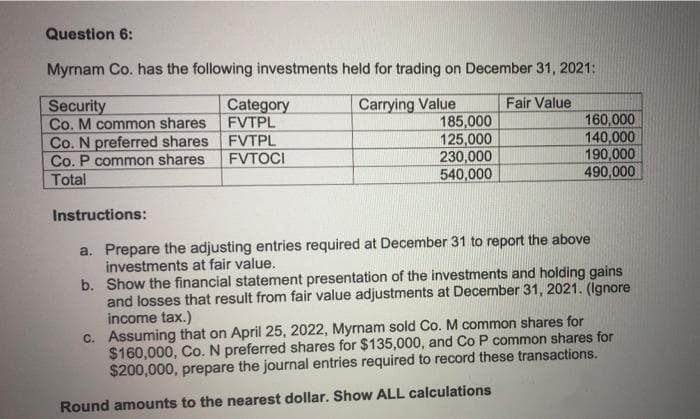

Question 6: Myrnam Co. has the following investments held for trading on December 31, 2021: Carrying Value 185,000 125,000 230,000 540,000 Fair Value Security Co. M common shares FVTPL Co. N preferred shares Co. P common shares Total Category 160,000 140,000 190,000 490,000 FVTPL FVTOCI Instructions: a. Prepare the adjusting entries required at December 31 to report the above investments at fair value. b. Show the financial statement presentation of the investments and holding gains and losses that result from fair value adjustments at December 31, 2021. (Ignore income tax.) c. Assuming that on April 25, 2022, Myrnam sold Co. M common shares for $160,000, Co. N preferred shares for $135,000, and Co P common shares for $200,000, prepare the journal entries required to record these transactions. Round amounts to the nearest dollar. Show ALL calculations

Question 6: Myrnam Co. has the following investments held for trading on December 31, 2021: Carrying Value 185,000 125,000 230,000 540,000 Fair Value Security Co. M common shares FVTPL Co. N preferred shares Co. P common shares Total Category 160,000 140,000 190,000 490,000 FVTPL FVTOCI Instructions: a. Prepare the adjusting entries required at December 31 to report the above investments at fair value. b. Show the financial statement presentation of the investments and holding gains and losses that result from fair value adjustments at December 31, 2021. (Ignore income tax.) c. Assuming that on April 25, 2022, Myrnam sold Co. M common shares for $160,000, Co. N preferred shares for $135,000, and Co P common shares for $200,000, prepare the journal entries required to record these transactions. Round amounts to the nearest dollar. Show ALL calculations

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter15: Shareholders’ Equity: Capital Contributions And Distributions

Section: Chapter Questions

Problem 24P

Related questions

Question

Transcribed Image Text:Question 6:

Myrnam Co. has the following investments held for trading on December 31, 2021:

Carrying Value

185,000

125,000

230,000

540,000

Fair Value

Category

FVTPL

Security

Co. M common shares

Co. N preferred shares

Co. P common shares

160,000

140,000

190,000

490,000

FVTPL

FVTOCI

Total

Instructions:

a. Prepare the adjusting entries required at December 31 to report the above

investments at fair value.

b. Show the financial statement presentation of the investments and holding gains

and losses that result from fair value adjustments at December 31, 2021. (Ignore

income tax.)

c. Assuming that on April 25, 2022, Myrnam sold Co. M common shares for

$160,000, Co. N preferred shares for $135,000, and Co P common shares for

$200,000, prepare the journal entries required to record these transactions.

Round amounts to the nearest dollar. Show ALL calculations

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT