Reporting Operating Lease—Lessee On January 1 of Year 1, Lessee Inc. leased equipment at an annual payment of $85,099, payable each January 1 for four years, with the first payment due immediately. The equipment had a fair value of $400,000 and a book value of $375,000, and was commonly purchased or leased by customers. The lessor estimates that the equipment has an estimated useful life of eight years and an estimated residual value of $125,000, not guaranteed by the lessee. Lessor’s implicit rate is 7.5%, which is unknown to the lessee. The lessee’s incremental borrowing rate is 8%. The lease does not contain a purchase option or a renewal option. The lessee had no other costs associated with this lease. 1. Prepare a schedule of the right-of-use asset for the 4-year lease term. -- Note: Round each amount in the schedule to the nearest whole dollar (attached in first picture) 2. Prepare the entries for Lessee Inc. on January 1 and December 31 of the first two years of the lease term, assuming Lessee Inc.’s accounting year ends December 31. -- Note: Round your answers to the nearest whole dollar. (attached in second picture)

Reporting Operating Lease—Lessee

On January 1 of Year 1, Lessee Inc. leased equipment at an annual payment of $85,099, payable each January 1 for four years, with the first payment due immediately. The equipment had a fair value of $400,000 and a book value of $375,000, and was commonly purchased or leased by customers. The lessor estimates that the equipment has an estimated useful life of eight years and an estimated residual value of $125,000, not guaranteed by the lessee. Lessor’s implicit rate is 7.5%, which is unknown to the lessee. The lessee’s incremental borrowing rate is 8%. The lease does not contain a purchase option or a renewal option. The lessee had no other costs associated with this lease.

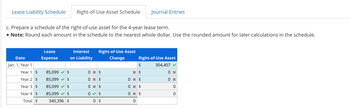

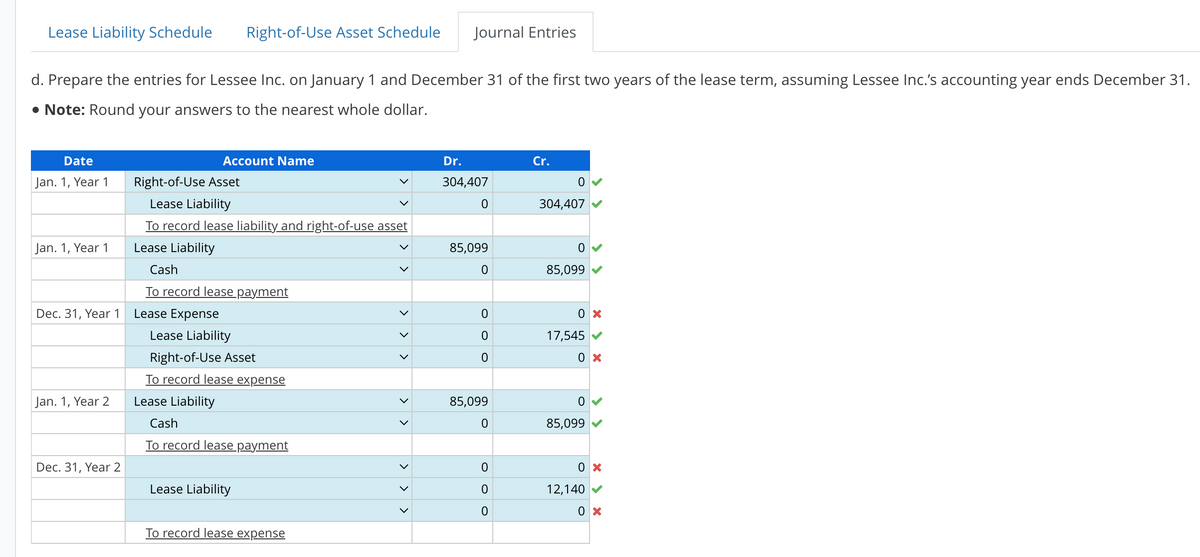

1. Prepare a schedule of the right-of-use asset for the 4-year lease term. -- Note: Round each amount in the schedule to the nearest whole dollar (attached in first picture)

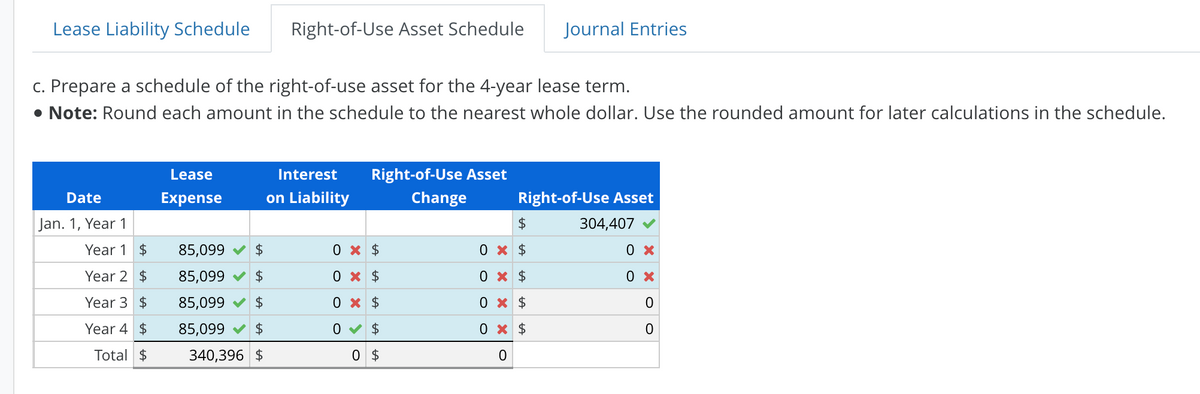

2. Prepare the entries for Lessee Inc. on January 1 and December 31 of the first two years of the lease term, assuming Lessee Inc.’s accounting year ends December 31. -- Note: Round your answers to the nearest whole dollar. (attached in second picture)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

I need the Right of Use Asset Ammortization table, not the lease liability amortization table.