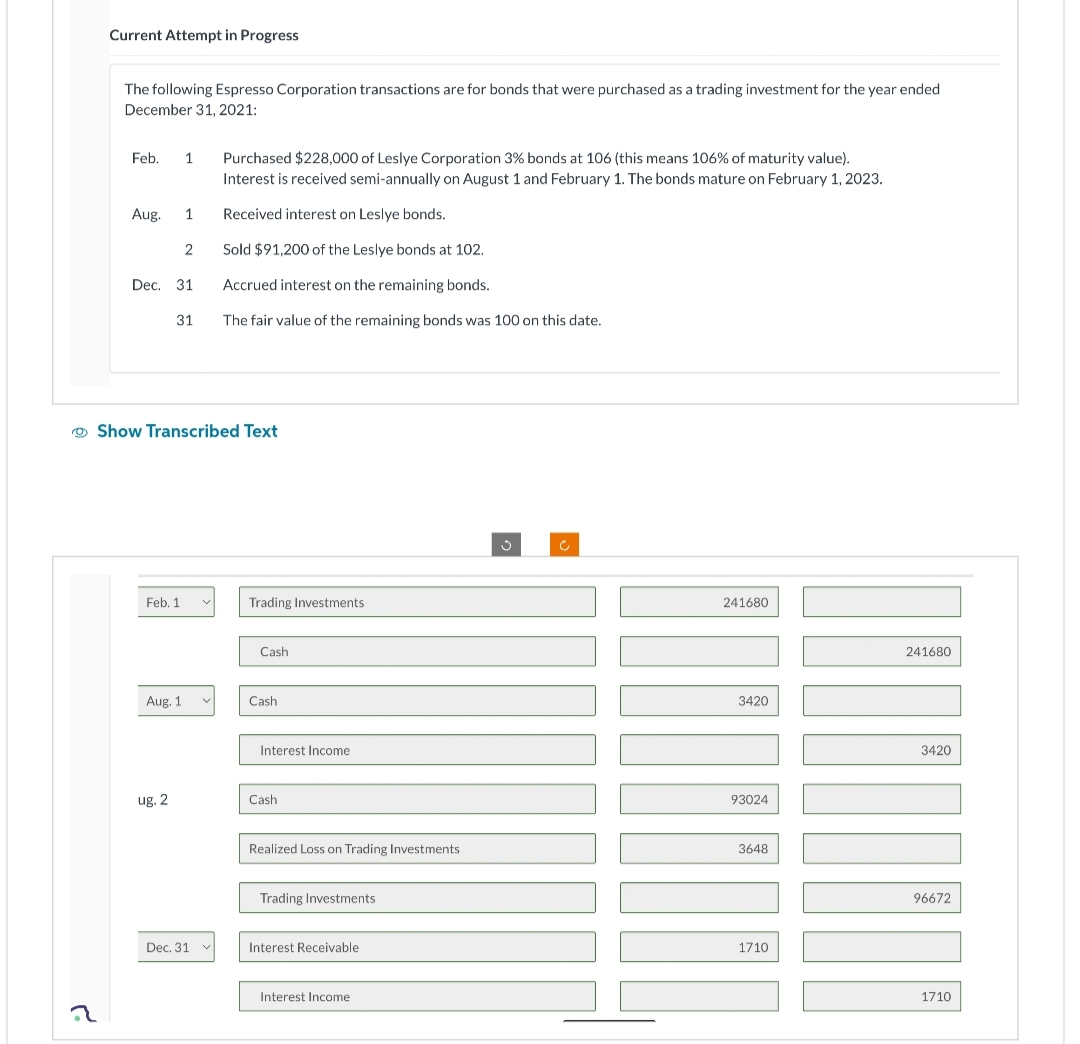

C. Current Attempt in Progress The following Espresso Corporation transactions are for bonds that were purchased as a trading investment for the year ended December 31, 2021: Feb. 1 Purchased $228,000 of Leslye Corporation 3% bonds at 106 (this means 106% of maturity value). Interest is received semi-annually on August 1 and February 1. The bonds mature on February 1, 2023. Received interest on Leslye bonds. Sold $91,200 of the Leslye bonds at 102. Accrued interest on the remaining bonds. The fair value of the remaining bonds was 100 on this date. Aug. 1 Dec. 31 2 31 Show Transcribed Text Feb. 1 Aug. 1 ug. 2 Dec. 31 Trading Investments Cash Cash Interest Income Cash Realized Loss on Trading Investments Trading Investments Interest Receivable Interest Income J 241680 3420 93024 3648 1710 241680 3420 1711 96672 1710

C. Current Attempt in Progress The following Espresso Corporation transactions are for bonds that were purchased as a trading investment for the year ended December 31, 2021: Feb. 1 Purchased $228,000 of Leslye Corporation 3% bonds at 106 (this means 106% of maturity value). Interest is received semi-annually on August 1 and February 1. The bonds mature on February 1, 2023. Received interest on Leslye bonds. Sold $91,200 of the Leslye bonds at 102. Accrued interest on the remaining bonds. The fair value of the remaining bonds was 100 on this date. Aug. 1 Dec. 31 2 31 Show Transcribed Text Feb. 1 Aug. 1 ug. 2 Dec. 31 Trading Investments Cash Cash Interest Income Cash Realized Loss on Trading Investments Trading Investments Interest Receivable Interest Income J 241680 3420 93024 3648 1710 241680 3420 1711 96672 1710

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 4E

Related questions

Question

Please explain proper steps by Step and Do Not Give Solution In Image Format ? And Fast Answering Please ?

Transcribed Image Text:Current Attempt in Progress

2

The following Espresso Corporation transactions are for bonds that were purchased as a trading investment for the year ended

December 31, 2021:

Feb. 1 Purchased $228,000 of Leslye Corporation 3% bonds at 106 (this means 106% of maturity value).

Interest is received semi-annually on August 1 and February 1. The bonds mature on February 1, 2023.

Received interest on Leslye bonds.

Sold $91,200 of the Leslye bonds at 102.

Accrued interest on the remaining bonds.

The fair value of the remaining bonds was 100 on this date.

Aug. 1

Dec. 31

Show Transcribed Text

2

31

Feb. 1

Aug. 1

ug. 2

Dec. 31

Trading Investments

Cash

Cash

Interest Income

Cash

Realized Loss on Trading Investments

Trading Investments

Interest Receivable

Interest Income

J

241680

3420

93024

3648

1710

241680

3420

1001

96672

1710

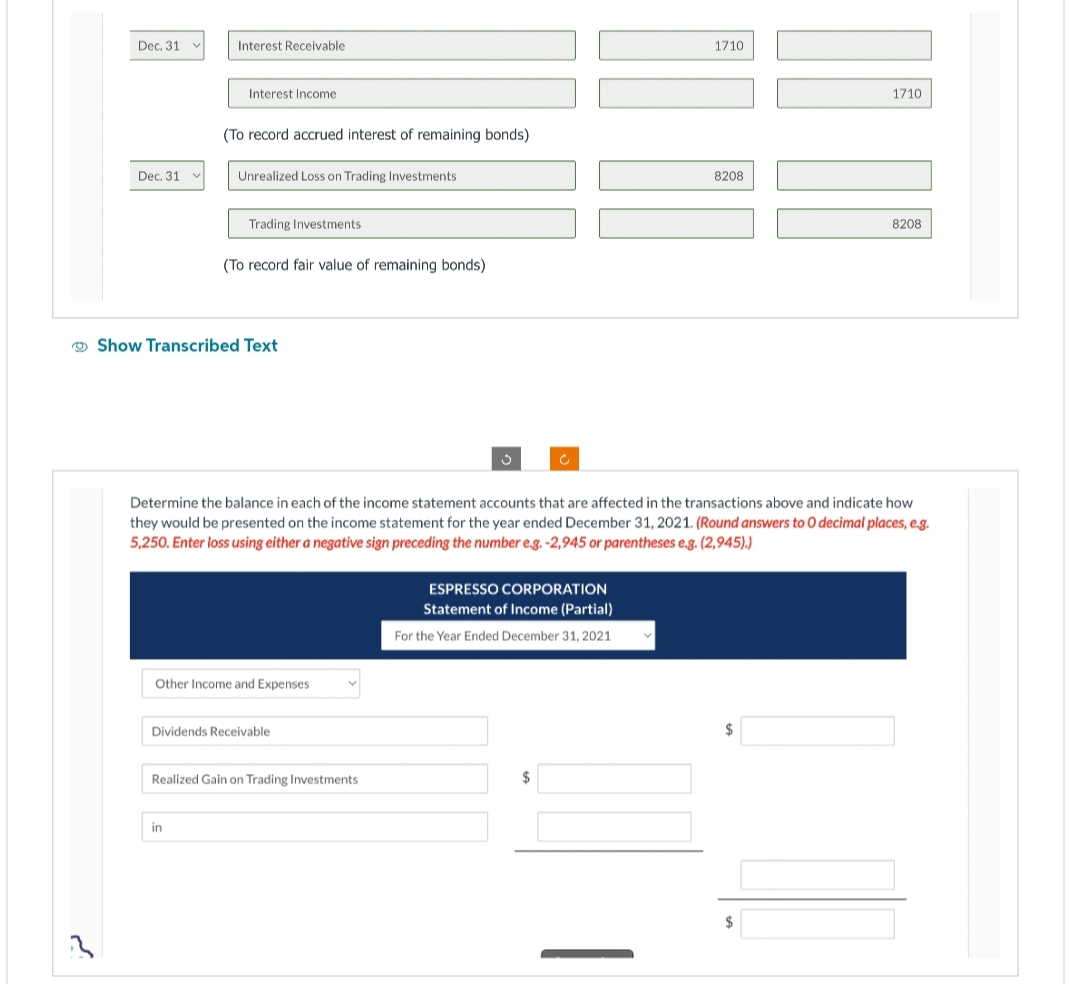

Transcribed Image Text:Dec. 31

Dec. 31

Interest Receivable

Interest Income

(To record accrued interest of remaining bonds)

Unrealized Loss on Trading Investments

Trading Investments

in

(To record fair value of remaining bonds)

Show Transcribed Text

Other Income and Expenses

Dividends Receivable

Realized Gain on Trading Investments

Determine the balance in each of the income statement accounts that are affected in the transactions above and indicate how

they would be presented on the income statement for the year ended December 31, 2021. (Round answers to O decimal places, e.g.

5,250. Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).)

ESPRESSO CORPORATION

Statement of Income (Partial)

For the Year Ended December 31, 2021

1710

$

8208

1710

$

8208

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT