he runs a coffee shop which ness on 4 March 2019 the sam

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 41P

Related questions

Question

solve the problem C with complete explanation asap

Transcribed Image Text:А.

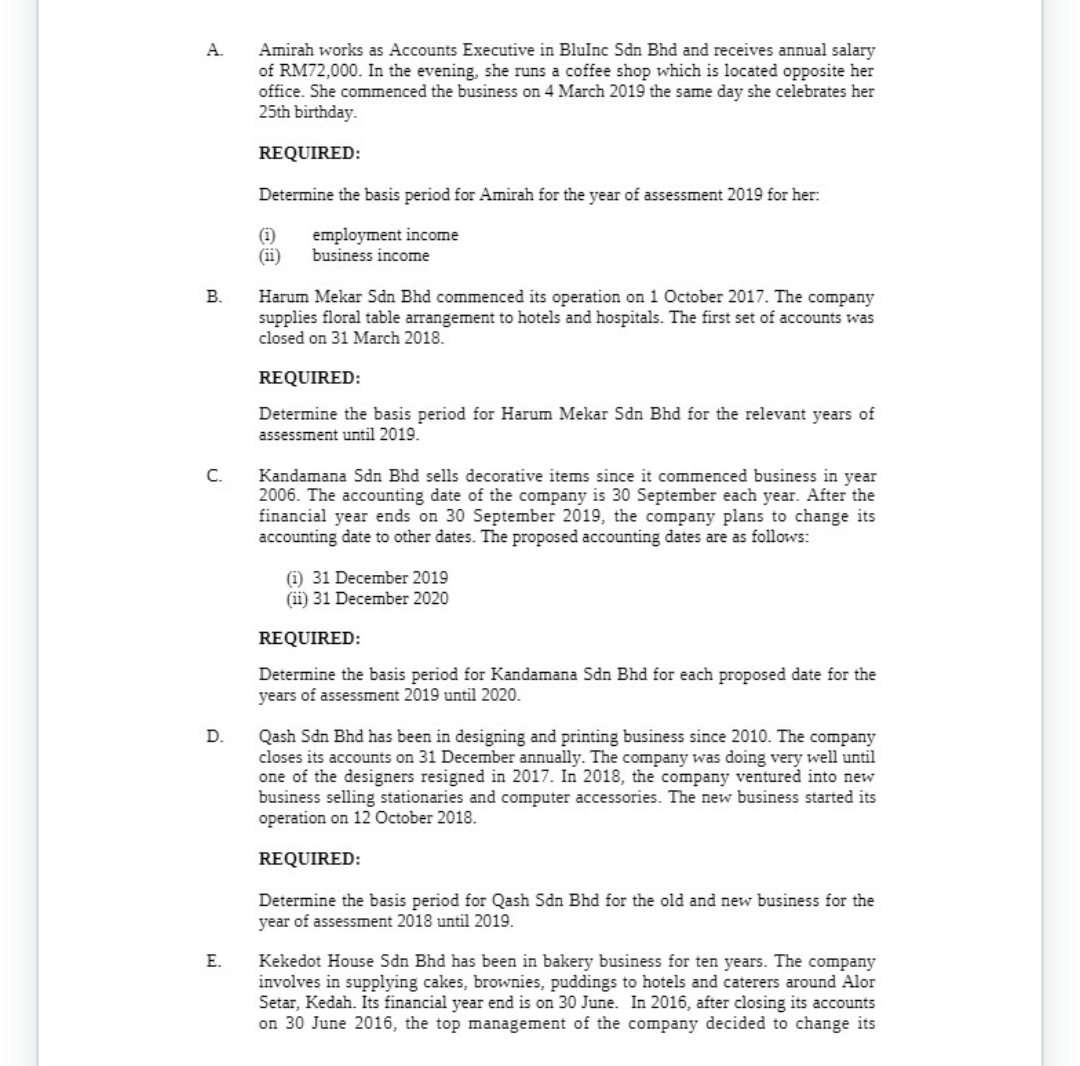

Amirah works as Accounts Executive in Blulnc Sdn Bhd and receives annual salary

of RM72,000. In the evening, she runs a coffee shop which is located opposite her

office. She commenced the business on 4 March 2019 the same day she celebrates her

25th birthday.

REQUIRED:

Determine the basis period for Amirah for the year of assessment 2019 for her:

(i)

(ii)

employment income

business income

Harum Mekar Sdn Bhd commenced its operation on 1 October 2017. The company

supplies floral table arrangement to hotels and hospitals. The first set of accounts was

closed on 31 March 2018.

В.

REQUIRED:

Determine the basis period for Harum Mekar Sdn Bhd for the relevant years of

assessment until 2019.

C.

Kandamana Sdn Bhd sells decorative items since it commenced business in year

2006. The accounting date of the company is 30 September each year. After the

financial year ends on 30 September 2019, the company plans to change its

accounting date to other dates. The proposed accounting dates are as follows:

(i) 31 December 2019

(ii) 31 December 2020

REQUIRED:

Determine the basis period for Kandamana Sdn Bhd for each proposed date for the

years of assessment 2019 until 2020.

D.

Qash Sdn Bhd has been in designing and printing business since 2010. The company

closes its accounts on 31 December annually. The company was doing very well until

one of the designers resigned in 2017. In 2018, the company ventured into new

business selling stationaries and computer accessories. The new business started its

operation on 12 October 2018.

REQUIRED:

Determine the basis period for Qash Sdn Bhd for the old and new business for the

year of assessment 2018 until 2019.

Kekedot House Sdn Bhd has been in bakery business for ten years. The company

involves in supplying cakes, brownies, puddings to hotels and caterers around Alor

Setar, Kedah. Its financial year end is on 30 June. In 2016, after closing its accounts

on 30 June 2016, the top management of the company decided to change its

E.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT