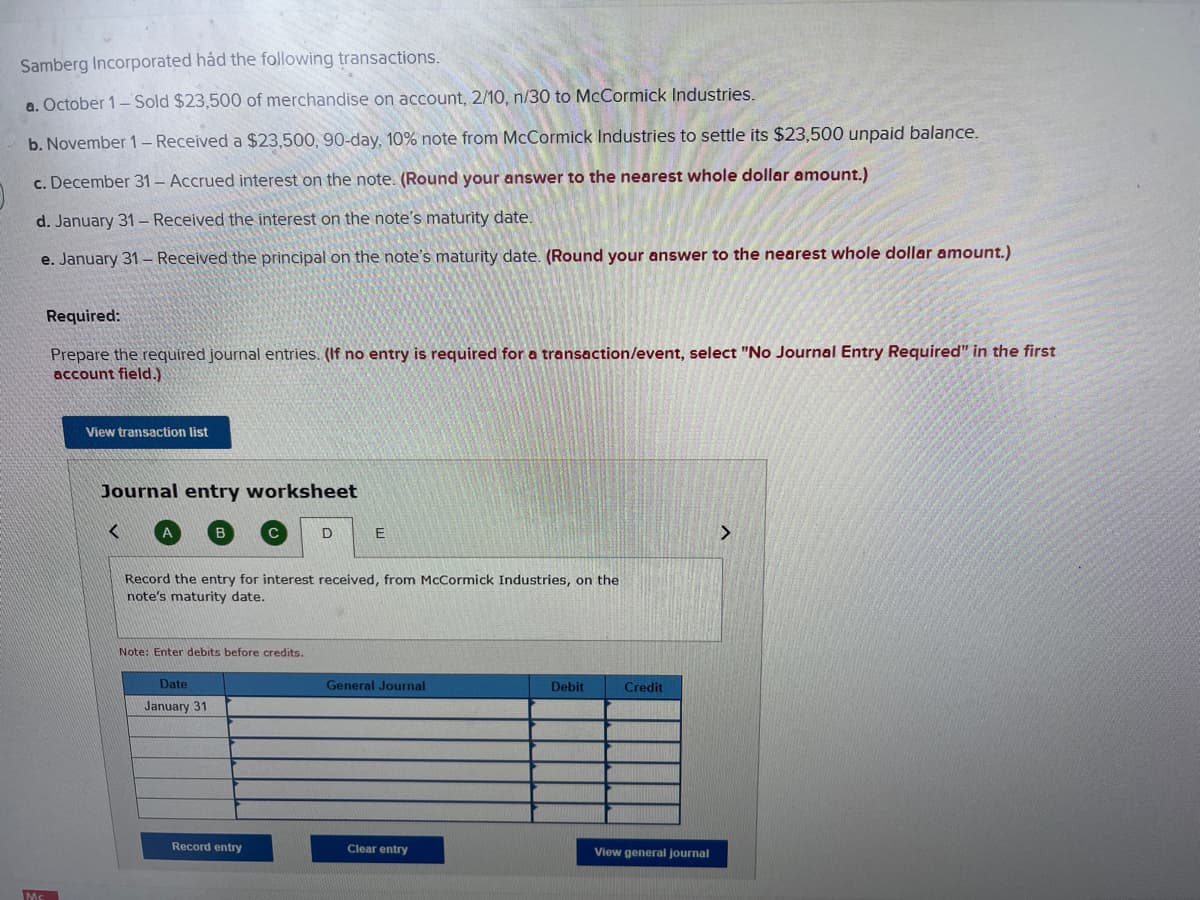

c. December 31- Accrued interest on the note. (Round your answer to the nearest whole dollar amount.) d. January 31-Received the interest on the note's maturity date. e. January 31-Received the principal on the note's maturity date. (Round your answer to the nearest whole dollar amount.

Q: Complete Stores Company is preparing its direct labor budget for 2022 from the following production…

A: Lets understand the basics. Management prepares various budget based for the estimating future…

Q: Given the following information, complete the balance sheet shown nex Collection period Days' sales…

A: As per the information provided: Collection period - 70 daysDays sales in cash - 32 daysCurrent…

Q: 1. Budgeted monthly absorption costing income statements for April-July are: Sales Cost of goods…

A: In the context of the given question, we are required to show the cash budget. Cash budget: The…

Q: i. 3 iv. vi. vii. (b) Categorize each transaction in Table Q4(a) as either an addition (+) or…

A: The investing activities under a cash flow statement show the cash flow in a transaction that…

Q: What would these securities be called and what does the Bank need to do to ensure the loan monies…

A: Loans refer to the agreement between the borrower and the bank or financial institution for…

Q: A $150 petty cash fund has cash of $25 and receipts of $119. The journal entry to replenish the…

A: A Journal entry is a primary entry that records the financial transactions initially. The…

Q: For each of the independent events listed below, analyze the impact on the indicated items at the…

A: Generally, Owers equity is increased by increase in net income and vice versa Cost of goods sold is…

Q: Ferran operates a boutique yarn store from their own. The store had accounting income after tax of…

A: Calculation of farran's taxable income as per law:

Q: Jan 1, 2021 Beginning Inventory 80 units at $8 Jan 11, 2021 Purchases 65 units at $10 55 units at…

A: One can learn more about the typical tax rates that apply to various taxpayers in this section.…

Q: Dave Krug finances a new automobile by paying $5,500 cash and agreeing to make 20 monthly payments…

A: Present Value- The value of an investment or amount today is referred to as its present value. It is…

Q: Part 3: Early Extinguishment of Debt On January 1, 2021, Free Design Industries had $700,000 of 12%…

A: When comparing the values of carrying value of the bond and Bond face value there is interconnection…

Q: Your invest $8,195 for 6 years at a 7 percent interest rate. what element would to determine the…

A: The majority of loan and borrowing transactions therefore involve interest rates. People take out…

Q: Cash Budget Activity Cash Receipts Less: Cash Disbursements Net: Cash Flow Add: Beginning Cash…

A: Budgeting - Budgeting is the process of estimating future operations based on past performance. %…

Q: Bird Company incurred $10,000 in salaries and wages for employees for the year; $9,000 of these…

A: Salaries and wages payable means the salaries and wage expense that has been incurred by the entity…

Q: Omega Company adjusts its accounts at the end of each month. The following information has been…

A: Depreciation on straight line method = = Cost of asset/ useful life Adjustment makes for…

Q: Zira Company reports the following production budget for the next four months. Each finished unit…

A: A budget is a forecast of revenue and expenses for a certain future period of time that is generally…

Q: Accounting Investor owns 1,000,000 shares of stock of Corp. XYZ with a zero basis and a FMV…

A: Tax consequences The total of any tax, net tax, input tax credit, rebate, or other amount owed by or…

Q: Pina Colada Company makes swimsuits and sells these suits directly to retailers. Although Pina…

A: Hi! Thank you for the question, As per the honor code , we are allowed to answer three sub -parts at…

Q: [The following information applies to the questions displayed below.] NewTech purchases computer…

A: Straight line method of depreciation (Cost of asset - salvage value) / useful life Depreciation…

Q: Use the Stockholders' Equity section of FSB's Balance Sheet to answer the questions below. FSB…

A: Introduction: The company's common stock is its ordinary stock. Common stockholders are the legal…

Q: When credit card sales occur, the seller may receive cash immediately, or within a few days,…

A: The given statement is true.

Q: Duluth Ranch, Incorporated purchased a machine on January 1, 2021. The cost of the machine was…

A: Decrease in the value of an asset is called Depreciation, calculation of depreciation of above case…

Q: cost leadership and differenti

A: Strategy refers to the work at the business where a person should focus on his efforts to achieve…

Q: During the eight-week period following Paycheck Protection Program (PPP) loan funding, the taxpayer…

A: Payback protection program is the program by which businesses in the US can obtained the loan from…

Q: Benjamin Company had the following results of operations for the past year: Sales (17,600 units at…

A: In order to determine the contribution margin per unit, the variable cost per units are required to…

Q: Which of the following statements is true? Oa. A one-time election is available to taxpayers 55…

A: A one-time election is available to taxpayers 55 years of age or older which allows them to sell…

Q: Use the following information for the next four questions: contract with Sheldon J. Plankton Co. to…

A: In the context of the given question, we are required to compute the total revenue that will…

Q: Popcorn Ltd uses a batch production method to produce its single product by combining two materials…

A: According to the given question, we are going to compute three sub-parts of this question. Material…

Q: Assume that at the beginning of the current year, a company has a net gain-AOCI of $25,600,000. At…

A: For the purpose of accounting for pension plans, the predicted return on plan assets are required to…

Q: Popcorn Ltd uses a batch production method to produce its single product by combining two materials…

A: Answer a (i):- Material price variance corn = £102.6 Material price variance salt = -£197.8…

Q: Sandhu Travel Agency Ltd. has 400,000 common shares authorized and 126,000 shares issued on December…

A: It is given that:authorized shares – 400,000 Issue shares – 126,000 Purchase price of new shares -…

Q: Harwood Company uses a job-order costing system that applies overhead cost to jobs on the basis of…

A: Overhead: In cost, a company uses an applied overhead to allocate manufacturing overhead costs. to…

Q: What are the advantages and disadvantages of a qualified audit opinion

A: Qualified Audit opinion :- Qualified Audit Opinion is the opinion of the Auditors on Financial…

Q: Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two…

A: The overhead cost is applied to the production on the basis of predetermined overhead rate. The unit…

Q: Allowance for Doubtful Accounts. An evaluation of accounts receivable indicates that the proper…

A: Bad Debts : When the debtors or customers does not paid the dues from a long time or become…

Q: Budgeted Income Statement For the Year Ending December 31, 2022

A: Given in the question: Sales 3,26,400.00 Direct Materials Used 73,750.00…

Q: mieson Ltd is preparing to set up business on 1/7/2022 and has made the following forecast for the…

A: Budgeting - A budget is the very best way of estimating future revenue and expense to be incurred.…

Q: Julia Hamilton started a new company beginning in May of the current year. She sells computers,…

A: Journal is used to record the daily transactions of the Business Entity. Transactions are recorded…

Q: What is the most correct implication of the additional funds needs (AFN) ________ If AFN is…

A:

Q: View Policies Current Attempt in Progress The stockholders' equity accounts of Splish Company have…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: Barley Hopp, Inc., manufactures custom-ordered commemorative beer steins. Its standard cost…

A: Cost Variance- The cost variance enables an entity to assess and track various expenses incurred in…

Q: Dr Peter Mark is a medical doctor. He works for his own medical clinic in Sydney. Overall, Dr Peter…

A: Tax /Deductions : It is the amount which allowed to deduct from the taxable incomes of the…

Q: Bairstow Company manufactures and sells a single product. The following costs were incurred during…

A: The income statement is one of the financial statements of the business which tells about the…

Q: 10-27. Henry Mills is responsible for preparing checks, recording cash disbursements, and preparing…

A: Internal control Internal control is a procedure implemented by a company's management, board of…

Q: Write off the $3,890 of accounts receivable due from Jacob Marley. If an amount box does not require…

A: The direct-write off method mean writing off a bad debt expense directly against the corresponding…

Q: Discuss the rationale of using total assets as a basic in determining materiality.

A: The concept of materiality is fundamental to the entire audit process and is applied by auditor. 1.…

Q: Mikayla Bhd is a company that produces fresh pineapple juice. During the year, the company bought…

A: Depreciation refers to the allocation or assigning the cost of the assets named as machinery,…

Q: The following selected transactions relate to cash collections for a firm that mainta $100 change…

A: Journal- A general journal entry is used to visualize the business transactions of any organization.…

Q: 1. The following budget information is available for the HD Sales Company (HDC) for January: Sales:…

A: Introduction: A pro forma income statement is a statement showing a company's estimated income after…

Q: Fraud Scandal about Wiredcard AG

A: Scandal refers to the situations of fraud arising in business from the manipulation by trusted…

Step by step

Solved in 2 steps

- Laminate Express extended credit to customer Amal Sunderland in the amount of $244,650 for his January 4 purchase of flooring. Terms of the sale are 2/30, n/120. The cost of the purchase to Laminate Express is $88,440. On April 5, Laminate Express determined that Amal Sunderlands account was uncollectible and wrote off the debt. On June 22, Amal Sunderland unexpectedly paid 30% of the total amount due in cash on his account. Record each Laminate Express transaction with Amal Sunderland. In order to demonstrate the write-off and then subsequent collection of an account receivable, assume in this example that Laminate Express rarely extends credit directly, so this transaction is permitted to use the direct write-off method. Remember, though, that in most cases the direct write-off method is not allowed.Window World extended credit to customer Nile Jenkins in the amount of $130,900 for his purchase of window treatments on April 2. Terms of the sale are 2/60, n/150. The cost of the purchase to Window World is $56,200. On September 4, Window World determined that Nile Jenkinss account was uncollectible and wrote off the debt. On December 3, Mr. Jenkins unexpectedly paid in full on his account. Record each Window World transaction with Nile Jenkins. In order to demonstrate the write-off and then subsequent collection of an account receivable, assume in this example that Window World rarely extends credit directly, so this transaction is permitted to use the direct write-off method. Remember, however, that in most cases the direct write-off method is not allowed.The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following transactions take place during the current year: A. On April 5, the company purchases 400 parts for $8.30 per part, on credit. Terms of the purchase are 4/ 10, n/30, invoice dated April 5. B. On May 5, Air Compressors does not pay the amount due and renegotiates with the supplier. The supplier agrees to $400 cash immediately as partial payment on note payable due, converting the debt owed into a short-term note, with a 7% annual interest rate, payable in three months from May 5. C. On August 5, Air Compressors pays its account in full. Record the journal entries to recognize the initial purchase, the conversion plus cash, and the payment.

- On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. Which journal would the company use to record this transaction on the 18th? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalOn March 24, MS Companys Accounts Receivable consisted of the following customer balances: S. Burton 310 A. Tangier 240 J. Holmes 504 F. Fullman 110 P. Molty 90 During the following week, MS made a sale of 104 to Molty and collected cash on account of 207 from Burton and 360 from Holmes. Prepare a schedule of accounts receivable for MS at March 31, 20--.If a customer owed your company $100 on the first day of the month, then purchased $200 of goods on credit on the fifth and paid you $50 on fifteenth, the customers ending balance for the month would show a (debit or credit) of how much?

- Casebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: a. Journalize the write-offs under the direct write-off method. b. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded 5,250,000 of credit sales during the year. Based on past history and industry averages, % of credit sales are expected to be uncollectible. c. How much higher (lower) would Casebolt Companys net income have been under the direct write-off method than under the allowance method?Review the following transactions and prepare any necessary journal entries for Lands Inc. A. On December 10, Lands Inc. contracts with a supplier to purchase 450 plants for its merchandise inventory, on credit, for $12.50 each. Credit terms are 4/15, n/30 from the invoice date of December 10. B. On December 28, Lands pays the amount due in cash to the supplier.The following transactions were completed by Yang Restaurant Equipment during January, the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Yang Restaurant Equipment does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to Tri-County Management Company for monthly rent, 850. 2L. Yang, the owner, invested an additional 4,500 in the business. 4Bought merchandise on account from Valentine and Company, invoice no. A694, 2,830; terms 2/10, n/30; dated January 2. 4Received check from Velez Appliance for 980 in payment of invoice for 1,000 less discount. 4Sold merchandise on account to L. Parrish, invoice no. 6483, 755. 6Received check from Peck, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Frost and Son, in payment of invoice no. C127 for 600 less discount. 7Bought supplies on account from Dudley Office Supply, invoice no. 190B, 93.54; terms net 30 days. 7Sold merchandise on account to Ewing and Charles, invoice no. 6484, 1,115. 9Issued credit memo no. 43 to L. Parrish, 47, for merchandise returned. 11Cash sales for January 1 through January 10, 4,454.87. 11Issued Ck. No. 6983, 2,773.40, to Valentine and Company, in payment of 2,830 invoice less discount. 14Sold merchandise on account to Velez Appliance, invoice no. 6485, 2,100. 14Received check from L. Parrish, 693.84, in payment of 755 invoice, less return of 47 and less discount. Jan. 19Bought merchandise on account from Crawford Products, invoice no. 7281, 3,700; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to invoice, 142 (total 3,842). 21Issued Ck. No. 6984, 245, to A. Bautista for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 3,689. 23Received credit memo no. 163, 87, from Crawford Products for merchandise returned. 29Sold merchandise on account to Bradford Supply, invoice no. 6486, 1,697.20. 29Issued Ck. No. 6985 to Western Freight, 64, for freight charges on merchandise purchased January 4. 31Cash sales for January 21 through January 31, 3,862. 31Issued Ck. No. 6986, 65, to M. Pineda for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 5,899.95; employees federal income tax withheld, 795; FICA Social Security tax withheld, 365.80, FICA Medicare tax withheld, 85.50. 31Recorded the payroll taxes: FICA Social Security tax, 365.80; FICA Medicare tax, 85.50; state unemployment tax, 318.60; federal unemployment tax, 35.40. 31Issued Ck. No. 6987, 4,653.65, for salaries for the month. 31L. Yang, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?